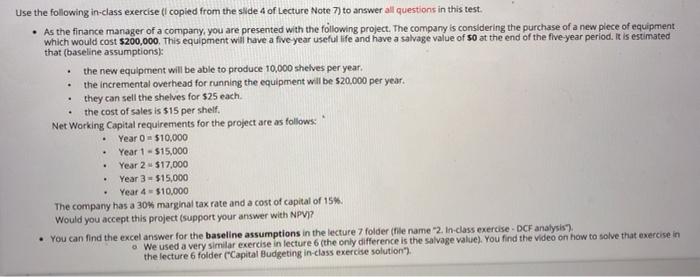

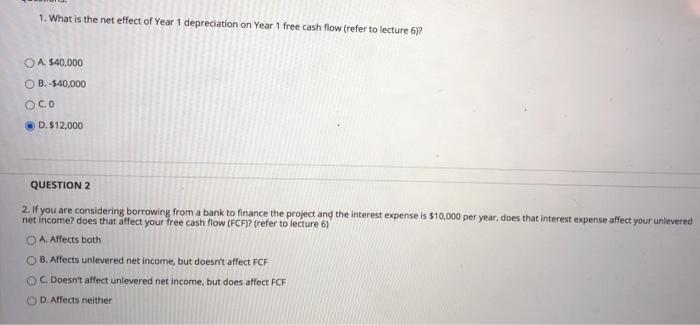

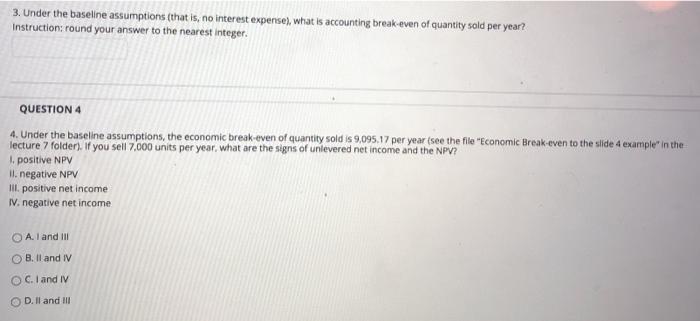

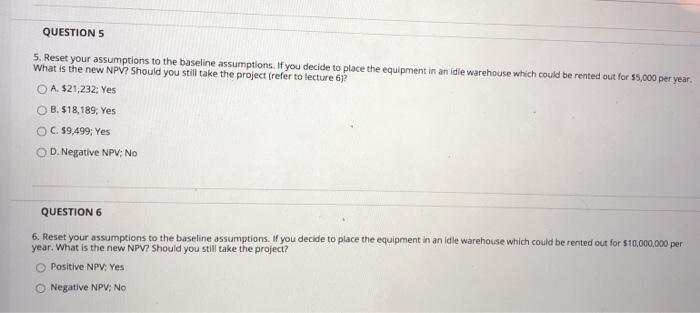

Use the following in-class exercise (i copied from the slide 4 of Lecture Note 7) to answer all questions in this test. . As the finance manager of a company, you are presented with the following project. The company is considering the purchase of a new piece of equipment which would cost $200,000. This equipment will have a five year useful life and have a salvage value of so at the end of the five year period. It is estimated that (baseline assumptions): the new equipment will be able to produce 10,000 shelves per year. the incremental overhead for running the equipment will be $20.000 per year. they can sell the shelves for $25 each the cost of sales is $15 per shelf Net Working Capital requirements for the project are as follows: Year $10.000 Year 1 - $15,000 Year 2 $17,000 Year 3 - $15,000 Year 4 - $10,000 The company has a 30% marginal tax rate and a cost of capital of 15%. Would you accept this project support your answer with NPV)? You can find the excel answer for the baseline assumptions in the lecture 7 folder (file name "2. In-class exercise - DCF analysis) We used a very similar exercise in lecture 6(the only difference is the salvage value). You find the video on how to solve that exercise in the lecture 6 folder("Capital Budgeting in-class exercise solution") 1. What is the net effect of Year 1 depreciation on Year 1 free cash flow (refer to lecture 652 A. $40,000 OB. -$40,000 OCO D. $12,000 QUESTION 2 2. If you are considering borrowing from a bank to finance the project and the interest expense is $10,000 per year, does that interest expense affect your unlevered net income? does that affect your free cash flow (FCF77 (refer to lecture 6) A. Affects both OB.Affects unlevered net income, but doesn't affect FCF C. Doesn't affect unlevered net income, but does affect FCF O D. Affects neither 3. Under the baseline assumptions (that is, no interest expense), what is accounting break-even of quantity sold per year? Instruction: round your answer to the nearest Integer. QUESTION 4 4. Under the baseline assumptions, the economic break-even of quantity sold is 9,095.17 per year (see the file "Economic Break even to the slide 4 example in the lecture 7 folder). If you sell 7,000 units per year, what are the signs of unlevered net income and the NPV? positive NPV II. negative NPV III. positive net income W. negative net income A. I and III OB. II and IV C. I and IV D. ll and I QUESTION 5 5. Reset your assumptions to the baseline assumptions. If you decide to place the equipment in an idie warehouse which could be rented out for $5,000 per year. What is the new NPV? Should you still take the project refer to lecture 612 A. $21,232: Yes OB. $18,189, Yes OC. 59,499: Yes D. Negative NPV; No QUESTION 6 6. Reset your assumptions to the baseline assumptions. If you decide to place the equipment in an idle warehouse which could be rented out for $10,000,000 per year. What is the new NPV? Should you still take the project? Positive NPV: Yes Negative NPV; No