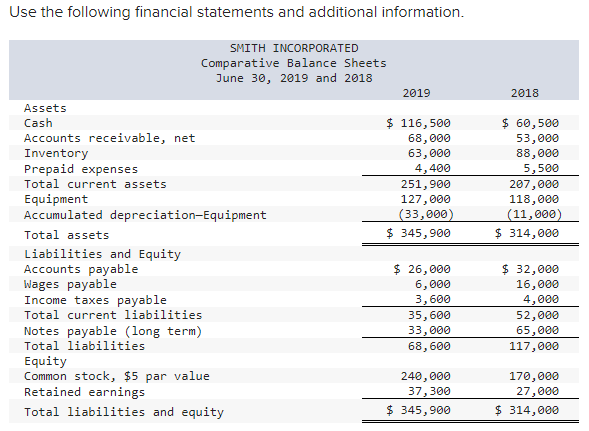

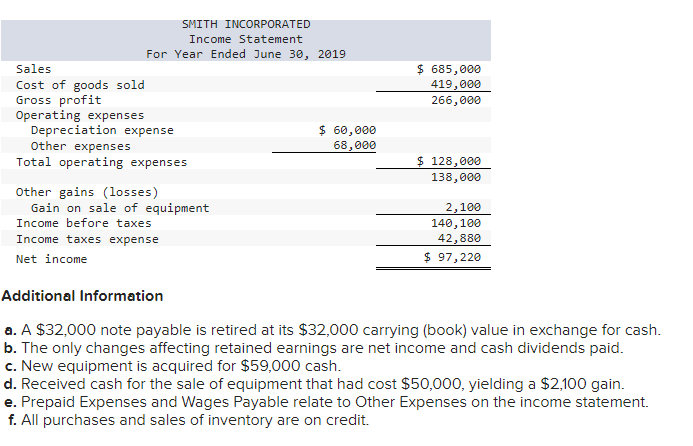

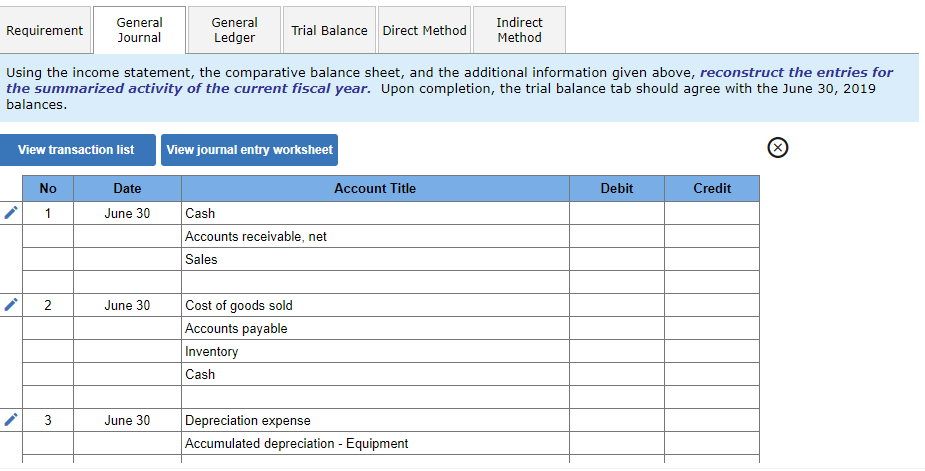

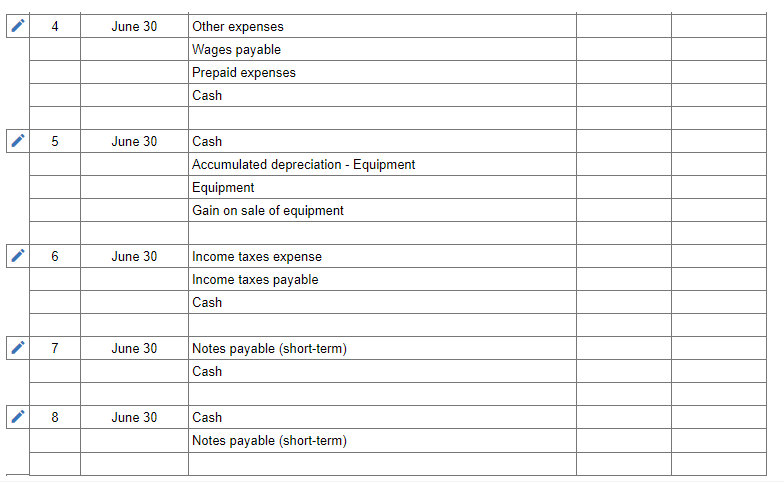

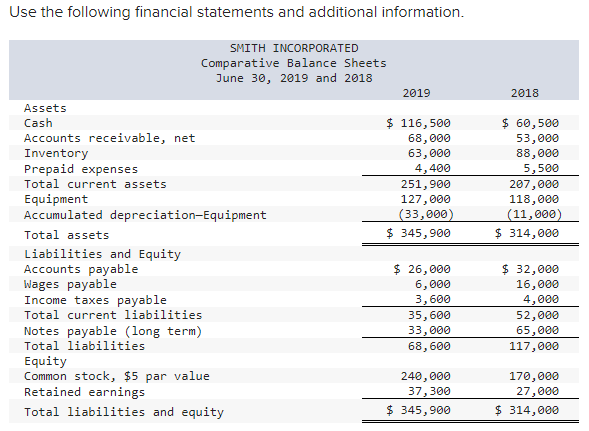

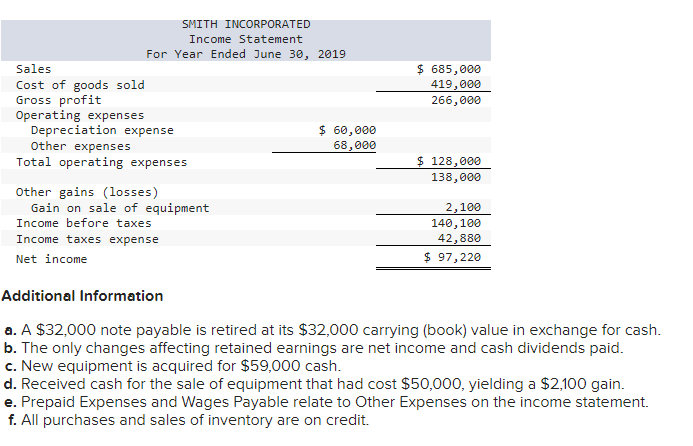

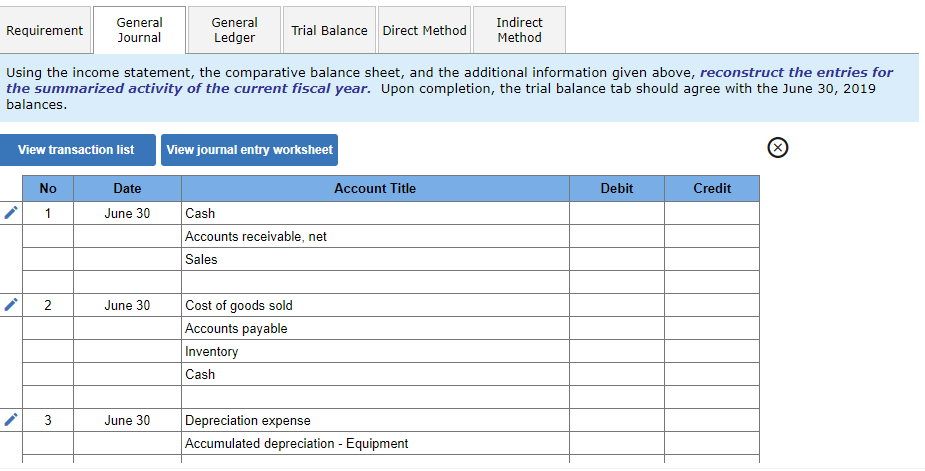

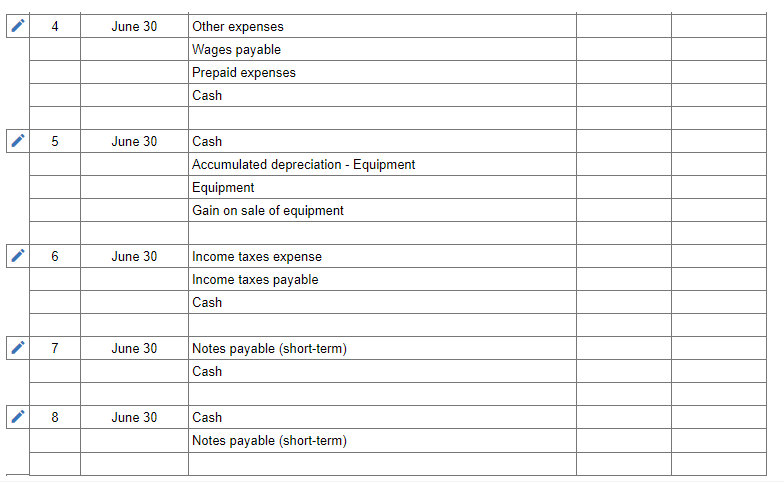

Use the following financial statements and additional information. SMITH INCORPORATED Comparative Balance Sheets June 30, 2019 and 2018 2019 2018 $ 116,500 68,000 63,000 4,400 251,900 127,000 (33,000) $ 345,900 $ 60,500 53,000 88,000 5,500 207,000 118,000 (11,000) $ 314,000 Assets Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Wages payable Income taxes payable Total current liabilities Notes payable (long term) Total liabilities Equity Common stock, $5 par value Retained earnings Total liabilities and equity $ 26,000 6,000 3,600 35,600 33,000 68,600 $ 32,000 16,000 4,000 52,000 65,000 117,000 240,000 37,300 $ 345, 900 170,000 27,000 $ 314,000 SMITH INCORPORATED Income Statement For Year Ended June 30, 2019 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense $ 60,000 Other expenses 68,000 Total operating expenses $ 685,000 419,000 266,000 $ 128,000 138,000 Other gains (losses) Gain on sale of equipment Income before taxes Income taxes expense Net income 2,100 140, 100 42,880 $ 97,220 Additional Information a. A $32,000 note payable is retired at its $32,000 carrying (book) value in exchange for cash. b. The only changes affecting retained earnings are net income and cash dividends paid. c. New equipment is acquired for $59,000 cash. d. Received cash for the sale of equipment that had cost $50,000, yielding a $2,100 gain. e. Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement. f. All purchases and sales of inventory are on credit. Requirement General Journal General Ledger Trial Balance Direct Method Indirect Method Using the income statement, the comparative balance sheet, and the additional information given above, reconstruct the entries for the summarized activity of the current fiscal year. Upon completion, the trial balance tab should agree with the June 30, 2019 balances. View transaction list View journal entry worksheet Account Title Debit Credit No 1 Date June 30 Cash Accounts receivable, net Sales 2 June 30 Cost of goods sold Accounts payable Inventory Cash 3 June 30 Depreciation expense Accumulated depreciation - Equipment 4 June 30 Other expenses Wages payable Prepaid expenses Cash 5 June 30 Cash Accumulated depreciation - Equipment Equipment Gain on sale of equipment 6 June 30 Income taxes expense Income taxes payable Cash 7 June 30 Notes payable (short-term) Cash 8 June 30 Cash Notes payable (short-term)