Answered step by step

Verified Expert Solution

Question

1 Approved Answer

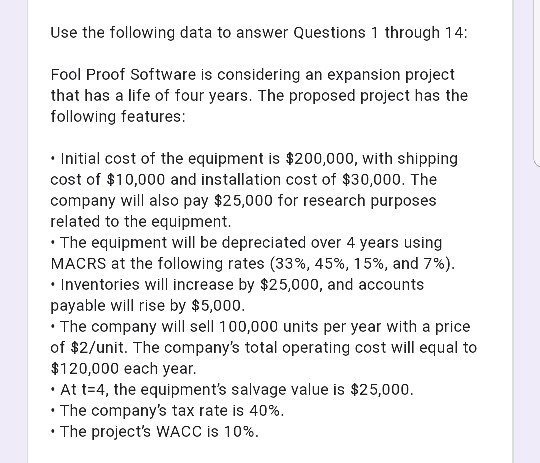

Use the following data to answer Questions 1 through 14: Fool Proof Software is considering an expansion project that has a life of four years.

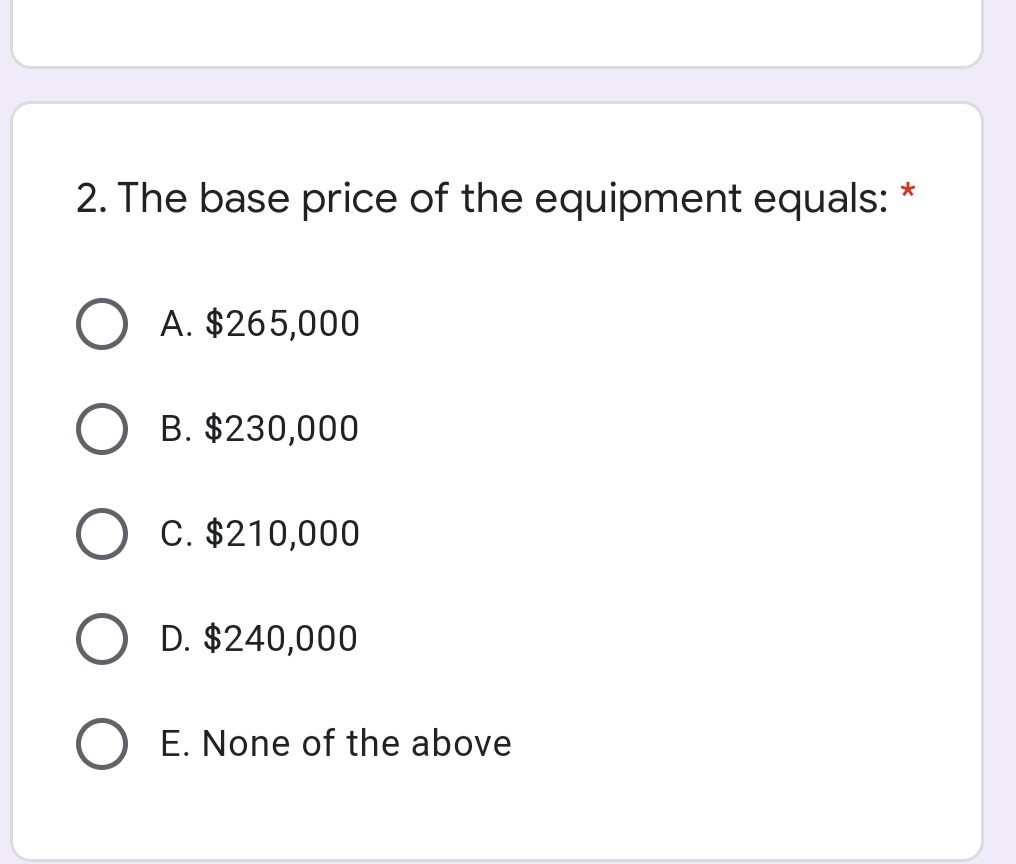

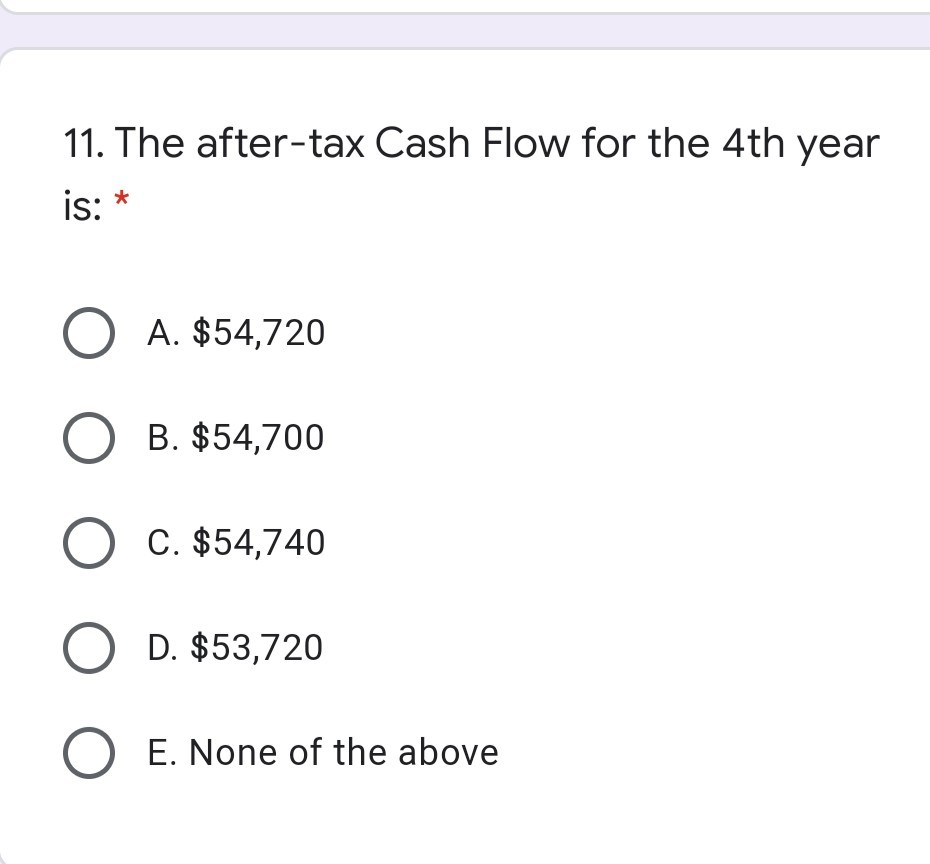

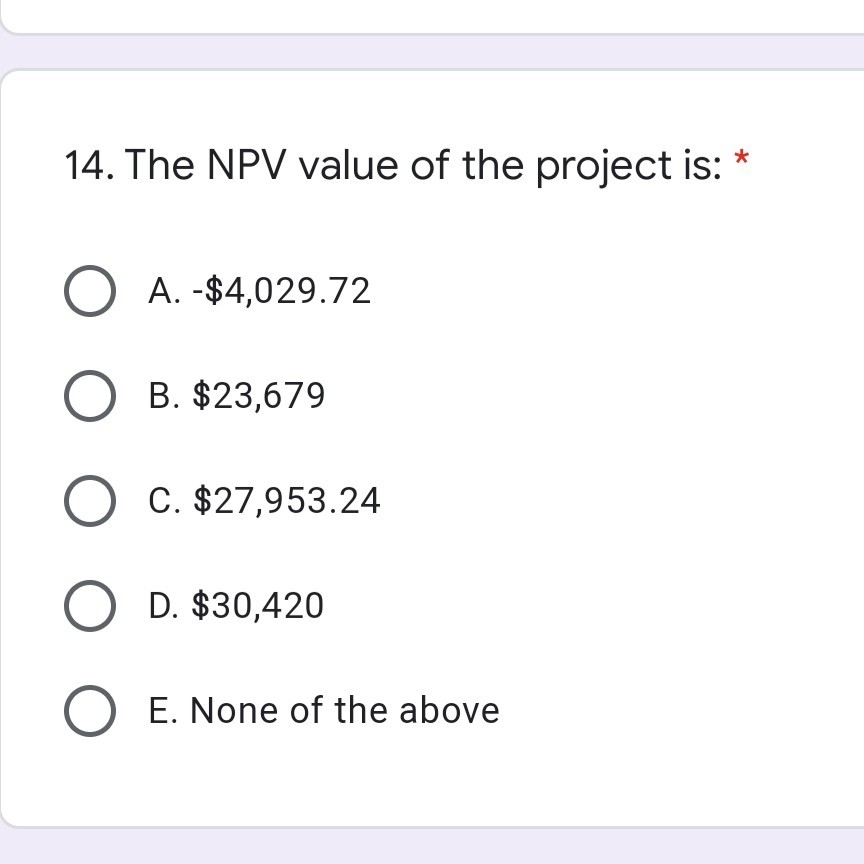

Use the following data to answer Questions 1 through 14: Fool Proof Software is considering an expansion project that has a life of four years. The proposed project has the following features: Initial cost of the equipment is $200,000, with shipping cost of $10,000 and installation cost of $30,000. The company will also pay $25,000 for research purposes related to the equipment. The equipment will be depreciated over 4 years using MACRS at the following rates (33%, 45%, 15%, and 7%). Inventories will increase by $25,000, and accounts payable will rise by $5,000. The company will sell 100,000 units per year with a price of $2/unit. The company's total operating cost will equal to $120,000 each year. At t=4, the equipment's salvage value is $25,000. The company's tax rate is 40%. The project's WACC is 10%. * 2. The base price of the equipment equals: O A. $265,000 B. $230,000 C. $210,000 D. $240,000 O E. None of the above 11. The after-tax Cash Flow for the 4th year is: O A. $54,720 O B. $54,700 O C. $54,740 O D. $53,720 O E. None of the above 14. The NPV value of the project is: * O A. -$4,029.72 O B. $23,679 O C. $27,953.24 O D. $30,420 O E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started