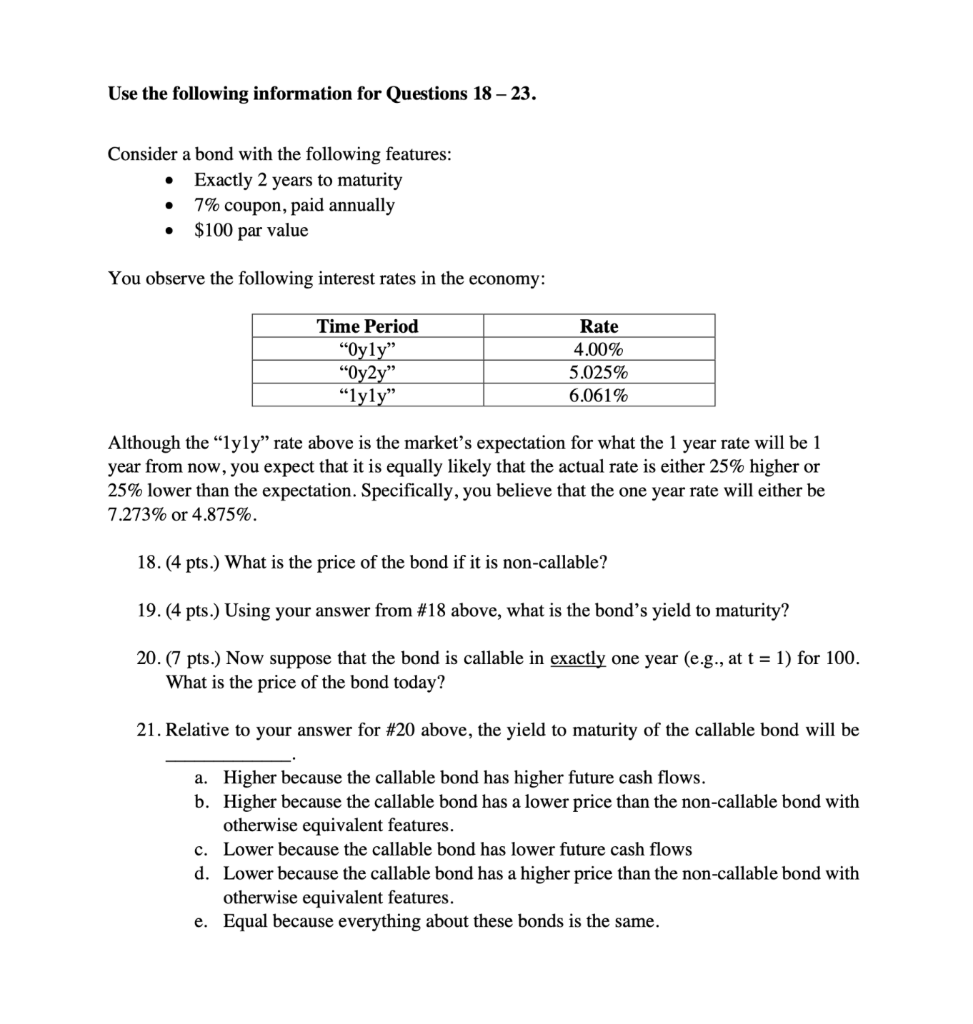

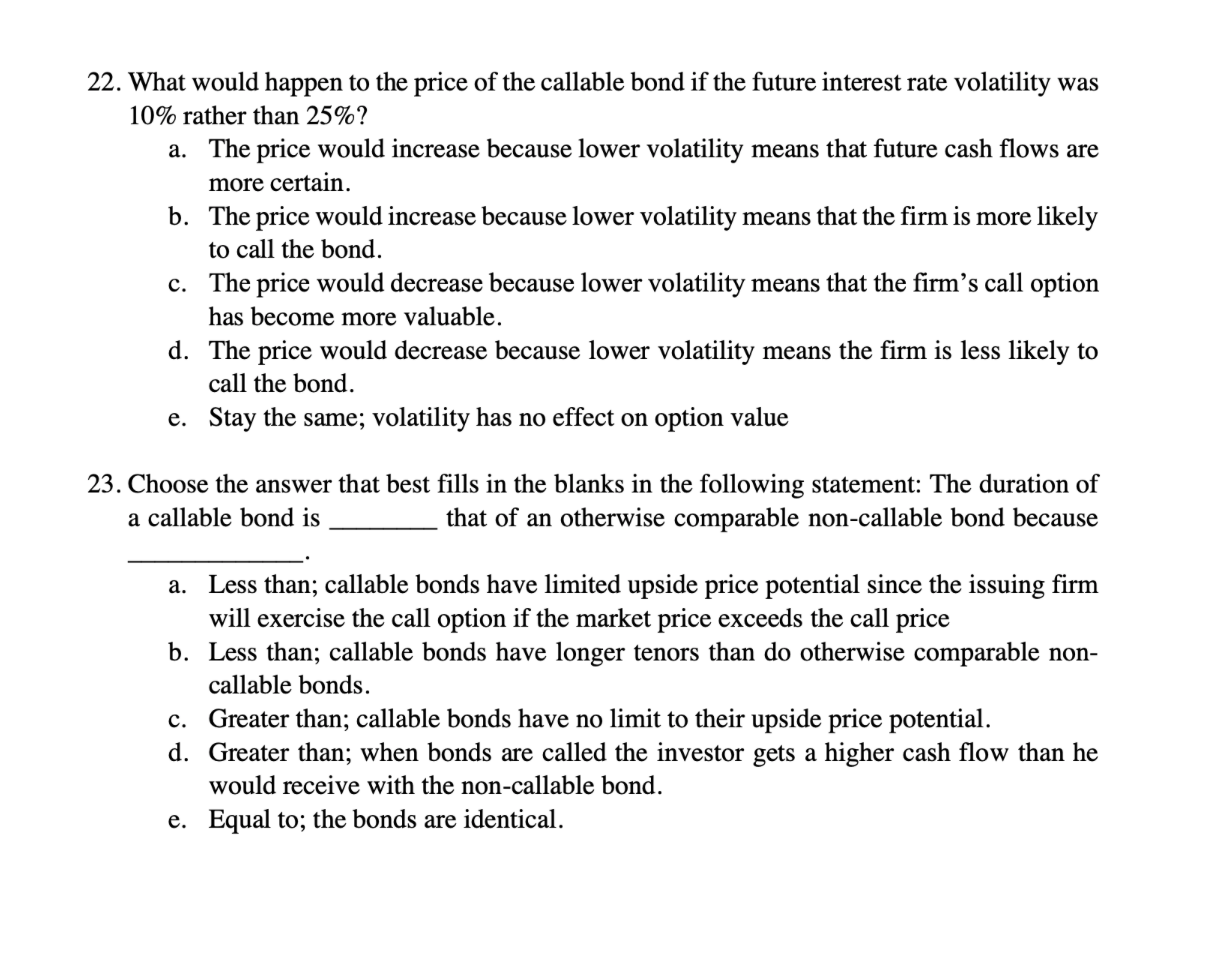

Use the following information for Questions 18 23. Consider a bond with the following features: Exactly 2 years to maturity 7% coupon, paid annually $100 par value You observe the following interest rates in the economy: Time Period "Oyly" Oy2y" "lyly Rate 4.00% 5.025% 6.061% Although the "lyly rate above is the market's expectation for what the 1 year rate will be 1 year from now, you expect that it is equally likely that the actual rate is either 25% higher or 25% lower than the expectation. Specifically, you believe that the one year rate will either be 7.273% or 4.875%. 18. (4 pts.) What is the price of the bond if it is non-callable? 19.(4 pts. Using your answer from #18 above, what is the bond's yield to maturity? 20.(7 pts. Now suppose that the bond is callable in exactly one year (e.g., at t = 1) for 100. What is the price of the bond today? 21. Relative to your answer for #20 above, the yield to maturity of the callable bond will be O a. Higher because the callable bond has higher future cash flows. b. Higher because the callable bond has a lower price than the non-callable bond with otherwise equivalent features. c. Lower because the callable bond has lower future cash flows d. Lower because the callable bond has a higher price than the non-callable bond with otherwise equivalent features. e. Equal because everything about these bonds is the same. 22. What would happen to the price of the callable bond if the future interest rate volatility was 10% rather than 25%? a. The price would increase because lower volatility means that future cash flows are more certain. b. The price would increase because lower volatility means that the firm is more likely to call the bond. c. The price would decrease because lower volatility means that the firm's call option has become more valuable. d. The price would decrease because lower volatility means the firm is less likely to call the bond. e. Stay the same; volatility has no effect on option value 23. Choose the answer that best fills in the blanks in the following statement: The duration of a callable bond is that of an otherwise comparable non-callable bond because a. Less than; callable bonds have limited upside price potential since the issuing firm will exercise the call option if the market price exceeds the call price b. Less than; callable bonds have longer tenors than do otherwise comparable non- callable bonds. c. Greater than; callable bonds have no limit to their upside price potential. d. Greater than; when bonds are called the investor gets a higher cash flow than he would receive with the non-callable bond. e. Equal to; the bonds are identical. Use the following information for Questions 18 23. Consider a bond with the following features: Exactly 2 years to maturity 7% coupon, paid annually $100 par value You observe the following interest rates in the economy: Time Period "Oyly" Oy2y" "lyly Rate 4.00% 5.025% 6.061% Although the "lyly rate above is the market's expectation for what the 1 year rate will be 1 year from now, you expect that it is equally likely that the actual rate is either 25% higher or 25% lower than the expectation. Specifically, you believe that the one year rate will either be 7.273% or 4.875%. 18. (4 pts.) What is the price of the bond if it is non-callable? 19.(4 pts. Using your answer from #18 above, what is the bond's yield to maturity? 20.(7 pts. Now suppose that the bond is callable in exactly one year (e.g., at t = 1) for 100. What is the price of the bond today? 21. Relative to your answer for #20 above, the yield to maturity of the callable bond will be O a. Higher because the callable bond has higher future cash flows. b. Higher because the callable bond has a lower price than the non-callable bond with otherwise equivalent features. c. Lower because the callable bond has lower future cash flows d. Lower because the callable bond has a higher price than the non-callable bond with otherwise equivalent features. e. Equal because everything about these bonds is the same. 22. What would happen to the price of the callable bond if the future interest rate volatility was 10% rather than 25%? a. The price would increase because lower volatility means that future cash flows are more certain. b. The price would increase because lower volatility means that the firm is more likely to call the bond. c. The price would decrease because lower volatility means that the firm's call option has become more valuable. d. The price would decrease because lower volatility means the firm is less likely to call the bond. e. Stay the same; volatility has no effect on option value 23. Choose the answer that best fills in the blanks in the following statement: The duration of a callable bond is that of an otherwise comparable non-callable bond because a. Less than; callable bonds have limited upside price potential since the issuing firm will exercise the call option if the market price exceeds the call price b. Less than; callable bonds have longer tenors than do otherwise comparable non- callable bonds. c. Greater than; callable bonds have no limit to their upside price potential. d. Greater than; when bonds are called the investor gets a higher cash flow than he would receive with the non-callable bond. e. Equal to; the bonds are identical