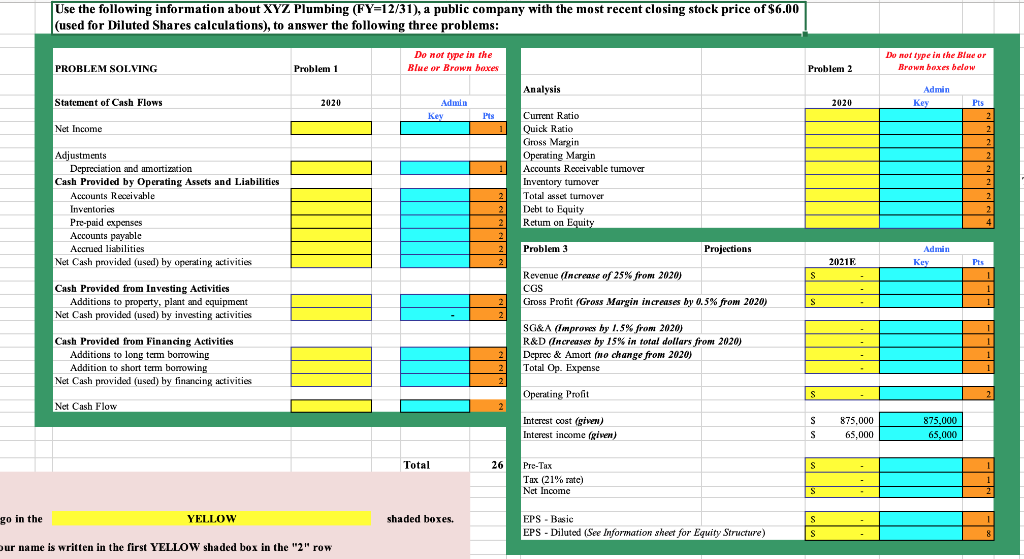

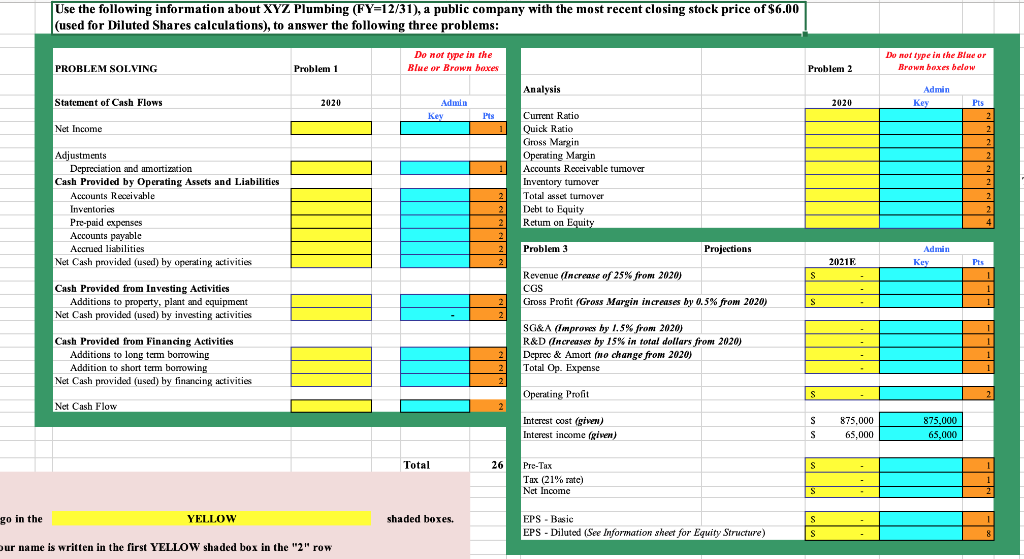

Use the following information about XYZ Plumbing (FY=12/31), a public company with the most recent closing stock price of $6.00 (used for Diluted Shares calculations), to answer the following three problems:

Use the following information about XYZ Plumbing (FY=12/31), a public company with the most recent closing stock price of $6.00 (used for Diluted Shares calculations), to answer the following three problems: Do not type in the Blue or Brown boxes Do not type in the Blue or Brown boxes below PROBLEM SOLVING Problem 1 Problem 2 Analysis Admin Statement of Cash Flows 2020 2020 Pts Admin Key Pts Net Income 2 2 2 Current Ratio Quick Ratio Gross Margin Operating Margin Accounts Receivable tumover Inventory tumover Total asset turnover Debt to Equity Retum on Equity Adjustments Depreciation and amortization Cash Provided by Operating Assets and Liabilities Accounts Receivable Inventories Pre-paid expenses Accounts payable Accrued liabilities Net Cash provided (used) by operating activities 2 2 2 2 Problem 3 2 2 Projections Admin Key 20215 Pts S Cash Provided from Investing Activities Additions to property, plant and equipment Net Cash provided (used) by investing activities Revenue (Increase of 25% from 2020) CGS Gross Profit (Gross Margin increases by 0.5% from 2020) 1 1 S 2 Cash Provided from Financing Activities Additions to long term borrowing Addition to short term borrowing Net Cash provided (used) by financing activities SG&A (Tpromos hy 1.5% from 2020) R&D (Increases by 15% in total dollars from 2020) Deprec & Amort (no change from 2020) Total Op. Expense 2 2 2 Operating Profit S Net Cash Flow Interest cost (given) Interest income (given) S S S 875.000 65,000 875,000 65,000 Total 26 S Pre-Tax Tax (21% rate) Net Income S go in the YELLOW shaded boxes. EPS - Basic EPS - Diluted (See Information sheet for Equity Structure) S s S Our name is written in the first YELLOW shaded box in the "2" row Use the following information about XYZ Plumbing (FY=12/31), a public company with the most recent closing stock price of $6.00 (used for Diluted Shares calculations), to answer the following three problems: Do not type in the Blue or Brown boxes Do not type in the Blue or Brown boxes below PROBLEM SOLVING Problem 1 Problem 2 Analysis Admin Statement of Cash Flows 2020 2020 Pts Admin Key Pts Net Income 2 2 2 Current Ratio Quick Ratio Gross Margin Operating Margin Accounts Receivable tumover Inventory tumover Total asset turnover Debt to Equity Retum on Equity Adjustments Depreciation and amortization Cash Provided by Operating Assets and Liabilities Accounts Receivable Inventories Pre-paid expenses Accounts payable Accrued liabilities Net Cash provided (used) by operating activities 2 2 2 2 Problem 3 2 2 Projections Admin Key 20215 Pts S Cash Provided from Investing Activities Additions to property, plant and equipment Net Cash provided (used) by investing activities Revenue (Increase of 25% from 2020) CGS Gross Profit (Gross Margin increases by 0.5% from 2020) 1 1 S 2 Cash Provided from Financing Activities Additions to long term borrowing Addition to short term borrowing Net Cash provided (used) by financing activities SG&A (Tpromos hy 1.5% from 2020) R&D (Increases by 15% in total dollars from 2020) Deprec & Amort (no change from 2020) Total Op. Expense 2 2 2 Operating Profit S Net Cash Flow Interest cost (given) Interest income (given) S S S 875.000 65,000 875,000 65,000 Total 26 S Pre-Tax Tax (21% rate) Net Income S go in the YELLOW shaded boxes. EPS - Basic EPS - Diluted (See Information sheet for Equity Structure) S s S Our name is written in the first YELLOW shaded box in the "2" row