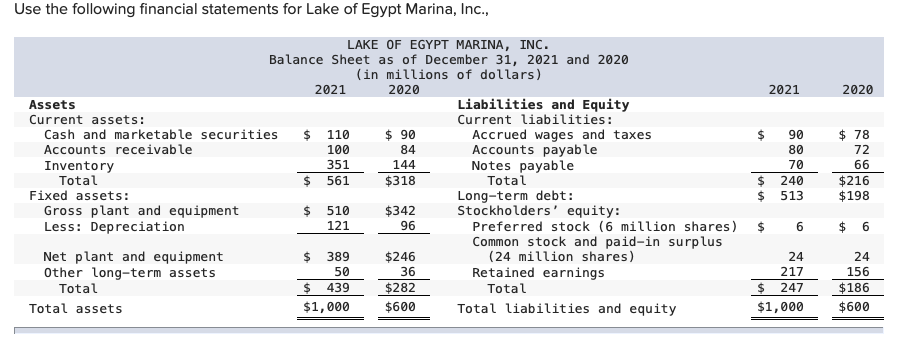

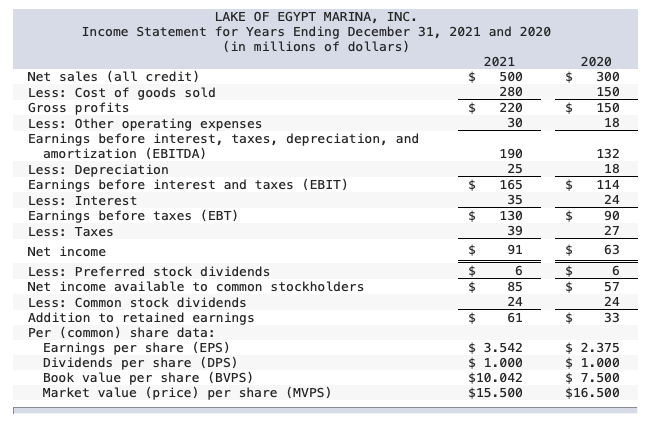

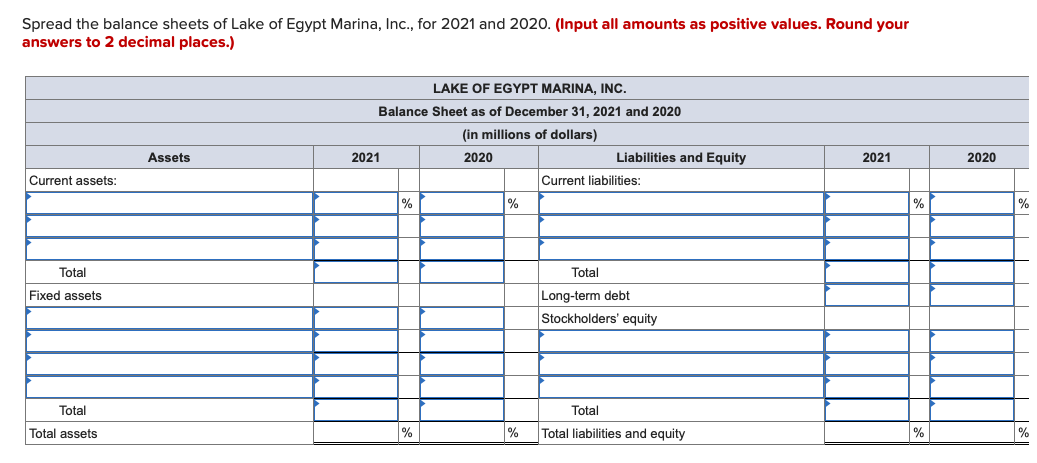

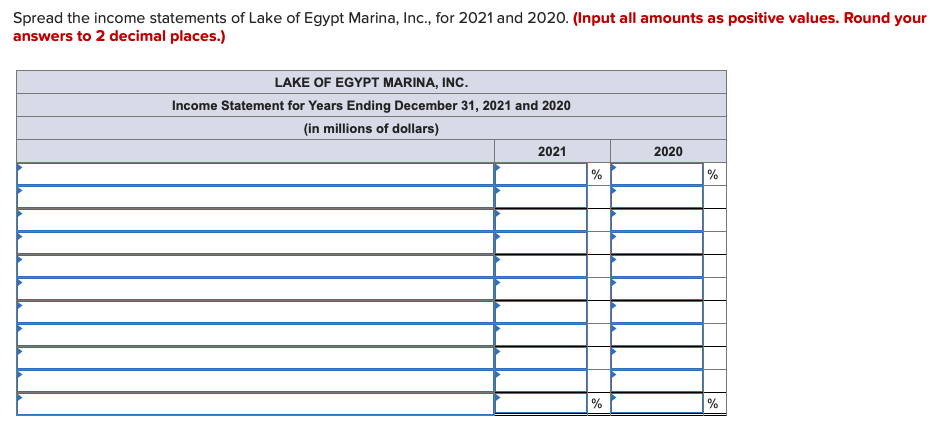

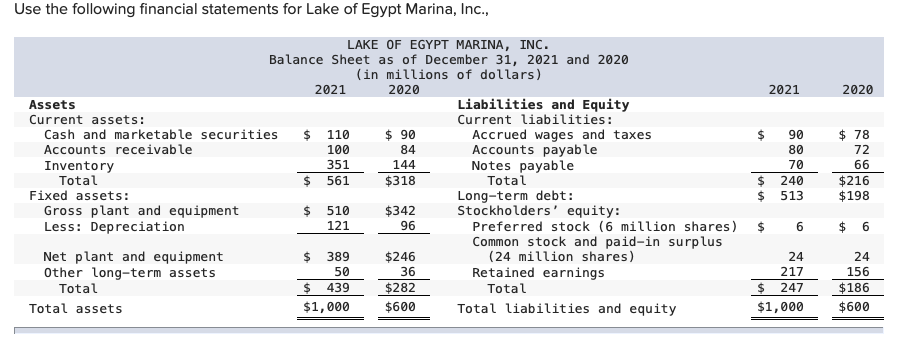

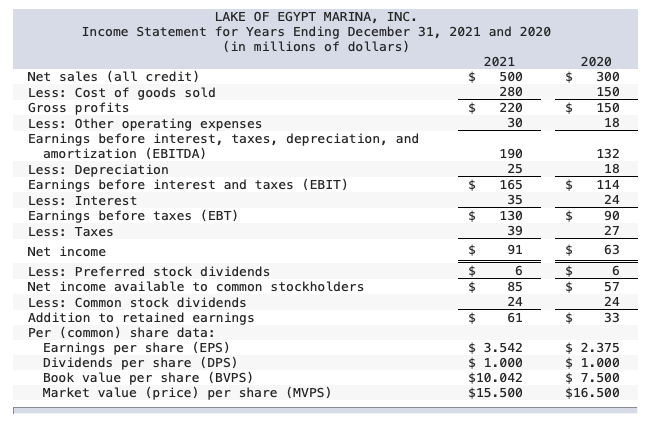

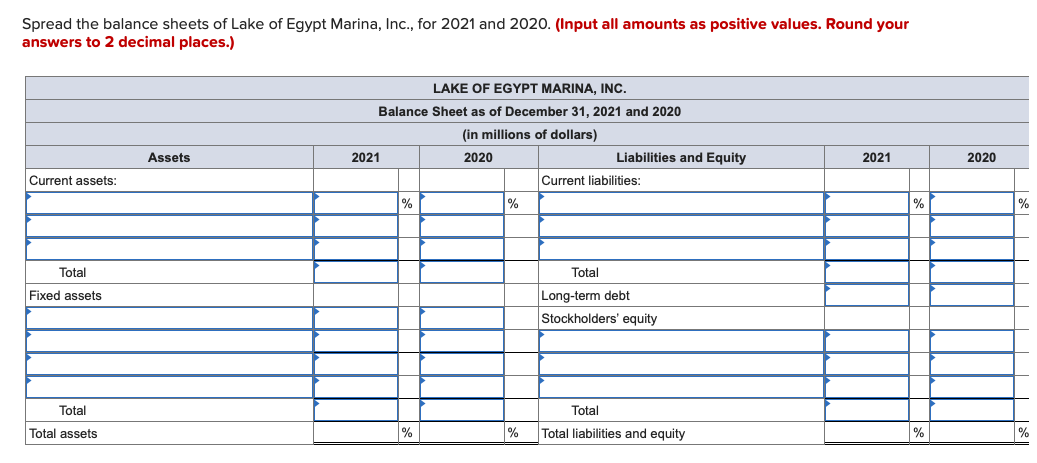

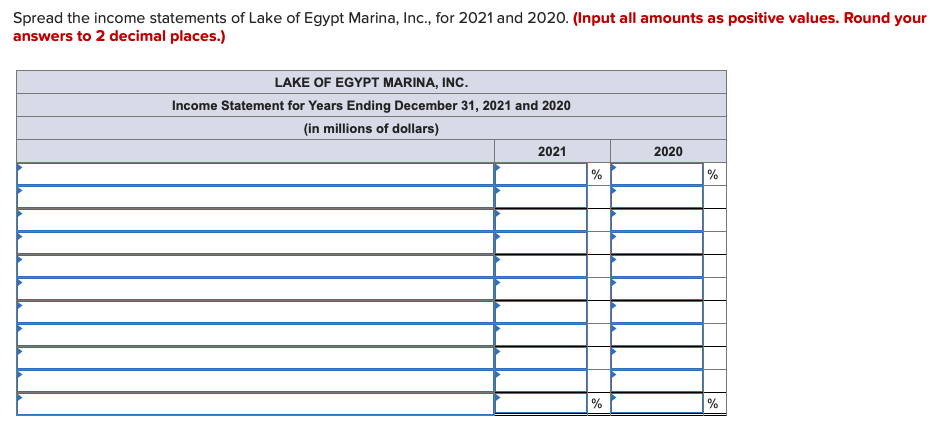

Use the following financial statements for Lake of Egypt Marina, Inc., 2021 2020 LAKE OF EGYPT MARINA, INC. Balance Sheet as of December 31, 2021 and 2020 (in millions of dollars) 2021 2020 Assets Liabilities and Equity Current assets: Current liabilities: Cash and marketable securities 110 $ 90 Accrued wages and taxes Accounts receivable 100 84 Accounts payable Inventory 351 144 Notes payable Total $ 561 $318 Totai Fixed assets: Long-term debt: Gross plant and equipment $ 510 $342 Stockholders' equity: Less: Depreciation 121 96 Preferred stock (6 million shares) Common stock and paid-in surplus Net plant and equipment $ 389 $246 (24 million shares) Other long-term assets 50 36 Retained earnings Total $ 439 $282 Total Total assets $1,000 $600 Total liabilities and equity 90 80 70 240 513 $ 78 72 66 $216 $198 $ $ $ 6 $ 6 24 217 $ 247 $1,000 24 156 $186 $600 2020 $ 300 150 150 18 $ LAKE OF EGYPT MARINA, INC. Income Statement for Years Ending December 31, 2021 and 2020 (in millions of dollars) 2021 Net sales (all credit) $ 500 Less: Cost of goods sold 280 Gross profits 220 Less: Other operating expenses 30 Earnings before interest, taxes, depreciation, and amortization (EBITDA) 190 Less: Depreciation Earnings before interest and taxes (EBIT) $ 165 Less: Interest Earnings before taxes (EBT) $ 130 Less: Taxes Net income $ 91 Less: Preferred stock dividends $ 6 Net income available to common stockholders $ 85 Less: Common stock dividends 24 Addition to retained earnings $ 61 Per (common) share data: Earnings per share (EPS) $ 3.542 Dividends per share (DPS) $ 1.000 Book value per share (BVPS) $10.042 Market value (price) per share (MVPS) $15.500 132 18 114 24 90 27 63 $ $ $ $ 6 57 24 33 $ $ 2.375 $ 1.000 $ 7.500 $16.500 Spread the balance sheets of Lake of Egypt Marina, Inc., for 2021 and 2020. (Input all amounts as positive values. Round your answers to 2 decimal places.) LAKE OF EGYPT MARINA, INC. Balance Sheet as of December 31, 2021 and 2020 (in millions of dollars) 2021 2020 Liabilities and Equity Current liabilities: % % Assets 2021 2020 Current assets: % % Total Total Fixed assets Long-term debt Stockholders' equity Total Total assets % % Total Total liabilities and equity % Spread the income statements of Lake of Egypt Marina, Inc., for 2021 and 2020. (Input all amounts as positive values. Round your answers to 2 decimal places.) LAKE OF EGYPT MARINA, INC. Income Statement for Years Ending December 31, 2021 and 2020 (in millions of dollars) 2021 2020 % % % % Use the following financial statements for Lake of Egypt Marina, Inc., 2021 2020 LAKE OF EGYPT MARINA, INC. Balance Sheet as of December 31, 2021 and 2020 (in millions of dollars) 2021 2020 Assets Liabilities and Equity Current assets: Current liabilities: Cash and marketable securities 110 $ 90 Accrued wages and taxes Accounts receivable 100 84 Accounts payable Inventory 351 144 Notes payable Total $ 561 $318 Totai Fixed assets: Long-term debt: Gross plant and equipment $ 510 $342 Stockholders' equity: Less: Depreciation 121 96 Preferred stock (6 million shares) Common stock and paid-in surplus Net plant and equipment $ 389 $246 (24 million shares) Other long-term assets 50 36 Retained earnings Total $ 439 $282 Total Total assets $1,000 $600 Total liabilities and equity 90 80 70 240 513 $ 78 72 66 $216 $198 $ $ $ 6 $ 6 24 217 $ 247 $1,000 24 156 $186 $600 2020 $ 300 150 150 18 $ LAKE OF EGYPT MARINA, INC. Income Statement for Years Ending December 31, 2021 and 2020 (in millions of dollars) 2021 Net sales (all credit) $ 500 Less: Cost of goods sold 280 Gross profits 220 Less: Other operating expenses 30 Earnings before interest, taxes, depreciation, and amortization (EBITDA) 190 Less: Depreciation Earnings before interest and taxes (EBIT) $ 165 Less: Interest Earnings before taxes (EBT) $ 130 Less: Taxes Net income $ 91 Less: Preferred stock dividends $ 6 Net income available to common stockholders $ 85 Less: Common stock dividends 24 Addition to retained earnings $ 61 Per (common) share data: Earnings per share (EPS) $ 3.542 Dividends per share (DPS) $ 1.000 Book value per share (BVPS) $10.042 Market value (price) per share (MVPS) $15.500 132 18 114 24 90 27 63 $ $ $ $ 6 57 24 33 $ $ 2.375 $ 1.000 $ 7.500 $16.500 Spread the balance sheets of Lake of Egypt Marina, Inc., for 2021 and 2020. (Input all amounts as positive values. Round your answers to 2 decimal places.) LAKE OF EGYPT MARINA, INC. Balance Sheet as of December 31, 2021 and 2020 (in millions of dollars) 2021 2020 Liabilities and Equity Current liabilities: % % Assets 2021 2020 Current assets: % % Total Total Fixed assets Long-term debt Stockholders' equity Total Total assets % % Total Total liabilities and equity % Spread the income statements of Lake of Egypt Marina, Inc., for 2021 and 2020. (Input all amounts as positive values. Round your answers to 2 decimal places.) LAKE OF EGYPT MARINA, INC. Income Statement for Years Ending December 31, 2021 and 2020 (in millions of dollars) 2021 2020 % % % %