Answered step by step

Verified Expert Solution

Question

1 Approved Answer

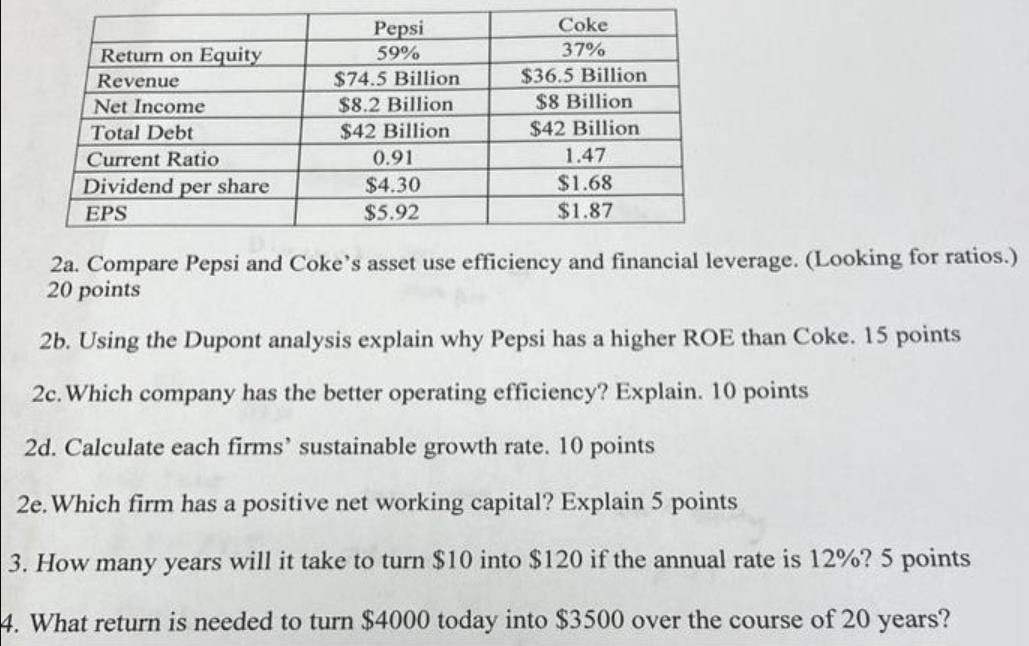

Use the following financial information to answer the questions that follow: Return on Equity Revenue Net Income Total Debt Current Ratio Dividend per share EPS

Use the following financial information to answer the questions that follow:

Return on Equity Revenue Net Income Total Debt Current Ratio Dividend per share EPS Pepsi 59% $74.5 Billion $8.2 Billion $42 Billion 0.91 $4.30 $5.92 Coke 37% $36.5 Billion $8 Billion $42 Billion 1.47 $1.68 $1.87 2a. Compare Pepsi and Coke's asset use efficiency and financial leverage. (Looking for ratios.) 20 points 2b. Using the Dupont analysis explain why Pepsi has a higher ROE than Coke. 15 points 2c. Which company has the better operating efficiency? Explain. 10 points 2d. Calculate each firms' sustainable growth rate. 10 points 2e. Which firm has a positive net working capital? Explain 5 points 3. How many years will it take to turn $10 into $120 if the annual rate is 12%? 5 points 4. What return is needed to turn $4000 today into $3500 over the course of 20 years?

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

2a Compare Pepsi and Cokes asset use efficiency and financial leverage Looking for ratios 20 points ANSWER Pepsis Asset Use Efficiency RevenueTotal Debt 745 Billion42 Billion 177 Cokes Asset Use Effic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started