Answered step by step

Verified Expert Solution

Question

1 Approved Answer

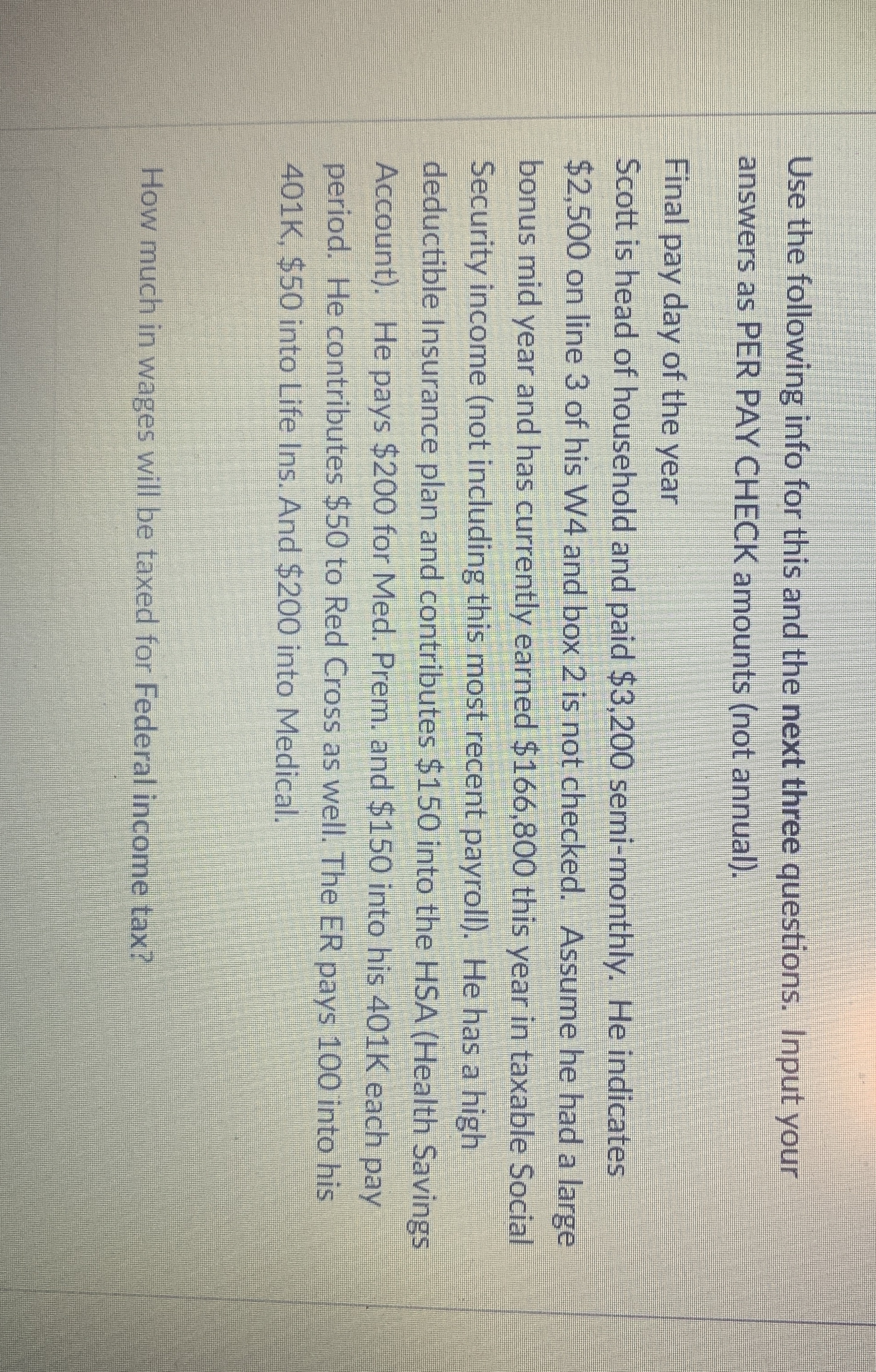

Use the following info for this and the next three questions. Input your answers as PER PAY CHECK amounts ( not annual ) . Final

Use the following info for this and the next three questions. Input your answers as PER PAY CHECK amounts not annual

Final pay day of the year

Scott is head of household and paid $ semimonthly. He indicates $ on line of his W and box is not checked. Assume he had a large bonus mid year and has currently earned $ this year in taxable Social Security income not including this most recent payroll He has a high deductible Insurance plan and contributes $ into the HSA Health Savings Account He pays $ for Med. Prem. and $ into his K each pay period. He contributes $ to Red Cross as well. The ER pays into his $ into Life Ins. And $ into Medical.

How much in wages will be taxed for Federal income tax?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started