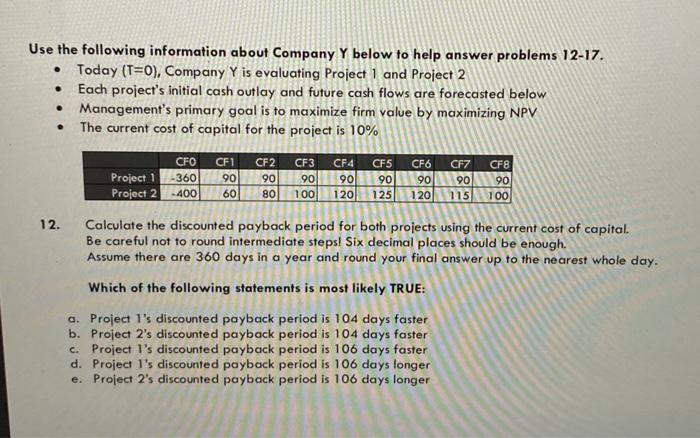

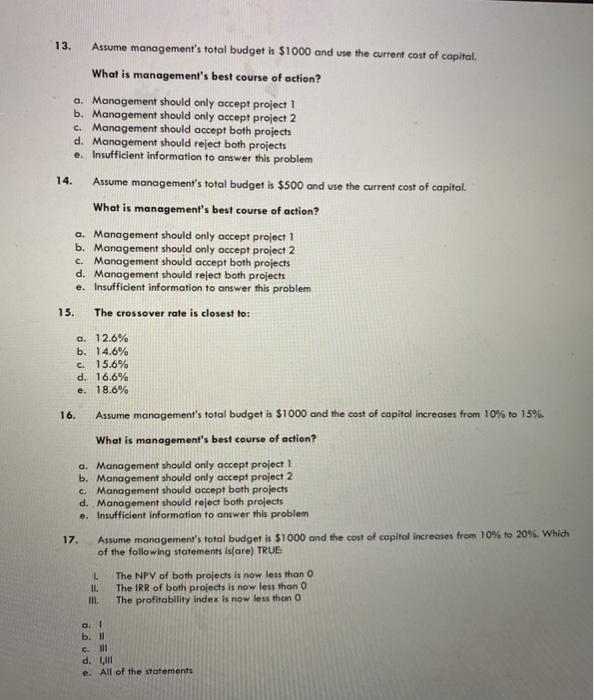

Use the following information about Company Y below to help answer problems 12-17. Today (T=0), Company Y is evaluating Project 1 and Project 2 Each project's initial cash outlay and future cash flows are forecasted below Management's primary goal is to maximize firm value by maximizing NPV The current cost of capital for the project is 10% . . CFO Project 1 -360 Project 2 -400 CF1 90 60 CF2 90 80 CF3 90 100 CF4 90 1201 CF5 CF6 CF7 CF8 90 90 90 90 125 120 115 100 12. Calculate the discounted payback period for both projects using the current cost of capital. Be careful not to round intermediate steps! Six decimal places should be enough. Assume there are 360 days in a year and round your final answer up to the nearest whole day. Which of the following statements is most likely TRUE: a. Project 1's discounted payback period is 104 days faster b. Project 2's discounted payback period is 104 days faster c. Project I's discounted payback period is 106 days faster d. Project I's discounted payback period is 106 days longer e. Project 2's discounted payback period is 106 days longer 13. Assume management's total budget is $1000 and use the current cost of capital. What is management's best course of action? a. Management should only accept project 1 b. Management should only accept project 2 C. Management should accept both projects d. Management should reject both projects e. Insufficient information to answer this problem 14. Assume management's total budget is $500 and use the current cost of capital. What is management's best course of action? a. Management should only accept project 1 b. Management should only accept project 2 c. Management should accept both projects d. Management should reject both projects e. Insufficient information to answer this problem 15. The crossover rate is closest to: a. 12.6% b. 14.6% C. 15.6% d. 16.6% e. 18.6% 16. Assume management's total budget is $1000 and the cost of capital increases from 10% to 15%. What is management's best course of action? a. Management should only accept project 1 b. Management should only accept project 2 c. Management should accept both projects d. Management should reject both projects e. Insufficient Information to answer this problem 17 Assume management's total budget is $1000 and the cost of copitol increases from 10% to 20%. Which of the following statements isare) TRUE L IL IIL The NPV of both projects is now less than 0 The IRR of both projects is now less than 0 The profitability index is now less than 0 G. b. Cell d. All e. All of the statements