Question

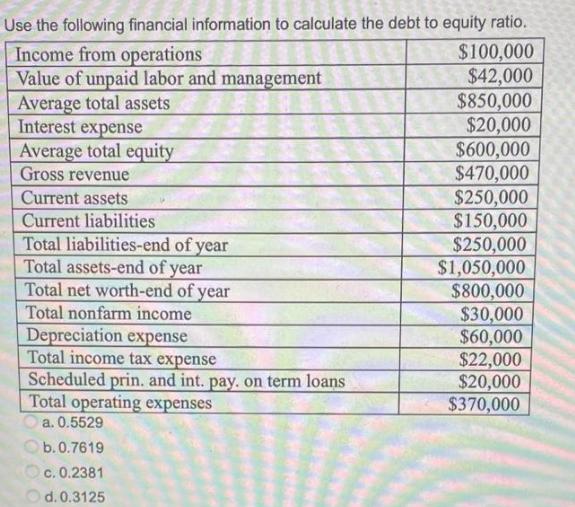

Use the following financial information to calculate the debt to equity ratio. Income from operations Value of unpaid labor and management Average total assets

Use the following financial information to calculate the debt to equity ratio. Income from operations Value of unpaid labor and management Average total assets Interest expense Average total equity Gross revenue Current assets Current liabilities Total liabilities-end of year Total assets-end of year Total net worth-end of year Total nonfarm income Depreciation expense Total income tax expense Scheduled prin. and int. pay. on term loans Total operating expenses a. 0.5529 b. 0.7619 c. 0.2381 d.0.3125 $100,000 $42,000 $850,000 $20,000 $600,000 $470,000 $250,000 $150,000 $250,000 $1,050,000 $800,000 $30,000 $60,000 $22,000 $20,000 $370,000

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The debt to equity ratio is 05529 Explanation The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial ACCT2

Authors: Norman H. Godwin, C. Wayne Alderman

2nd edition

9781285632544, 1111530769, 1285632540, 978-1111530761

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App