Answered step by step

Verified Expert Solution

Question

1 Approved Answer

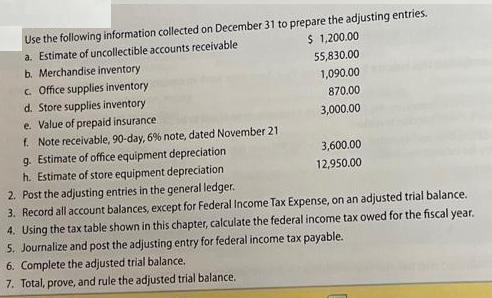

Use the following information collected on December 31 to prepare the adjusting entries. a. Estimate of uncollectible accounts receivable $ 1,200.00 b. Merchandise inventory

Use the following information collected on December 31 to prepare the adjusting entries. a. Estimate of uncollectible accounts receivable $ 1,200.00 b. Merchandise inventory 55,830.00 1,090.00 870.00 3,000,00 c. Office supplies inventory d. Store supplies inventory e. Value of prepaid insurance f. Note receivable, 90-day, 6% note, dated November 21 g. Estimate of office equipment depreciation h. Estimate of store equipment depreciation 2. Post the adjusting entries in the general ledger.. 3. Record all account balances, except for Federal Income Tax Expense, on an adjusted trial balance. 4. Using the tax table shown in this chapter, calculate the federal income tax owed for the fiscal year. 5. Journalize and post the adjusting entry for federal income tax payable. 6. Complete the adjusted trial balance. 7. Total, prove, and rule the adjusted trial balance. 3,600.00 12,950.00

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Adjusting Entries a Estimate of uncollectible accounts receivable Debit Allowance for Doubtful Accounts 1200 Credit Accounts Receivable 1200 b Merchandise Inventory Debit Inventory 55830 Credit Cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started