Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the following information for the next four questions: On December 31, 2021, Jollibee Foods Corp. enters into a contract with Honey Bee Corp. to

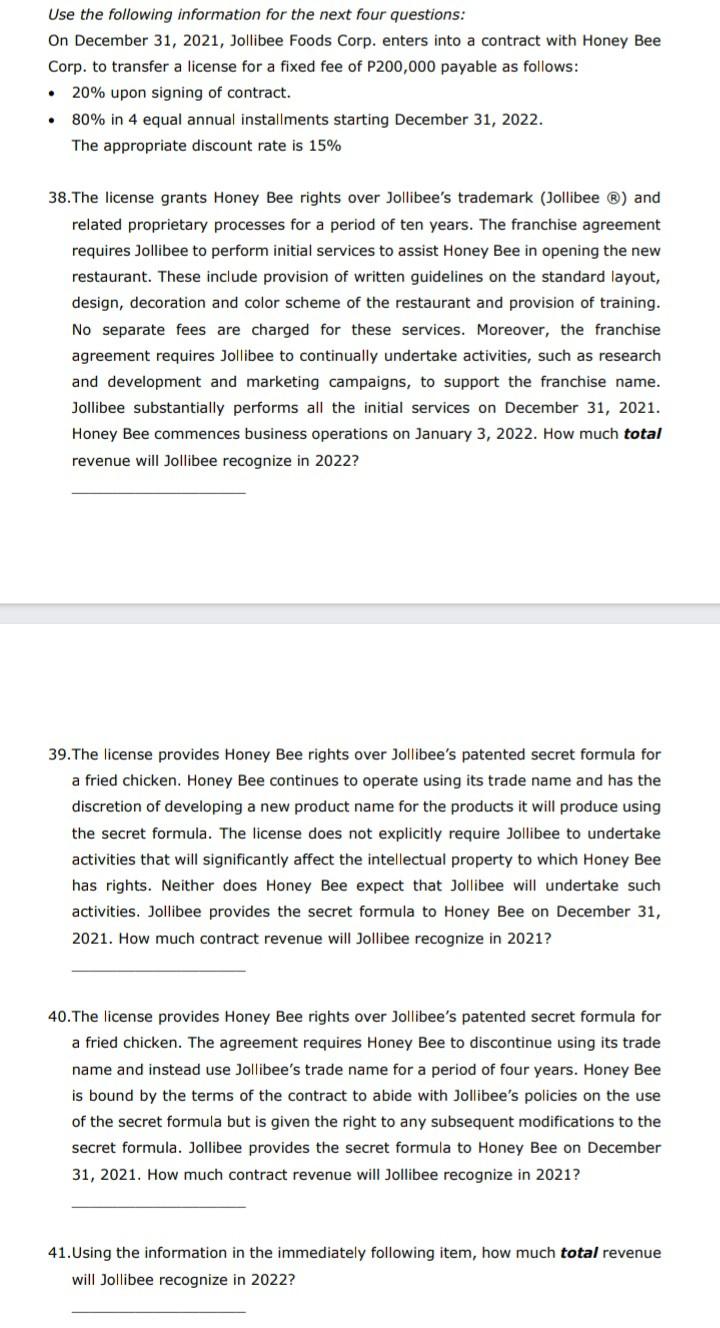

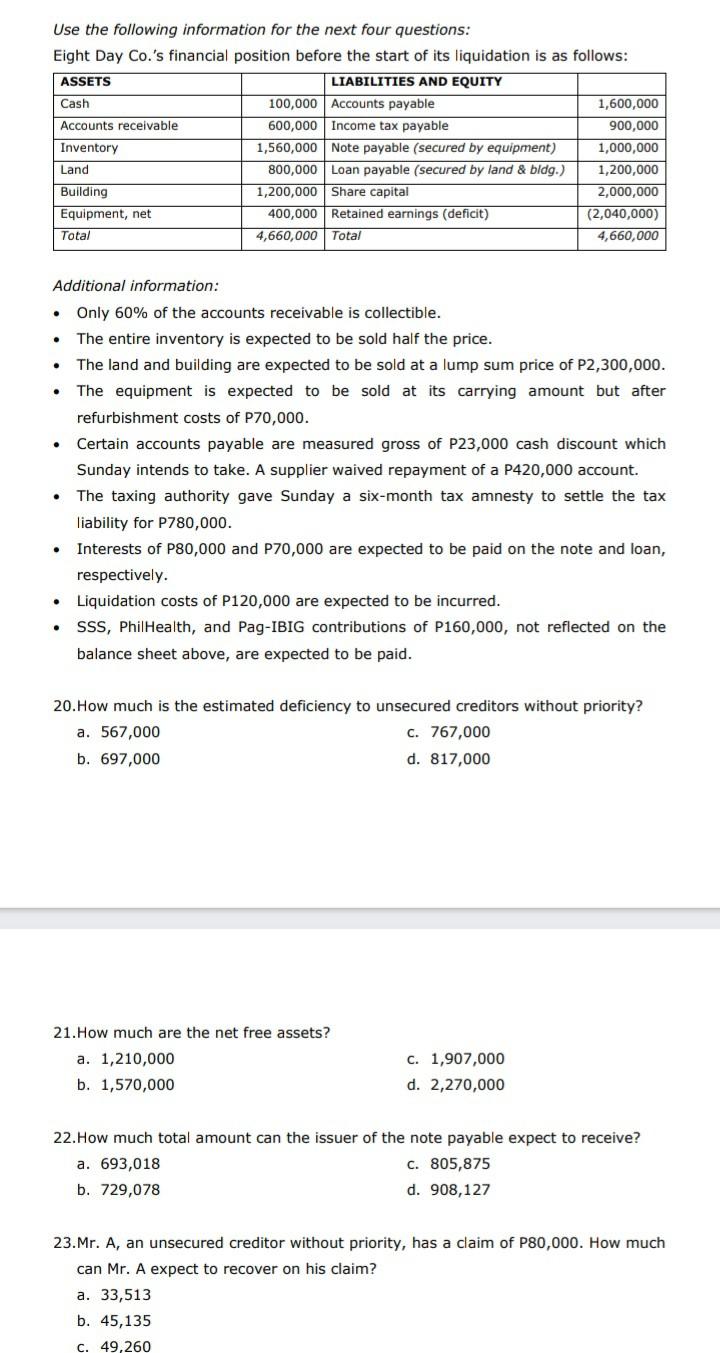

Use the following information for the next four questions: On December 31, 2021, Jollibee Foods Corp. enters into a contract with Honey Bee Corp. to transfer a license for a fixed fee of P200,000 payable as follows: 20% upon signing of contract. 80% in 4 equal annual installments starting December 31, 2022. The appropriate discount rate is 15% 38. The license grants Honey Bee rights over Jollibee's trademark (Jollibee ) and related proprietary processes for a period of ten years. The franchise agreement requires Jollibee to perform initial services to assist Honey Bee in opening the new restaurant. These include provision of written guidelines on the standard layout, design, decoration and color scheme of the restaurant and provision of training. No separate fees are charged for these services. Moreover, the franchise agreement requires Jollibee to continually undertake activities, such as research and development and marketing campaigns, to support the franchise name. Jollibee substantially performs all the initial services on December 31, 2021. Honey Bee commences business operations on January 3, 2022. How much total revenue will Jollibee recognize in 2022? 39. The license provides Honey Bee rights over Jollibee's patented secret formula for a fried chicken. Honey Bee continues to operate using its trade name and has the discretion of developing a new product name for the products it will produce using the secret formula. The license does not explicitly require Jollibee to undertake activities that will significantly affect the intellectual property to which Honey Bee has rights. Neither does Honey Bee expect that Jollibee will undertake such activities. Jollibee provides the secret formula to Honey Bee on December 31, 2021. How much contract revenue will Jollibee recognize in 2021? 40. The license provides Honey Bee rights over Jollibee's patented secret formula for a fried chicken. The agreement requires Honey Bee to discontinue using its trade name and instead use Jollibee's trade name for a period of four years. Honey Bee is bound by the terms of the contract to abide with Jollibee's policies on the use of the secret formula but is given the right to any subsequent modifications to the secret formula. Jollibee provides the secret formula to Honey Bee on December 31, 2021. How much contract revenue will Jollibee recognize in 2021? 41.Using the information in the immediately following item, how much total revenue will Jollibee recognize in 2022? Use the following information for the next four questions: Eight Day Co.'s financial position before the start of its liquidation is as follows: ASSETS LIABILITIES AND EQUITY Cash 100,000 Accounts payable 1,600,000 Accounts receivable 600,000 Income tax payable 900,000 Inventory 1,560,000 Note payable (secured by equipment) 1,000,000 Land 800,000 Loan payable (secured by land & bldg.) 1,200,000 Building 1,200,000 Share capital 2,000,000 Equipment, net 400,000 Retained earnings (deficit) (2,040,000) Total 4,660,000 Total 4,660,000 Additional information: Only 60% of the accounts receivable is collectible. The entire inventory is expected to be sold half the price. The land and building are expected to be sold at a lump sum price of P2,300,000. The equipment is expected to be sold at its carrying amount but after refurbishment costs of P70,000. Certain accounts payable are measured gross of P23,000 cash discount which Sunday intends to take. A supplier waived repayment of a P420,000 account. The taxing authority gave Sunday a six-month tax amnesty to settle the tax liability for P780,000. Interests of P80,000 and P70,000 are expected to be paid on the note and loan, respectively. Liquidation costs of P120,000 are expected to be incurred. SSS, PhilHealth, and Pag-IBIG contributions of P160,000, not reflected on the balance sheet above, are expected to be paid. . 20. How much is the estimated deficiency to unsecured creditors without priority? a. 567,000 C. 767,000 b. 697,000 d. 817,000 21. How much are the net free assets? a. 1,210,000 b. 1,570,000 C. 1,907,000 d. 2,270,000 22.How much total amount can the issuer of the note payable expect to receive? a. 693,018 C. 805,875 b. 729,078 d. 908,127 23. Mr. A, an unsecured creditor without priority, has a claim of P80,000. How much can Mr. A expect to recover on his claim? a. 33,513 b. 45,135 C. 49,260

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started