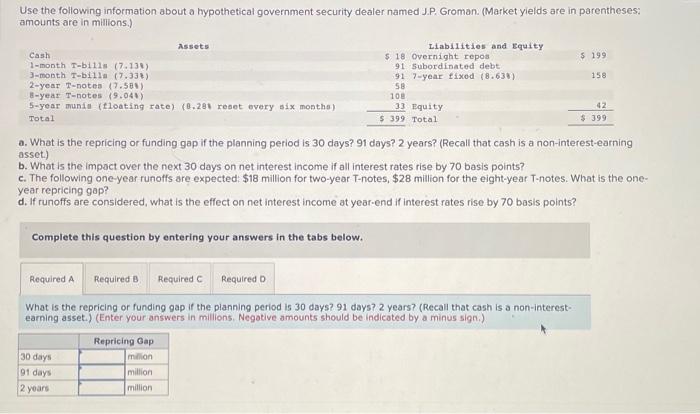

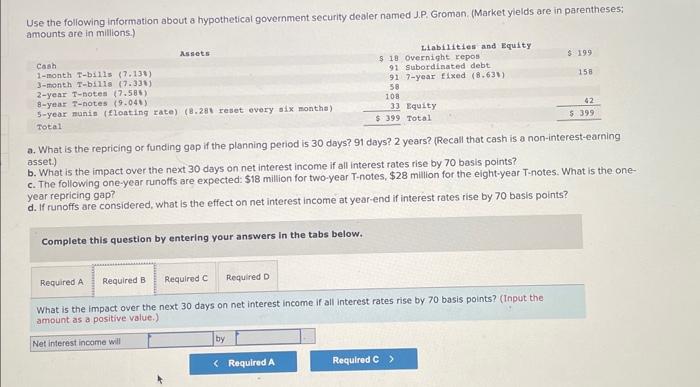

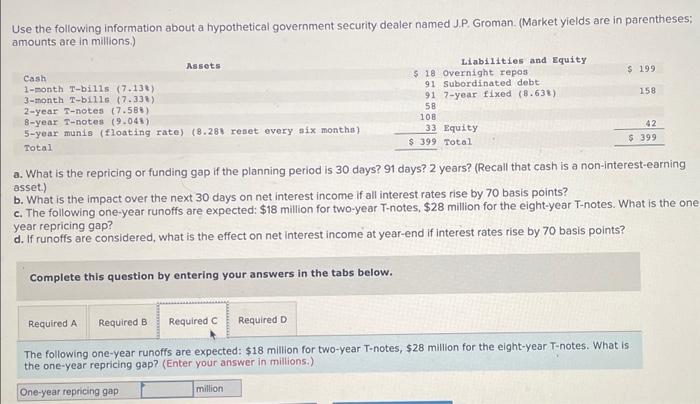

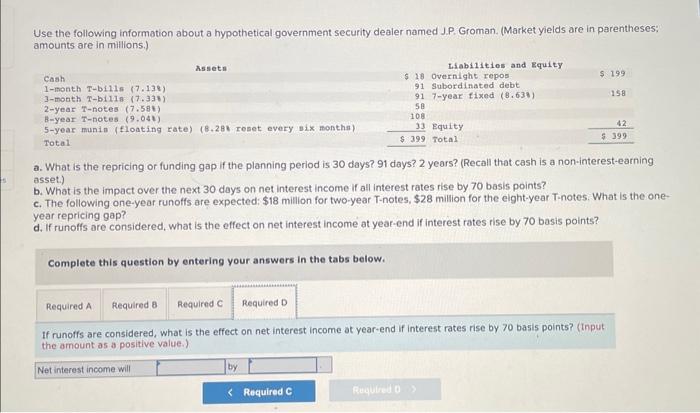

Use the following information about a hypothetical government security dealer named J.P. Groman. (Market yields are in parentheses: amounts are in milions.) a. What is the repricing or funding gap if the planning period is 30 days? 91 days? 2 years? (Recall that cash is a non-interest-earning asset.) b. What is the impact over the next 30 days on net interest income if all interest rates rise by 70 basis points? c. The following one-year runoffs are expected: $18 million for two-year T-notes, $28 million for the eight-year T-notes. What is the oneyear repricing gap? d. If runoffs are considered, what is the effect on net interest income at year-end if interest rates rise by 70 basis points? Complete this question by entering your answers in the tabs below. What is the repricing or funding gap if the planning period is 30 days? 91 days? 2 years? (Recall that cash is a non-interestearning asset.) (Enter your answers in millons. Negative amounts should be indicated by a minus sign.) Use the following information about a hypothetical government security dealer named J.P. Groman. (Market ylelds are in parentheses; ammunte arm in millions.1 a. What is the repricing or funding gap if the planning period is 30 days? 91 days? 2 years? (Recall that cash is a non-interest-earning b. What is the impact over the next 30 days on net interest income if all interest rates rise by 70 basis points? asset.) c. The following one-year runoffs are expected: $18 million for two-year T-notes, $28 million for the eight-year T-notes. What is the one- d. If runoffs are considered, what is the effect on net interest income at year-end if interest rates rise by 70 basis points? year repricing gap? Complete this question by entering your answers in the tabs below. What is the impact over the next 30 days on net interest income if all interest rates rise by 70 basis points? (Input the amount as a positive value.) Use the following information about a hypothetical government security dealer named J.P. Groman. (Market yields are in parentheses: amounts are in millions.) a. What is the repricing or funding gap if the planning period is 30 days? 91 days? 2 years? (Recall that cash is a non-interest-earning asset) b. What is the impact over the next 30 days on net interest income if all interest rates rise by 70 basis points? c. The following one-year runoffs are expected: $18 million for two-year T-notes, $28 million for the eight-year T-notes. What is the on year repricing gap? d. If runoffs are considered, what is the effect on net interest income at year-end if interest rates rise by 70 basis points? Complete this question by entering your answers in the tabs below. The following one-year runoffs are expected: $18 million for two-year T-notes, $28 million for the eight-year T-notes. What is the one-year repricing gap? (Enter your answer in millions.) Use the following information about a hypothetical government security dealer named J.P. Groman. (Market yields are in parentheses: amounts are in millions.) a. What is the repricing or funding gap if the planning period is 30 days? 91 days? 2 years? (Recall that cash is a non-interest-earning asset.) b. What is the impact over the next 30 days on net interest income if all interest rates rise by 70 basis points? c. The following one-year runoffs are expected: $18 milion for two-year T-notes, $28 million for the eight-year T-notes. What is the oneyear repricing gap? d. If runolfs ore considered, what is the effect on net interest income at year-end if interest rates rise by 70 basis points? Complete this question by entering your answers in the tabs below. If runoffs are considered, what is the effect on net interest income at year-end if interest rates rise by 70 basis points? (Input the amount as a positive value.)