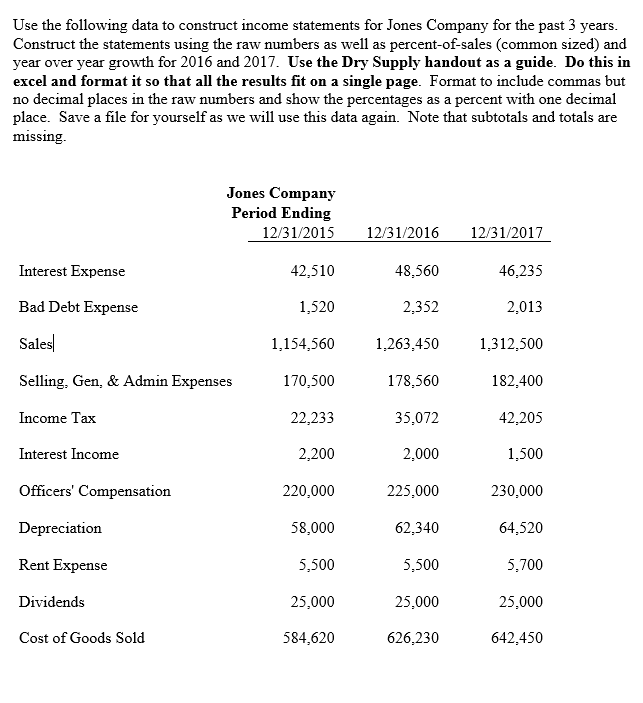

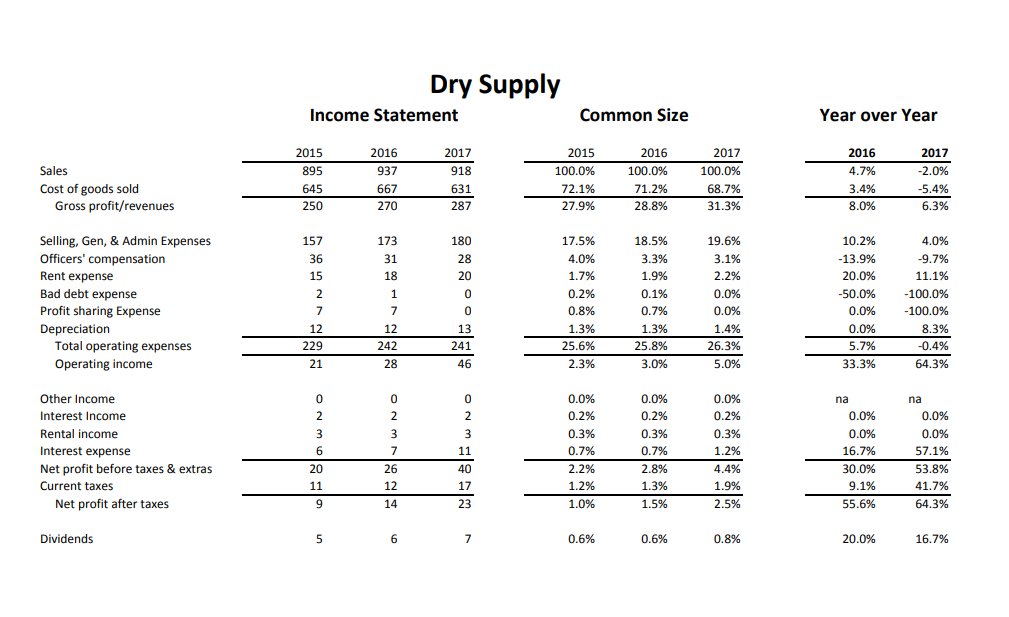

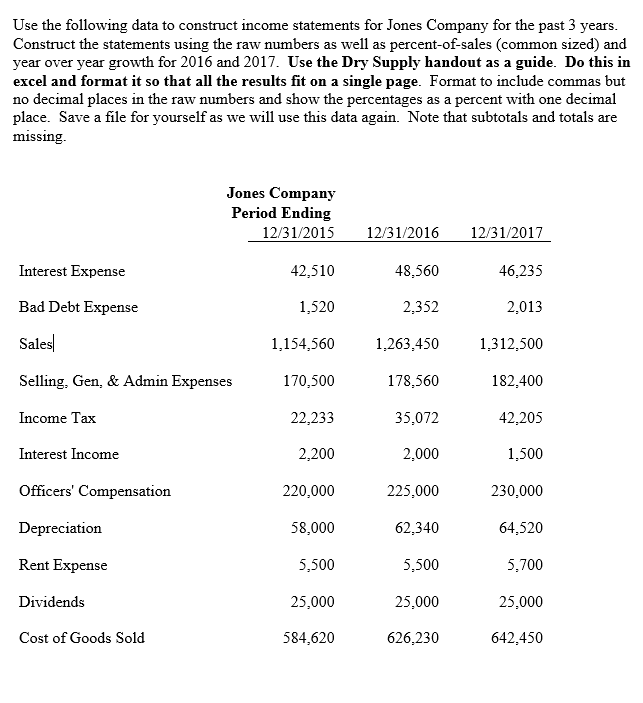

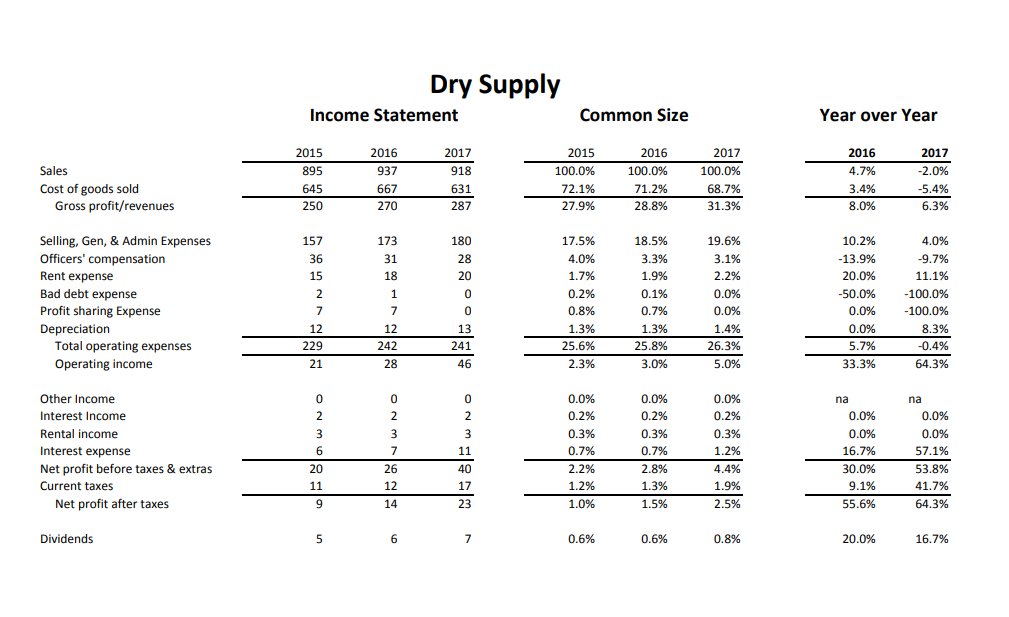

Use the following data to construct income statements for Jones Company for the past 3 years. Construct the statements using the raw numbers as well as percent-of-sales (common sized) and year over year growth for 2016 and 2017. Use the Dry Supply handout as a guide. Do this in excel and format it so that all the results fit on a single page. Format to include commas but no decimal places in the raw numbers and show the percentages as a percent with one decimal place. Save a file for yourself as we will use this data again. Note that subtotals and totals are missing. Jones Company Period Ending 12/31/2015 12/31/2016 12/31/2017 Interest Expense 42,510 48,560 46,235 Bad Debt Expense 1,520 2,352 2,013 Sales 1,154,560 1.263,450 1,312,500 Selling, Gen, & Admin Expenses 170,500 178,560 182.400 Income Tax 22,233 35,072 42,205 Interest Income 2,200 2,000 1,500 Officers' Compensation 220,000 225,000 230,000 Depreciation 58,000 62.340 64.520 Rent Expense 5,500 5,500 5,700 Dividends 25,000 25,000 25.000 Cost of Goods Sold 584,620 626,230 642.450 Dry Supply Income Statement Common Size Year over Year 2016 Sales Cost of goods sold Gross profit/revenues 2015 895 645 250 2016 937 667 2017 918 631 287 2015 100.0% 72.1% 27.9% 2016 100.0% 71.2% 28.8% 2017 100.0% 68.7% 31.3% 4.7% 3.4% 8.0% 2017 -2.0% -5.4% 6.3% 270 173 180 157 36 15 31 18 1 Selling, Gen, & Admin Expenses Officers' compensation Rent expense Bad debt expense Profit sharing Expense Depreciation Total operating expenses Operating income 2 7 12 229 28 20 0 0 13 17.5% 4.0% 1.7% 0.2% 0.8% 1.3% 25.6% 2.3% 18.5% 3.3% 1.9% 0.1% 0.7% 1.3% 25.8% 3.0% 19.6% 3.1% 2.2% 0.0% 0.0% 1.4% 26.3% 5.0% 10.2% -13.9% 20.0% -50.0% 0.0% 0.0% 5.7% 33.3% 4.0% -9.7% 11.1% -100.0% -100.0% 8.3% -0.4% 64.3% 7 12 242 241 21 28 46 0 na 0 2 3 Other Income Interest Income Rental income Interest expense Net profit before taxes & extras Current taxes Net profit after taxes 2 3 6 20 11 9 7 26 12 0 2 3 11 40 17 23 0.0% 0.2% 0.3% 0.7% 2.2% 1.2% 1.0% 0.0% 0.2% 0.3% 0.7% 2.8% 1.3% 1.5% 0.0% 0.2% 0.3% 1.2% 4.4% 1.9% 2.5% na 0.0% 0.0% 16.7% 30.0% 9.1% 55.6% 0.0% 0.0% 57.1% 53.8% 41.7% 64.3% 14 Dividends 5 6 7 0.6% 0.6% 0.8% 20.0% 16.7%