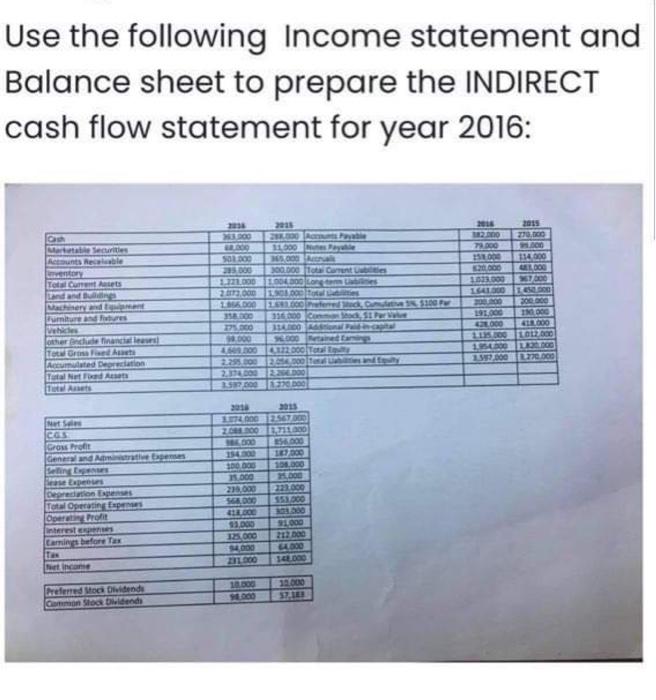

Use the following Income statement and Balance sheet to prepare the INDIRECT cash flow statement for year 2016: 2015 2016 Cash 263,000 $8,000 182.000 2015 270,000 288.000 Acts Payable 11,000 Nunes Payable 79.000 9.000 Marketable Securities Accounts Recalable ventory 501.000 345,000 Accrual 158,000 114,000 295.000 300.000 Total Current abilities 820.000 481.000 Total Current Assets 1.221.000 1.004.000 Long 1033.000 967,000 Land and Buildings 2.072.000 1.908.000 Total Ladies 1641.000 1.450.000 Machinery and Equipment 200,000 1856.000 1.483.000 Preferred Stock, Cumulative 3%, $100 Par 316.000 Comma Stock, 51 Par Valve 300.000 Furniture and fixtures 358.000 191,000 190,000 Vehicles 275,000 314,000 Additional Paid capital 438.000 418.000 other onclude financial leaves) 98.000 96000 Retained Earnings 1135.000 1012,000 Total Gross Fixed Assets 4,609,000 4,322.000 Total Equilty 1954.000 1830.000 Accumulated Depreciation 2.295.000 2,054,000 Taal Labies and Equity 3.397,000 8.270.000 Total Net Fixed Assets 2,374,000 2.206.000 Total Assets 3.587.000 1.270.000 2015 Net Seles 2018 1074.000 2.567.000 2.088.000 3.711.000 CGS Gross Profit 186.000 856,000 General and Administrative Expenses 154.000 187,000 300.000 108,000 Selling Expenses 31.000 31,000 ease Expenses Depreciation Expenses 239,000 223.000 564,000 151,000 Total Operating Expenses Operating Profit 418,000 303.000 $3,000 91,000 interest expenses Camings before Tax 325,000 212.000 $4,000 64.000 Tax Net income 231.000 148.000 18.000 30.000 Preferred Stock Dividends Common Stock Dividends 94,000 $7,188 Use the following Income statement and Balance sheet to prepare the INDIRECT cash flow statement for year 2016: 2015 2016 Cash 263,000 $8,000 182.000 2015 270,000 288.000 Acts Payable 11,000 Nunes Payable 79.000 9.000 Marketable Securities Accounts Recalable ventory 501.000 345,000 Accrual 158,000 114,000 295.000 300.000 Total Current abilities 820.000 481.000 Total Current Assets 1.221.000 1.004.000 Long 1033.000 967,000 Land and Buildings 2.072.000 1.908.000 Total Ladies 1641.000 1.450.000 Machinery and Equipment 200,000 1856.000 1.483.000 Preferred Stock, Cumulative 3%, $100 Par 316.000 Comma Stock, 51 Par Valve 300.000 Furniture and fixtures 358.000 191,000 190,000 Vehicles 275,000 314,000 Additional Paid capital 438.000 418.000 other onclude financial leaves) 98.000 96000 Retained Earnings 1135.000 1012,000 Total Gross Fixed Assets 4,609,000 4,322.000 Total Equilty 1954.000 1830.000 Accumulated Depreciation 2.295.000 2,054,000 Taal Labies and Equity 3.397,000 8.270.000 Total Net Fixed Assets 2,374,000 2.206.000 Total Assets 3.587.000 1.270.000 2015 Net Seles 2018 1074.000 2.567.000 2.088.000 3.711.000 CGS Gross Profit 186.000 856,000 General and Administrative Expenses 154.000 187,000 300.000 108,000 Selling Expenses 31.000 31,000 ease Expenses Depreciation Expenses 239,000 223.000 564,000 151,000 Total Operating Expenses Operating Profit 418,000 303.000 $3,000 91,000 interest expenses Camings before Tax 325,000 212.000 $4,000 64.000 Tax Net income 231.000 148.000 18.000 30.000 Preferred Stock Dividends Common Stock Dividends 94,000 $7,188