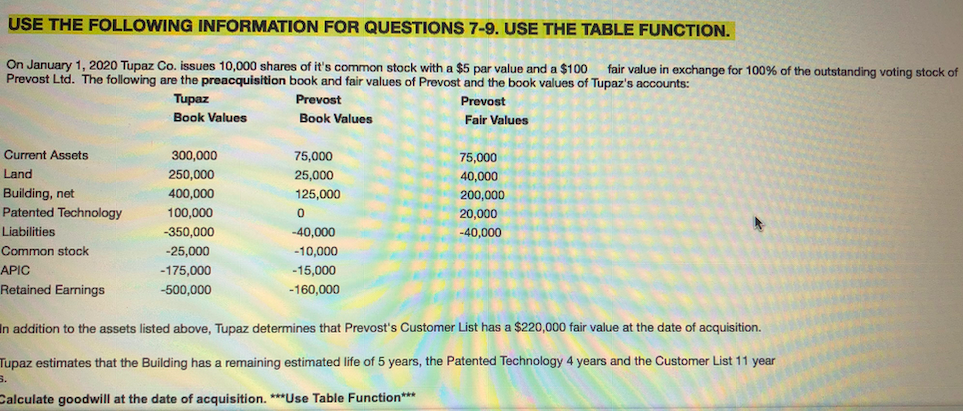

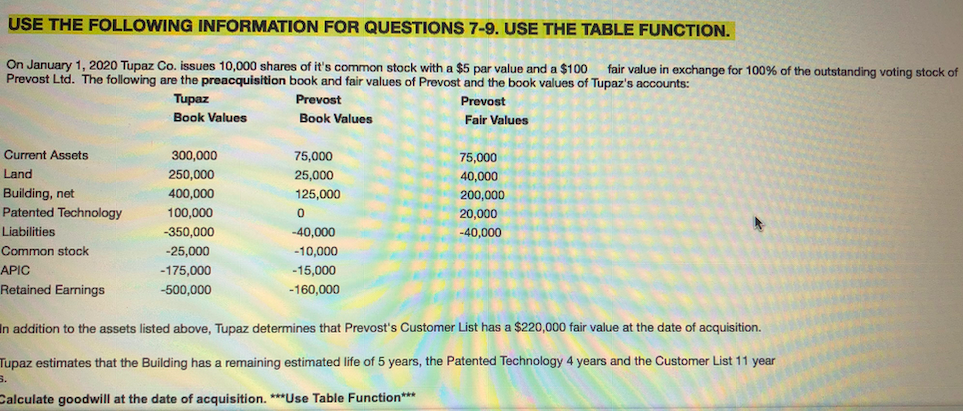

USE THE FOLLOWING INFORMATION FOR QUESTIONS 7-9. USE THE TABLE FUNCTION. On January 1, 2020 Tupaz Co. issues 10,000 shares of it's common stock with a $5 par value and a $100 Prevost Ltd. The following are the preacquisition book and fair values of Prevost and the book values of Tupaz's accounts: fair value in exchange for 100% of the outstanding voting stock of Tupaz Prevost Prevost Book Values Book Values Fair Values 75,000 40,000 Current Assets Land Building, net Patented Technology Liabilities Common stock APIC Retained Earnings 300,000 250,000 400,000 100,000 -350,000 -25,000 -175,000 -500,000 75,000 25,000 125,000 0 -40,000 -10,000 -15,000 - 160,000 200,000 20,000 -40,000 In addition to the assets listed above, Tupaz determines that Prevost's Customer List has a $220,000 fair value at the date of acquisition. Tupaz estimates that the Building has a remaining estimated life of 5 years, the Patented Technology 4 years and the Customer List 11 year 5. Calculate goodwill at the date of acquisition. ***Use Table Function *** QUESTION 8 Assuming the following book balances on December 31, 2024, compute the consolidated totals for each category: ***Use Table Function*** Paragraph Arial # 3 (120) QUESTION 9 If Tupaz had issued no additional shares since the acquisition on January 1,2020, what are the consolidated totals for: ***Use Table Function*** USE THE FOLLOWING INFORMATION FOR QUESTIONS 7-9. USE THE TABLE FUNCTION. On January 1, 2020 Tupaz Co. issues 10,000 shares of it's common stock with a $5 par value and a $100 Prevost Ltd. The following are the preacquisition book and fair values of Prevost and the book values of Tupaz's accounts: fair value in exchange for 100% of the outstanding voting stock of Tupaz Prevost Prevost Book Values Book Values Fair Values 75,000 40,000 Current Assets Land Building, net Patented Technology Liabilities Common stock APIC Retained Earnings 300,000 250,000 400,000 100,000 -350,000 -25,000 -175,000 -500,000 75,000 25,000 125,000 0 -40,000 -10,000 -15,000 - 160,000 200,000 20,000 -40,000 In addition to the assets listed above, Tupaz determines that Prevost's Customer List has a $220,000 fair value at the date of acquisition. Tupaz estimates that the Building has a remaining estimated life of 5 years, the Patented Technology 4 years and the Customer List 11 year 5. Calculate goodwill at the date of acquisition. ***Use Table Function *** QUESTION 8 Assuming the following book balances on December 31, 2024, compute the consolidated totals for each category: ***Use Table Function*** Paragraph Arial # 3 (120) QUESTION 9 If Tupaz had issued no additional shares since the acquisition on January 1,2020, what are the consolidated totals for: ***Use Table Function***