Answered step by step

Verified Expert Solution

Question

1 Approved Answer

USE THE FOLLOWING INFORMATION FOR PROBLEMS 9 THROUGH 16 An estate distributes an asset to its sole income beneficiary. The distribution was not a specific

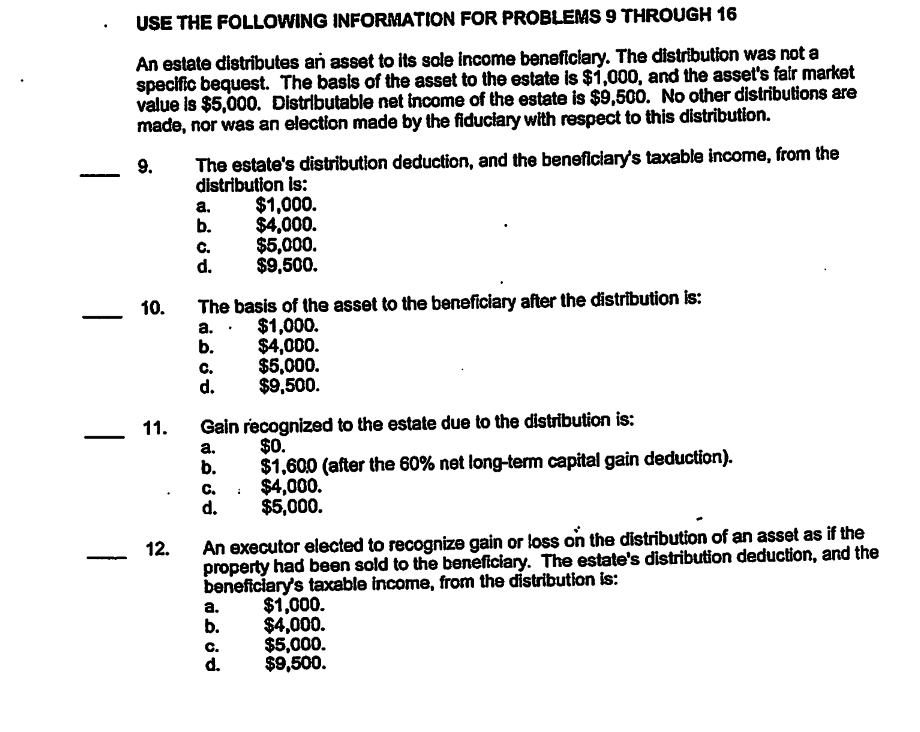

USE THE FOLLOWING INFORMATION FOR PROBLEMS 9 THROUGH 16 An estate distributes an asset to its sole income beneficiary. The distribution was not a specific bequest. The basis of the asset to the estate is $1,000, and the asset's fair market value is $5,000. Distrbutable net income of the estate is $9,500. No other distributions are made, nor was an election made by the fiduciary with respect to this distribution. 9. The estate's distribution deduction, and the beneficiary's taxable income, from the distribution is: a. $1,000. b. $4,000. c. $5,000. d. $9,500. 10. The basis of the asset to the beneficiary after the distribution is: a. $1,000. b. $4,000. c. $5,000. d. $9,500. 11. Gain recognized to the estate due to the distribution is: a. $0. b. $1,600 (after the 60% net long-term capital gain deduction). c. : $4,000. d. $5,000. 12. An executor elected to recognize gain or loss on the distribution of an asset as if the property had been sold to the beneficiary. The estate's distribution deduction, and the beneficiary's taxable income, from the distribution is: a. $1,000. b. $4,000. c. $5,000. d. $9,500

USE THE FOLLOWING INFORMATION FOR PROBLEMS 9 THROUGH 16 An estate distributes an asset to its sole income beneficiary. The distribution was not a specific bequest. The basis of the asset to the estate is $1,000, and the asset's fair market value is $5,000. Distrbutable net income of the estate is $9,500. No other distributions are made, nor was an election made by the fiduciary with respect to this distribution. 9. The estate's distribution deduction, and the beneficiary's taxable income, from the distribution is: a. $1,000. b. $4,000. c. $5,000. d. $9,500. 10. The basis of the asset to the beneficiary after the distribution is: a. $1,000. b. $4,000. c. $5,000. d. $9,500. 11. Gain recognized to the estate due to the distribution is: a. $0. b. $1,600 (after the 60% net long-term capital gain deduction). c. : $4,000. d. $5,000. 12. An executor elected to recognize gain or loss on the distribution of an asset as if the property had been sold to the beneficiary. The estate's distribution deduction, and the beneficiary's taxable income, from the distribution is: a. $1,000. b. $4,000. c. $5,000. d. $9,500 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started