Answered step by step

Verified Expert Solution

Question

1 Approved Answer

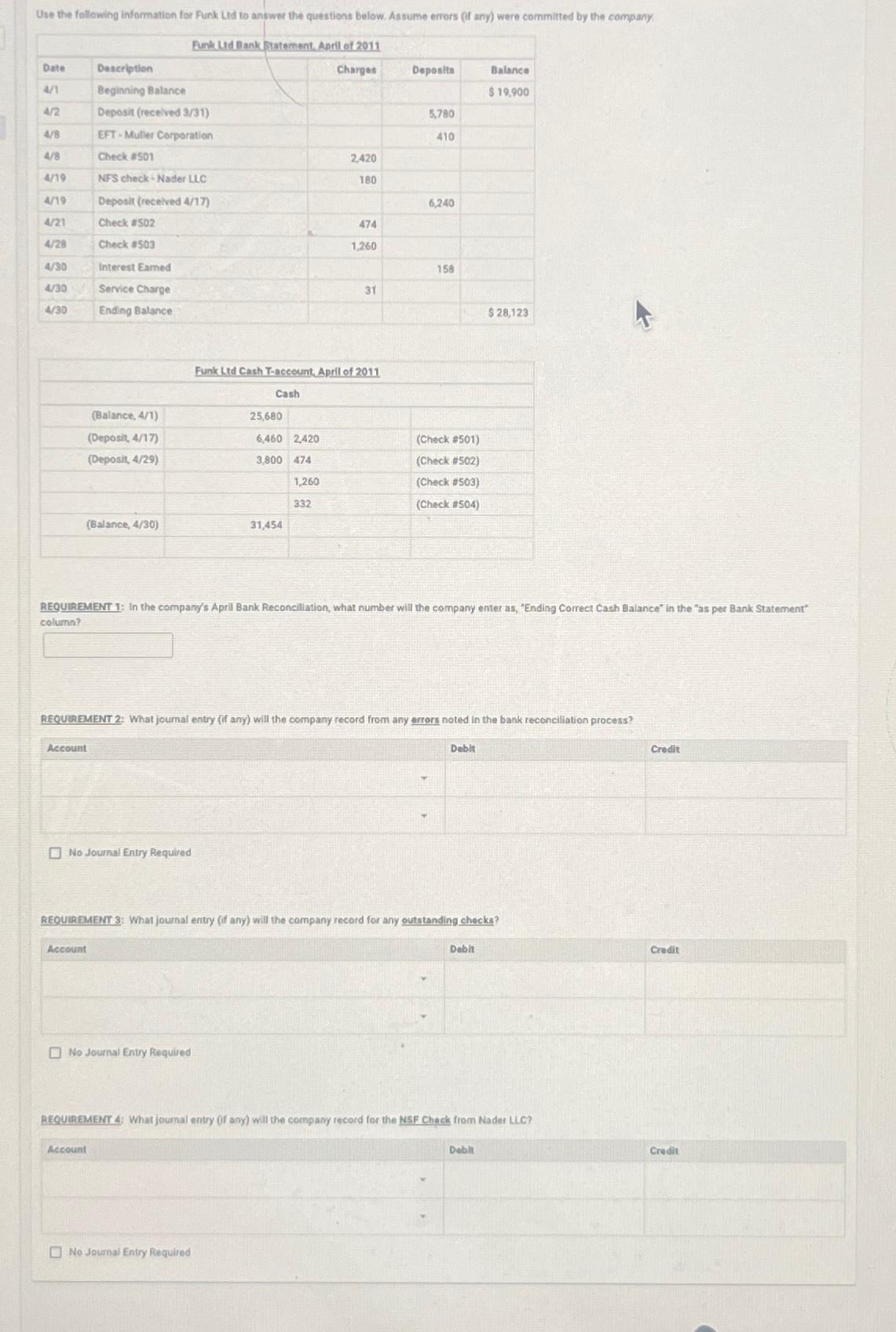

Use the following information for Funk Ltd to answer the questions below. Assume errors (if any) were committed by the company Funk Ltd Bank

Use the following information for Funk Ltd to answer the questions below. Assume errors (if any) were committed by the company Funk Ltd Bank Statement, April of 2011 Date 4/1 Description Beginning Balance Charges Deposits Balance $19,900 4/2 Deposit (received 3/31) 5,780 4/8 EFT-Muller Corporation 410 4/8 Check #501 2,420 4/19 NFS check-Nader LLC 180 4/19 Deposit (received 4/17) 6,240 4/21 Check #502 474 4/28 Check #503 1,260 4/30 Interest Earned 158 4/30 Service Charge 31 4/30 Ending Balance $28,123 Funk Ltd Cash T-account, April of 2011 Cash (Balance, 4/1) (Deposit, 4/17) (Deposit, 4/29) 25,680 6,460 2,420 3,800 474 (Check #501) (Check #502) 1,260 (Check #503) 332 (Check #504) (Balance, 4/30) 31,454 REQUIREMENT 1: In the company's April Bank Reconciliation, what number will the company enter as, "Ending Correct Cash Balance" in the "as per Bank Statement" column? REQUIREMENT 2: What journal entry (if any) will the company record from any errors noted in the bank reconciliation process? Account No Journal Entry Required Debit REQUIREMENT 3: What journal entry (if any) will the company record for any outstanding checks? Account No Journal Entry Required Debit REQUIREMENT 4: What journal entry (if any) will the company record for the NSF Chack from Nader LLC? Account No Journal Entry Required Debit Credit Credit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Requirement 1 The Ending Correct Cash Balance in th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started