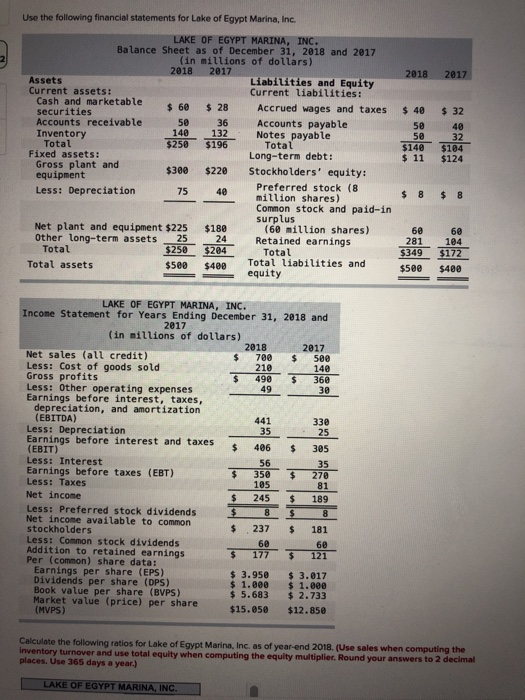

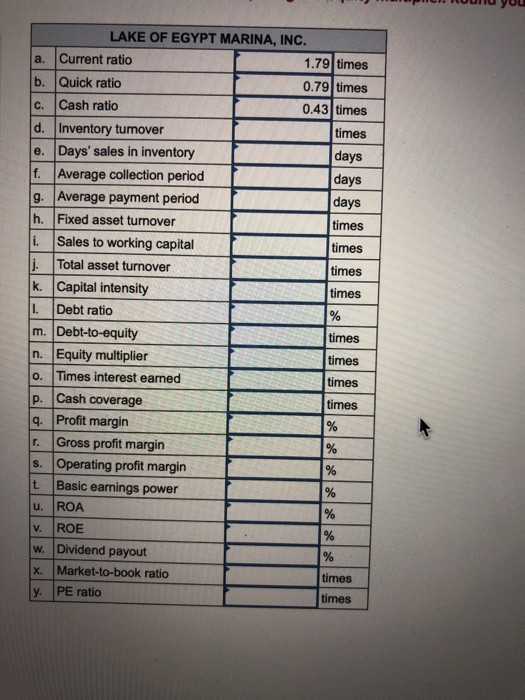

Use the following financial statements for Lake of Egypt Marina, Inc. 2018 2017 LAKE OF EGYPT MARINA, INC. Balance Sheet as of December 31, 2018 and 2017 (in millions of dollars) 2018 2017 Assets Liabilities and Equity Current assets: Current liabilities: Cash and marketable securities $ 60 $ 28 Accrued wages and taxes Accounts receivable 50 36 Accounts payable Inventory 140 132 Notes payable Total $250 $196 Total Fixed assets: Long-term debt: Gross plant and $300 $220 Stockholders' equity: equipment Less: Depreciation 75 Preferred stock (8 40 million shares) Common stock and paid-in surplus Net plant and equipment $225 $180 (60 million shares) Other long-term assets 25 24 Retained earnings Total $250 $204 Total Total assets $500 $400 Total liabilities and equity $ 40 50 50 $140 $ 11 $ 32 40 32 $104 $124 $ 8 $ 8 60 281 $349 $500 be 104 $172 $400 LAKE OF EGYPT MARINA, INC. Income Statement for Years Ending December 31, 2018 and 2017 (in millions of dollars) 2018 2017 Net sales (all credit) $ 700 500 Less: Cost of goods sold 210 140 Gross profits $ 498 $ 360 Less: Other operating expenses 49 30 Earnings before interest, taxes, depreciation, and amortization (EBITDA) 441 330 Less: Depreciation 35 25 Earnings before interest and taxes (EBIT) $ 406 $ 305 Less: Interest 56 35 Earnings before taxes (EBT) $ 350 $ 270 Less: Taxes 105 81 Net income $ 245 $ 189 Less: Preferred stock dividends $ 8 $ 8 Net income available to common stockholders $ 237 181 Less: Common stock dividends 60 60 Addition to retained earnings $ 177 121 Per (common) share data: Earnings per share (EPS) $ 3.950 $ 3.017 Dividends per share (DPS) $ 1.000 $ 1.000 Book value per share (BVPS) $ 5.683 $ 2.733 Market value (price) per share (MVPS) $15.050 $12.850 $ Calculate the following ratios for Lake of Egypt Marina, Inc. as of year-end 2018. (Use sales when computing the Inventory turnover and use total equity when computing the equity multiplier. Round your answers to 2 decimal places. Use 365 days a year.) LAKE OF EGYPT MARINA, INC. LAKE OF EGYPT MARINA, INC. a. Current ratio 1.79 times b. Quick ratio 0.79 times C. Cash ratio 0.43 times d. Inventory turnover times e. Days' sales in inventory days f. Average collection period days g. Average payment period days h. Fixed asset turnover times i. Sales to working capital times j. Total asset turnover times k. Capital intensity times L. Debt ratio % m. Debt-to-equity times n. Equity multiplier times o. Times interest earned times p. Cash coverage times q. Profit margin % Gross profit margin % s. Operating profit margin % t. Basic earnings power ROA % V. ROE % w. Dividend payout % X Market-to-book ratio times y. PE ratio times u