Answered step by step

Verified Expert Solution

Question

1 Approved Answer

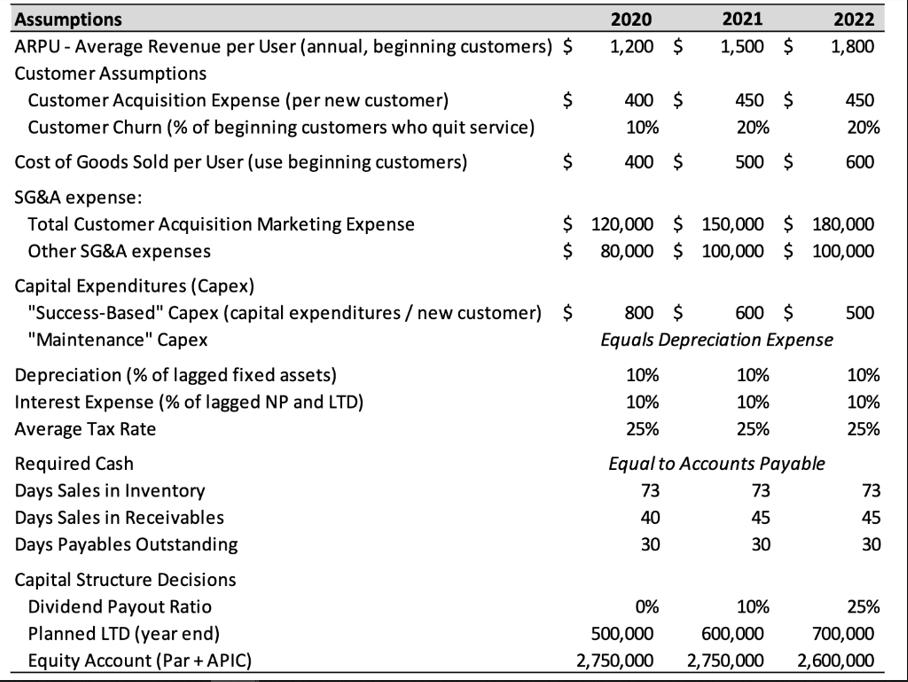

Use the following information and answer the questions Assumptions ARPU - Average Revenue per User (annual, beginning customers) $ Customer Assumptions Customer Acquisition Expense (per

Use the following information and answer the questions

Assumptions ARPU - Average Revenue per User (annual, beginning customers) $ Customer Assumptions Customer Acquisition Expense (per new customer) Customer Churn (% of beginning customers who quit service) Cost of Goods Sold per User (use beginning customers) SG&A expense: Total Customer Acquisition Marketing Expense Other SG&A expenses Capital Expenditures (Capex) Depreciation (% of lagged fixed assets) Interest Expense (% of lagged NP and LTD) Average Tax Rate $ Required Cash Days Sales in Inventory Days Sales in Receivables Days Payables Outstanding Capital Structure Decisions Dividend Payout Ratio Planned LTD (year end) Equity Account (Par + APIC) $ "Success-Based" Capex (capital expenditures / new customer) $ "Maintenance" Capex $ $ 2020 1,200 $ 400 $ 10% 400 $ 2021 1,500 $ 10% 10% 25% 450 $ 20% 500 $ 120,000 $ 150,000 $ 180,000 80,000 $ 100,000 $100,000 800 $ 600 $ Equals Depreciation Expense 0% 500,000 2,750,000 10% 10% 25% Equal to Accounts Payable 73 40 30 2022 1,800 73 45 30 10% 600,000 2,750,000 450 20% 600 500 10% 10% 25% 73 45 30 25% 700,000 2,600,000 Assumptions ARPU - Average Revenue per User (annual, beginning customers) $ Customer Assumptions Customer Acquisition Expense (per new customer) Customer Churn (% of beginning customers who quit service) Cost of Goods Sold per User (use beginning customers) SG&A expense: Total Customer Acquisition Marketing Expense Other SG&A expenses Capital Expenditures (Capex) Depreciation (% of lagged fixed assets) Interest Expense (% of lagged NP and LTD) Average Tax Rate $ Required Cash Days Sales in Inventory Days Sales in Receivables Days Payables Outstanding Capital Structure Decisions Dividend Payout Ratio Planned LTD (year end) Equity Account (Par + APIC) $ "Success-Based" Capex (capital expenditures / new customer) $ "Maintenance" Capex $ $ 2020 1,200 $ 400 $ 10% 400 $ 120,000 $ 80,000 $ 10% 10% 25% 2021 1,500 $ 450 $ 20% 500 $ 0% 500,000 2,750,000 800 $ 600 $ Equals Depreciation Expense 150,000 $ 180,000 100,000 $ 100,000 10% 10% 25% Equal to Accounts Payable 73 40 30 2022 1,800 73 45 30 10% 600,000 2,750,000 450 20% 600 500 10% 10% 25% 73 45 30 25% 700,000 2,600,000

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the projected investment into inventory between 2021 and 2022 we need to first calculate the projected cost of goods sold COGS for 2022 Projected COGS for 2022 Projected COGS for 2022 Pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started