Answered step by step

Verified Expert Solution

Question

1 Approved Answer

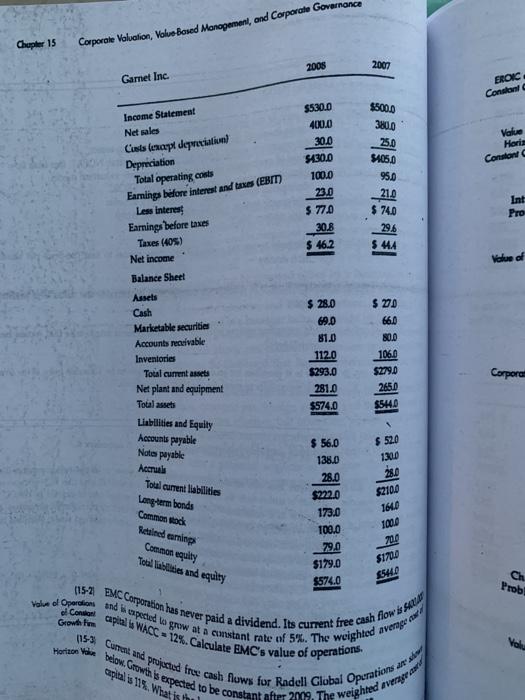

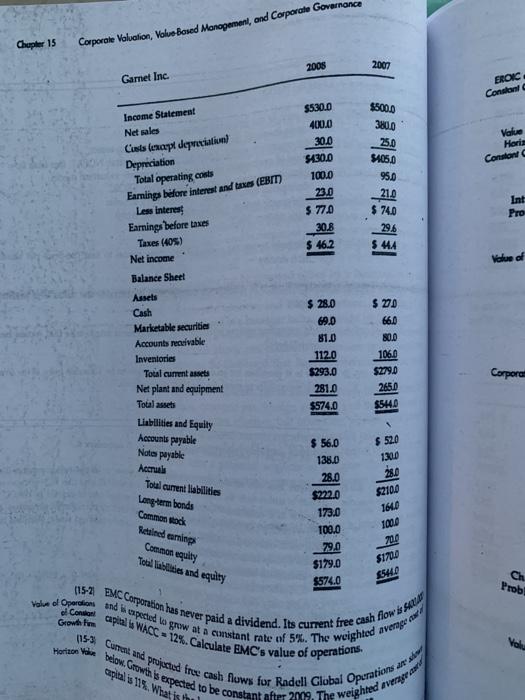

use the following income statements and balance sheets to calculate Garnet Inc's free cash flow for 2008 Cheater 15 Corporate Valuation, Value Boxed Management, and

use the following income statements and balance sheets to calculate Garnet Inc's free cash flow for 2008

Cheater 15 Corporate Valuation, Value Boxed Management, and Corporate Governance 2008 2007 Gamnet Inc. EROL Conslow $530.0 $500.0 380.0 25.0 Income Statement Net als Canis (napt depreciation Depreciation Total operating costs Eaming before interest and bexas (EBIT Value Herit Contow 400.0 30.0 54300 100.0 230 $ 770 30.8 $ 46.2 51050 95.0 21.0 $ 74.0 296 SMA Pro Value of Value of Operation und Specielo grow at a constant rate of 5%. The weighted avere (15-2 PMC Corporation has never paid a dividend. Its current free cash flow is Growth for pitals WACC = 12%. Calculate EMC's value of operations. 15-3 Current and proceed free cash flows for Radell Global Operations Horton below. Grow's expected to be constant after 2009. The weighted av el Conson Less interest Earnings before taxes Taxes (405) Net income Balance Sheet Assets Cash Marketable securities Accounts reivable Inventories Total current assets Net plant and equipment $ 28.0 69.0 810 1120 $293.0 281.0 $ 270 66.0 80.0 106.0 52790 2650 $540 Corpore $574.0 Total assets Liabilities and Equity Accounts payable Notes payabic Accra Toul current liabilities Long-term bonds $ 56.0 138.0 28.0 $2720 173.0 100.0 792 $179.0 $574.0 $ 52.0 1300 28.0 $2100 166 Commen ock Stains earning Common equity Total abilities and equity 1000 2010 $1700 $542 Ch Prob capital is 11%. What is the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started