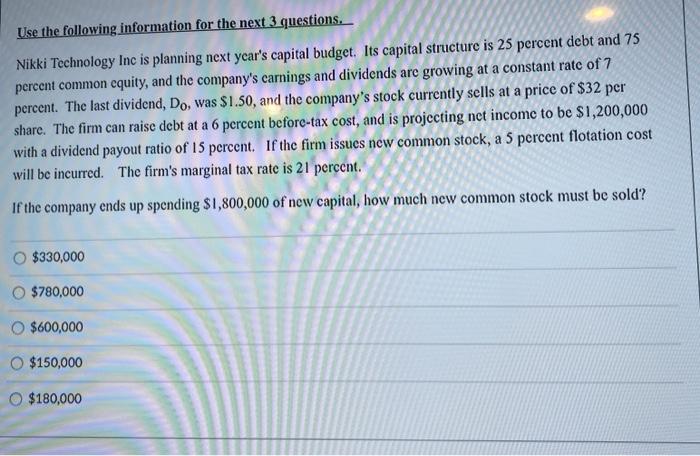

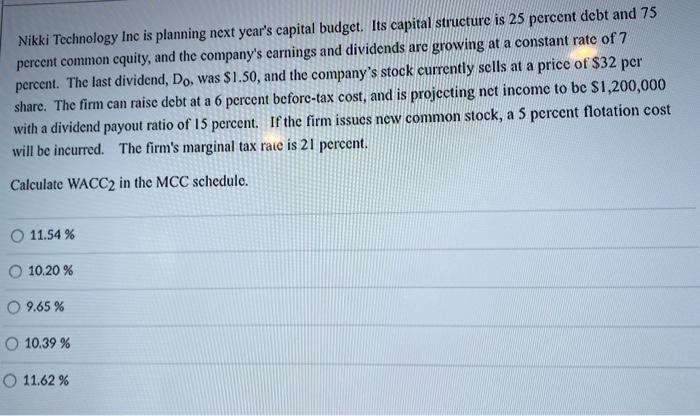

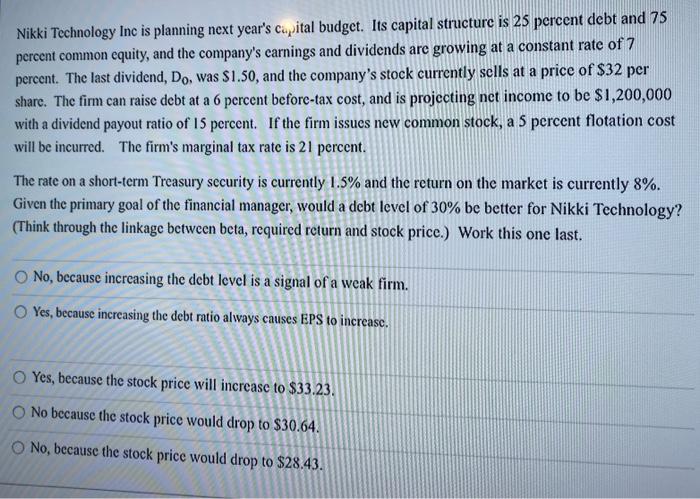

Use the following information for the next 3 questions. Nikki Technology Inc is planning next year's capital budget. Its capital structure is 25 percent debt and 75 percent common equity, and the company's carnings and dividends are growing at a constant rate of 7 percent. The last dividend, Do, was $1.50, and the company's stock currently sells at a price of $32 per share. The firm can raise debt at a 6 percent before-tax cost, and is projecting net income to be $1,200,000 with a dividend payout ratio of 15 percent. If the firm issues new common stock, a 5 percent flotation cost will be incurred. The firm's marginal tax rate is 21 percent. If the company ends up spending $1,800,000 of new capital, how much new common stock must be sold? $330,000 $780,000 $600,000 O $150,000 O $180,000 Nikki Technology Inc is planning next year's capital budget. Its capital structure is 25 percent debt and 75 percent common cquity, and the company's earnings and dividends are growing at a constant rate of 7 percent. The last dividend, Do, was $1.50, and the company's stock currently sells at a price of $32 per share. The firm can raise debt at a 6 percent before-tax cost, and is projecting net income to be $1,200,000 with a dividend payout ratio of 15 percent. If the firm issues new common stock, a 5 percent flotation cost will be incurred. The firm's marginal tax rate is 21 percent. Calculate WACC2 in the MCC schedule. 11.54 % 10.20% 9.65 % 10.39 % O 11.62 % Nikki Technology Inc is planning next year's capital budget. Its capital structure is 25 percent debt and 75 percent common equity, and the company's carnings and dividends are growing at a constant rate of 7 percent. The last dividend, Do, was $1.50, and the company's stock currently sells at a price of $32 per share. The firm can raise debt at a 6 percent before-tax cost, and is projecting net income to be $1,200,000 with a dividend payout ratio of 15 percent. If the firm issues new common stock, a 5 percent flotation cost will be incurred. The firm's marginal tax rate is 21 percent. The rate on a short-term Treasury security is currently 1.5% and the return on the market is currently 8%. Given the primary goal of the financial manager, would a debt level of 30% be better for Nikki Technology? (Think through the linkage between beta, required return and stock price.) Work this one last. No, because increasing the debt level is a signal of a weak firm. Yes, because increasing the debt ratio always causes EPS to increase. Yes, because the stock price will increase to $33.23. No because the stock price would drop to $30.64. No, because the stock price would drop to $28.43