Question

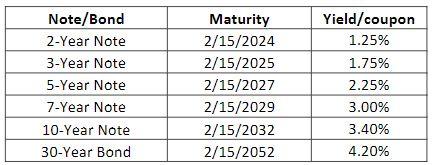

Use the following information as your starting point. There are five notes and one bond. Theoretical ontherun Treasury yields for a 2/15/22 settlement date are

Use the following information as your starting point. There are five notes and one bond. Theoretical ontherun Treasury yields for a 2/15/22 settlement date are given with the maturities. Assume each security is priced at par. Calculate the modified duration in years for each security using the MDURATION function in excel.

1) Calculate the modified duration and convexity measure in years using the approximation in the notes and book (slide 28 in Duration and Convexity Notes). Use 10 basis points (0.10%) as the plus and minus change in yield. 2) Calculate the portfolio weighted average: duration, convexity, and yield for two different portfolios: Portfolio 1: 25% weight in 3year, 50% weight in 5year, 25% weight in 7year. Portfolio 2: 73% weight in 2year, 16% weight in 10year, 11% weight in 30year. 3) Assume a 6month holding period and that you collect semiannual 1 coupon payment. Calculate the returns for portfolios 1 and 2 under the following 6 parallel yield curve shift scenarios: Delta Y: +1.50%, +1.00%, +0.50%, 0.50%, 1.00%, 1.50% 4) Explain the differences between the portfolio returns under the different parallel shift scenarios. Your answers should include a discussion of portfolio duration, convexity, and coupon.

Note/Bond 2-Year Note 3-Year Note 5-Year Note 7-Year Note 10-Year Note 30-Year Bond Maturity 2/15/2024 2/15/2025 2/15/2027 2/15/2029 2/15/2032 2/15/2052 Yield/coupon 1.25% 1.75% 2.25% 3.00% 3.40% 4.20% Note/Bond 2-Year Note 3-Year Note 5-Year Note 7-Year Note 10-Year Note 30-Year Bond Maturity 2/15/2024 2/15/2025 2/15/2027 2/15/2029 2/15/2032 2/15/2052 Yield/coupon 1.25% 1.75% 2.25% 3.00% 3.40% 4.20%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started