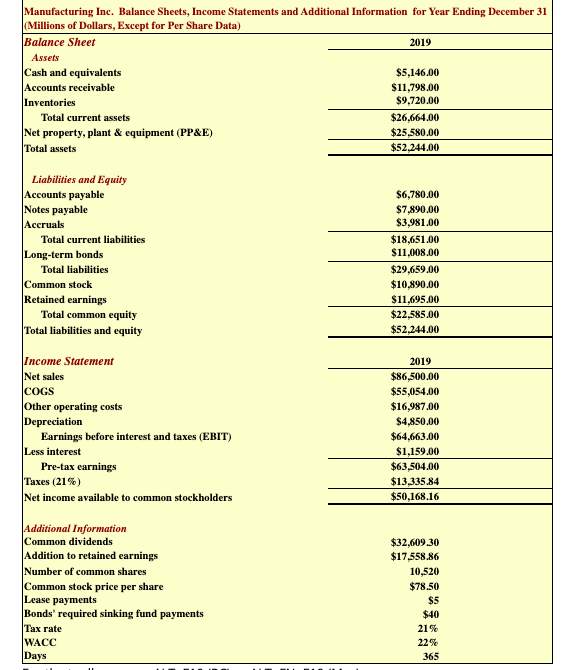

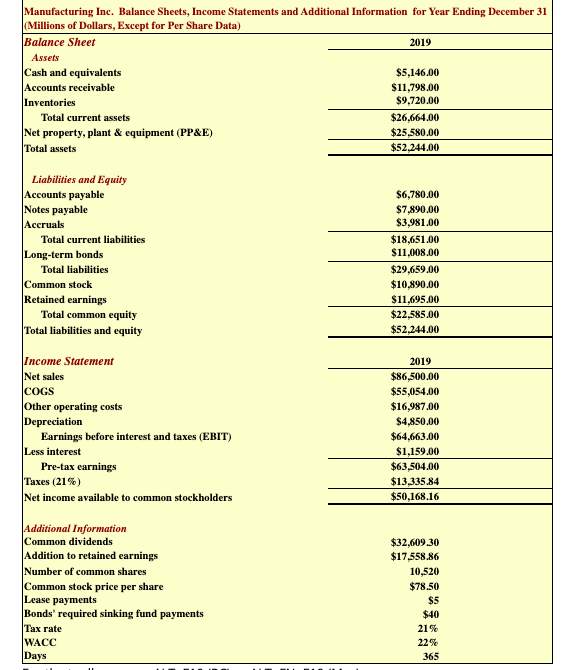

Use the following financial statements for Manufacturing Inc. to determine the

1) Inventory turnover

2) Total debt to capital ratio

3) Market debt ratio

4) Equity multiplier

5) ROE

6) ROIC

7) MVA

8) EVA

Manufacturing Inc. Balance Sheets, Income Statements and Additional Information for Year Ending December 31 (Millions of Dollars, Except for Per Share Data) Balance Sheet 2019 Assets Cash and equivalents $5,146.00 Accounts receivable $11,798.00 Inventories $9,720.00 Total current assets $26,664.00 Net property, plant & equipment (PP&E) $25,580.00 Total assets $52,244.00 Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Total liabilities Common stock Retained earnings Total common equity Total liabilities and equity $6,780.00 $7,890.00 $3,981.00 $18,651.00 $11,008.00 $29,659.00 $10,890.00 $11,695.00 $22,585.00 $52,244.00 Income Statement Net sales COGS Other operating costs Depreciation Earnings before interest and taxes (EBIT) Less interest Pre-tax earnings Taxes (21%) Net income available to common stockholders 2019 $86,500.00 $55,054.00 $16.987.00 $4,850.00 $64,663.00 $1,159.00 $63,504.00 $13.335.84 $50,168.16 Additional Information Common dividends Addition to retained earnings Number of common shares Common stock price per share Lease payments Bonds' required sinking fund payments Tax rate WACC Days $32,609.30 $17,558.86 10,520 $78.50 $5 $40 21% 22% 365 Manufacturing Inc. Balance Sheets, Income Statements and Additional Information for Year Ending December 31 (Millions of Dollars, Except for Per Share Data) Balance Sheet 2019 Assets Cash and equivalents $5,146.00 Accounts receivable $11,798.00 Inventories $9,720.00 Total current assets $26,664.00 Net property, plant & equipment (PP&E) $25,580.00 Total assets $52,244.00 Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Total liabilities Common stock Retained earnings Total common equity Total liabilities and equity $6,780.00 $7,890.00 $3,981.00 $18,651.00 $11,008.00 $29,659.00 $10,890.00 $11,695.00 $22,585.00 $52,244.00 Income Statement Net sales COGS Other operating costs Depreciation Earnings before interest and taxes (EBIT) Less interest Pre-tax earnings Taxes (21%) Net income available to common stockholders 2019 $86,500.00 $55,054.00 $16.987.00 $4,850.00 $64,663.00 $1,159.00 $63,504.00 $13.335.84 $50,168.16 Additional Information Common dividends Addition to retained earnings Number of common shares Common stock price per share Lease payments Bonds' required sinking fund payments Tax rate WACC Days $32,609.30 $17,558.86 10,520 $78.50 $5 $40 21% 22% 365