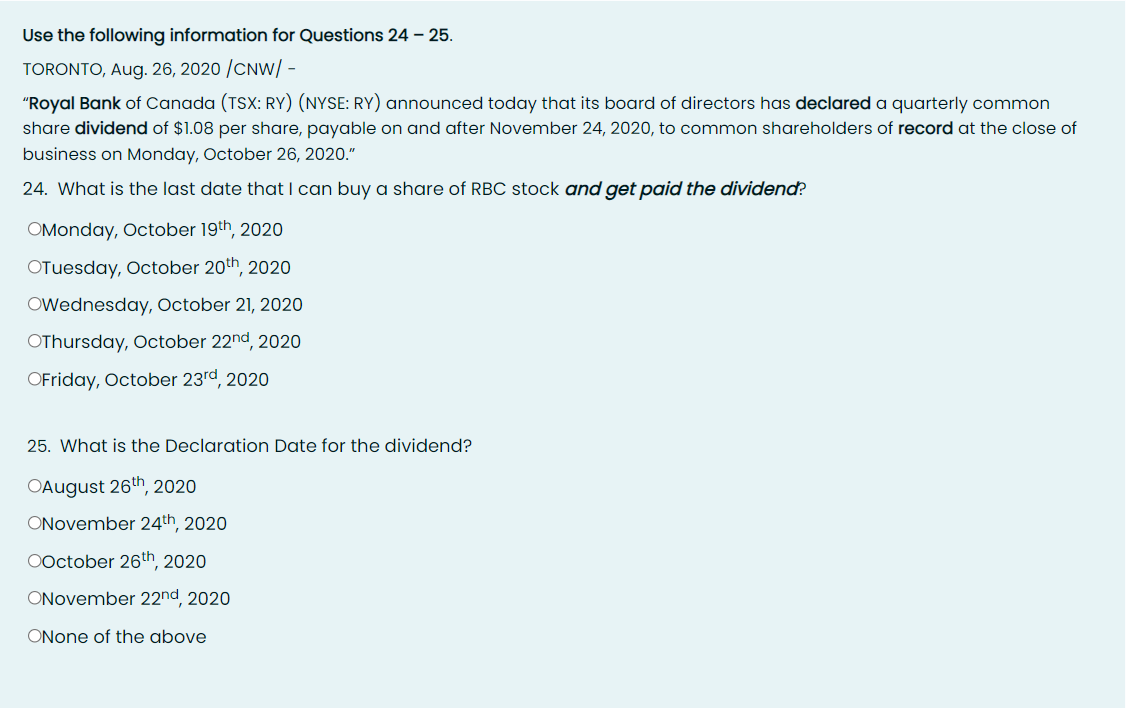

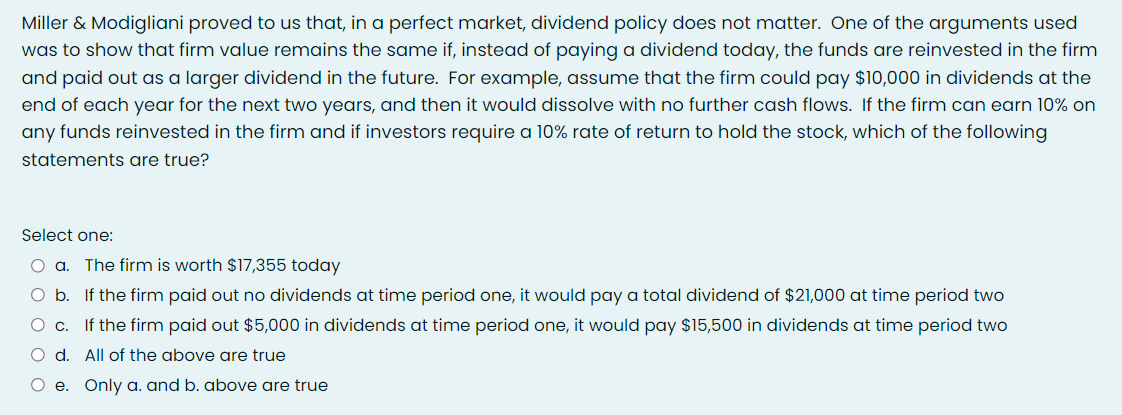

Use the following information for Questions 24 - 25. TORONTO, Aug. 26, 2020 /CNW/ - "Royal Bank of Canada (TSX: RY) (NYSE: RY) announced today that its board of directors has declared a quarterly common share dividend of $1.08 per share, payable on and after November 24, 2020, to common shareholders of record at the close of business on Monday, October 26, 2020." 24. What is the last date that I can buy a share of RBC stock and get paid the dividend? OMonday, October 19th, 2020 OTuesday, October 20th, 2020 OWednesday, October 21, 2020 OThursday, October 22nd, 2020 OFriday, October 23rd, 2020 25. What is the Declaration Date for the dividend? OAugust 26th, 2020 ONovember 24th, 2020 OOctober 26th, 2020 ONovember 22nd, 2020 ONone of the above Miller & Modigliani proved to us that, in a perfect market, dividend policy does not matter. One of the arguments used was to show that firm value remains the same if, instead of paying a dividend today, the funds are reinvested in the firm and paid out as a larger dividend in the future. For example, assume that the firm could pay $10,000 in dividends at the end of each year for the next two years, and then it would dissolve with no further cash flows. If the firm can earn 10% on any funds reinvested in the firm and if investors require a 10% rate of return to hold the stock, which of the following statements are true? Select one: O a. The firm is worth $17,355 today O b. If the firm paid out no dividends at time period one, it would pay a total dividend of $21,000 at time period two O c. If the firm paid out $5,000 in dividends at time period one, it would pay $15,500 in dividends at time period two O d. All of the above are true O e. Only a. and b. above are true Use the following information for Questions 24 - 25. TORONTO, Aug. 26, 2020 /CNW/ - "Royal Bank of Canada (TSX: RY) (NYSE: RY) announced today that its board of directors has declared a quarterly common share dividend of $1.08 per share, payable on and after November 24, 2020, to common shareholders of record at the close of business on Monday, October 26, 2020." 24. What is the last date that I can buy a share of RBC stock and get paid the dividend? OMonday, October 19th, 2020 OTuesday, October 20th, 2020 OWednesday, October 21, 2020 OThursday, October 22nd, 2020 OFriday, October 23rd, 2020 25. What is the Declaration Date for the dividend? OAugust 26th, 2020 ONovember 24th, 2020 OOctober 26th, 2020 ONovember 22nd, 2020 ONone of the above Miller & Modigliani proved to us that, in a perfect market, dividend policy does not matter. One of the arguments used was to show that firm value remains the same if, instead of paying a dividend today, the funds are reinvested in the firm and paid out as a larger dividend in the future. For example, assume that the firm could pay $10,000 in dividends at the end of each year for the next two years, and then it would dissolve with no further cash flows. If the firm can earn 10% on any funds reinvested in the firm and if investors require a 10% rate of return to hold the stock, which of the following statements are true? Select one: O a. The firm is worth $17,355 today O b. If the firm paid out no dividends at time period one, it would pay a total dividend of $21,000 at time period two O c. If the firm paid out $5,000 in dividends at time period one, it would pay $15,500 in dividends at time period two O d. All of the above are true O e. Only a. and b. above are true