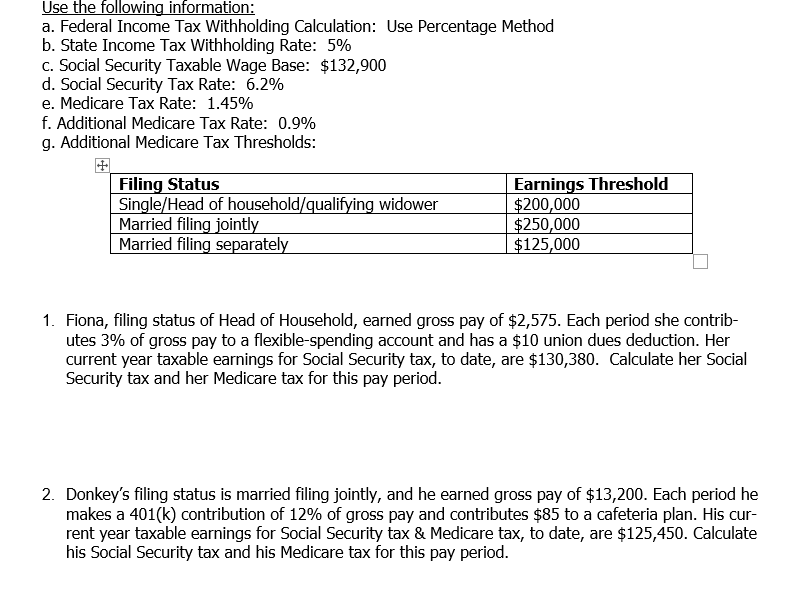

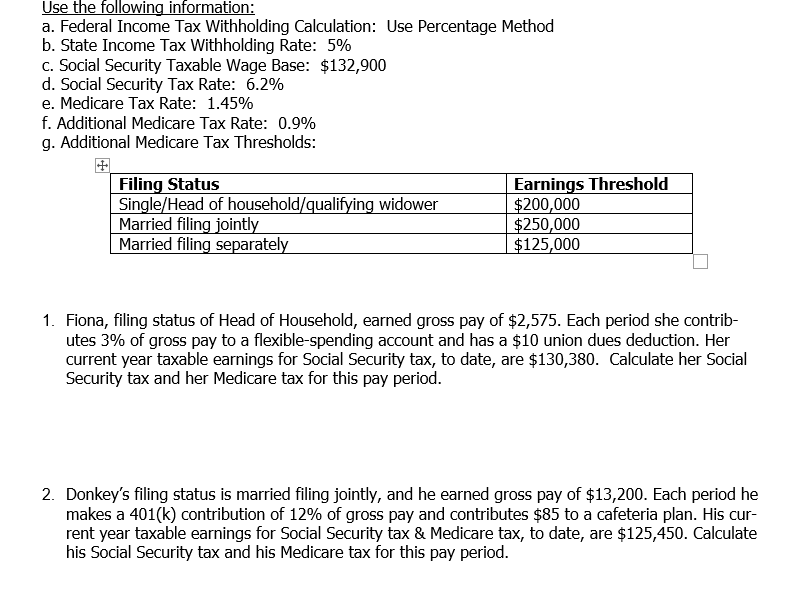

Use the following information: a. Federal Income Tax Withholding Calculation: Use Percentage Method b. State Income Tax Withholding Rate: 5% C. Social Security Taxable Wage Base: $132,900 d. Social Security Tax Rate: 6.2% e. Medicare Tax Rate: 1.45% f. Additional Medicare Tax Rate: 0.9% g. Additional Medicare Tax Thresholds: Filing Status Single/Head of household/qualifying widower Married filing jointly Married filing separately Earnings Threshold $200,000 $250,000 $125,000 1. Fiona, filing status of Head of Household, earned gross pay of $2,575. Each period she contrib- utes 3% of gross pay to a flexible-spending account and has a $10 union dues deduction. Her current year taxable earnings for Social Security tax, to date, are $130,380. Calculate her Social Security tax and her Medicare tax for this pay period. 2. Donkey's filing status is married filing jointly, and he earned gross pay of $13,200. Each period he makes a 401(k) contribution of 12% of gross pay and contributes $85 to a cafeteria plan. His cur- rent year taxable earnings for Social Security tax & Medicare tax, to date, are $125,450. Calculate his Social Security tax and his Medicare tax for this pay period. Use the following information: a. Federal Income Tax Withholding Calculation: Use Percentage Method b. State Income Tax Withholding Rate: 5% C. Social Security Taxable Wage Base: $132,900 d. Social Security Tax Rate: 6.2% e. Medicare Tax Rate: 1.45% f. Additional Medicare Tax Rate: 0.9% g. Additional Medicare Tax Thresholds: Filing Status Single/Head of household/qualifying widower Married filing jointly Married filing separately Earnings Threshold $200,000 $250,000 $125,000 1. Fiona, filing status of Head of Household, earned gross pay of $2,575. Each period she contrib- utes 3% of gross pay to a flexible-spending account and has a $10 union dues deduction. Her current year taxable earnings for Social Security tax, to date, are $130,380. Calculate her Social Security tax and her Medicare tax for this pay period. 2. Donkey's filing status is married filing jointly, and he earned gross pay of $13,200. Each period he makes a 401(k) contribution of 12% of gross pay and contributes $85 to a cafeteria plan. His cur- rent year taxable earnings for Social Security tax & Medicare tax, to date, are $125,450. Calculate his Social Security tax and his Medicare tax for this pay period