Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the following information for the next four questions: Eight Day Co.'s financial position before the start of its liquidation is as follows: ASSETS LIABILITIES

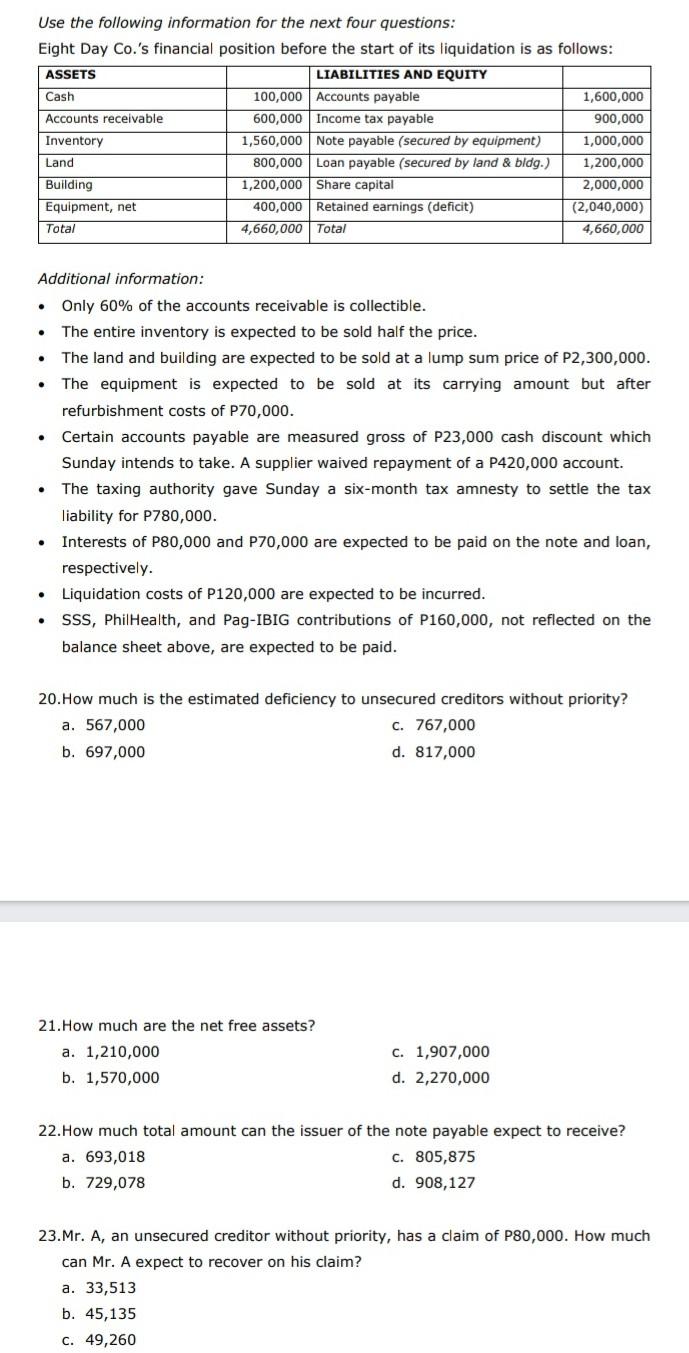

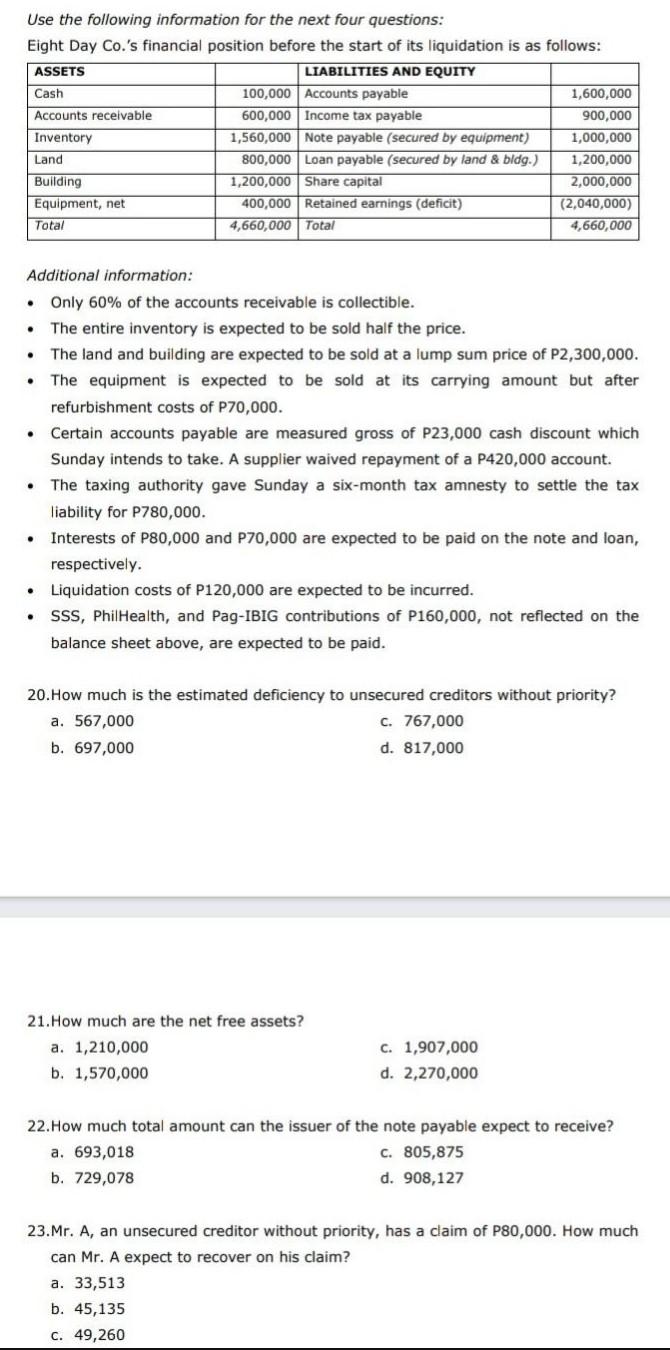

Use the following information for the next four questions: Eight Day Co.'s financial position before the start of its liquidation is as follows: ASSETS LIABILITIES AND EQUITY Cash 100,000 Accounts payable 1,600,000 Accounts receivable 600,000 Income tax payable 900,000 Inventory 1,560,000 Note payable (secured by equipment) 1,000,000 Land 800,000 Loan payable (secured by land & bldg.) 1,200,000 Building 1,200,000 Share capital 2,000,000 Equipment, net 400,000 Retained earnings (deficit) (2,040,000) Total 4,660,000 Total 4,660,000 . . . Additional information: Only 60% of the accounts receivable is collectible. The entire inventory is expected to be sold half the price. The land and building are expected to be sold at a lump sum price of P2,300,000. The equipment is expected to be sold at its carrying amount but after refurbishment costs of P70,000. Certain accounts payable are measured gross of P23,000 cash discount which Sunday intends to take. A supplier waived repayment P420,000 account. The taxing authority gave Sunday a six-month tax amnesty to settle the tax liability for P780,000. Interests of P80,000 and P70,000 are expected to be paid on the note and loan, respectively. Liquidation costs of P120,000 are expected to be incurred. SSS, PhilHealth, and Pag-IBIG contributions of P160,000, not reflected on the balance sheet above, are expected to be paid. . 20. How much is the estimated deficiency to unsecured creditors without priority? a. 567,000 c. 767,000 b. 697,000 d. 817,000 21. How much are the net free assets? a. 1,210,000 b. 1,570,000 C. 1,907,000 d. 2,270,000 22. How much total amount can the issuer of the note payable expect to receive? a. 693,018 C. 805,875 b. 729,078 d. 908,127 23.Mr. A, an unsecured creditor without priority, has a claim of P80,000. How much can Mr. A expect to recover on his claim? a. 33,513 b. 45,135 c. 49,260 Use the following information for the next four questions: Eight Day Co.'s financial position before the start of its liquidation is as follows: ASSETS LIABILITIES AND EQUITY Cash 100,000 Accounts payable 1,600,000 Accounts receivable 600,000 Income tax payable 900,000 Inventory 1,560,000 Note payable (secured by equipment) 1,000,000 Land 800,000 Loan payable (secured by land & bldg.) 1,200,000 Building 1,200,000 Share capital 2,000,000 Equipment, net 400,000 Retained earnings (deficit) (2,040,000) 4,660,000 Total 4,660,000 Total . . . . Additional information: Only 60% of the accounts receivable is collectible. The entire inventory is expected to be sold half the price. The land and building are expected to be sold at a lump sum price of P2,300,000. The equipment is expected to be sold at its carrying amount but after refurbishment costs of P70,000. Certain accounts payable are measured gross of P23,000 cash discount which Sunday intends to take. A supplier waived repayment of a P420,000 account. The taxing authority gave Sunday a six-month tax amnesty to settle the tax liability for P780,000. Interests of P80,000 and P70,000 are expected to be paid on the note and loan, respectively. Liquidation costs of P120,000 are expected to be incurred. SSS, PhilHealth, and Pag-IBIG contributions of P160,000, not reflected on the balance sheet above, are expected to be paid. . . 20. How much is the estimated deficiency to unsecured creditors without priority? a. 567,000 c. 767,000 b. 697,000 d. 817,000 21. How much are the net free assets? a. 1,210,000 b. 1,570,000 c. 1,907,000 d. 2,270,000 22. How much total amount can the issuer of the note payable expect to receive? a. 693,018 C. 805,875 b. 729,078 d. 908,127 23.Mr. A, an unsecured creditor without priority, has a claim of P80,000. How much can Mr. A expect to recover on his claim? a. 33,513 b. 45,135 c. 49,260

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started