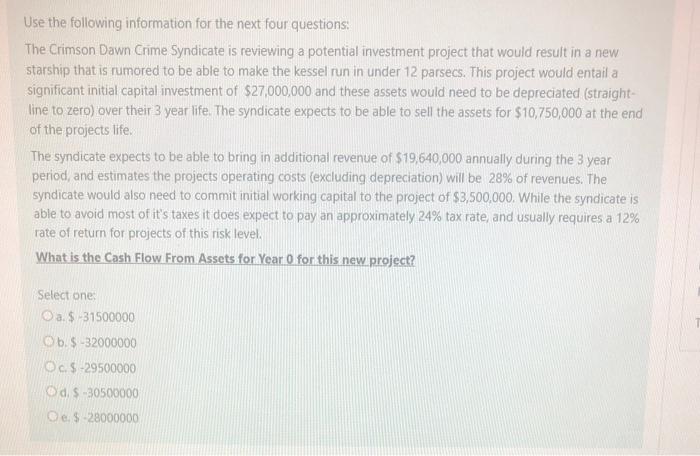

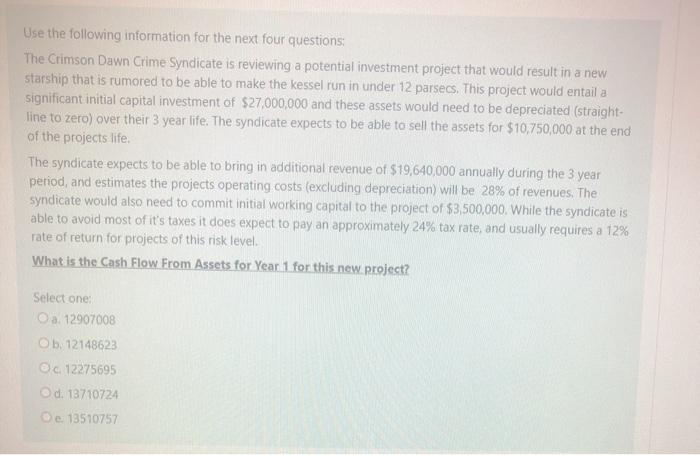

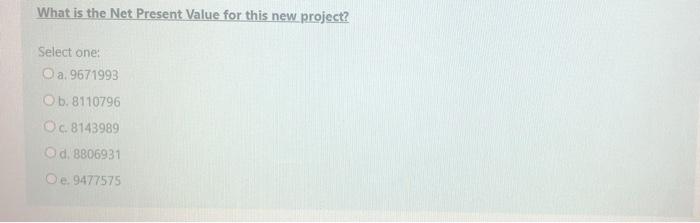

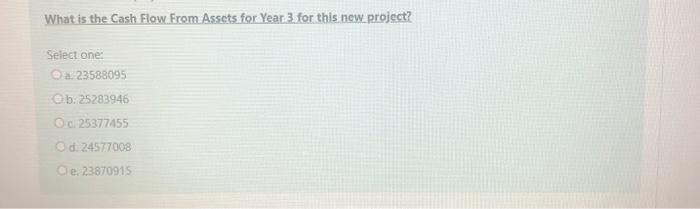

Use the following information for the next four questions: The Crimson Dawn Crime Syndicate is reviewing a potential investment project that would result in a new starship that is rumored to be able to make the kessel run in under 12 parsecs. This project would entaila significant initial capital investment of $27,000,000 and these assets would need to be depreciated (straight- line to zero) over their 3 year life. The syndicate expects to be able to sell the assets for $10,750,000 at the end of the projects life. The syndicate expects to be able to bring in additional revenue of $19,640,000 annually during the 3 yean period, and estimates the projects operating costs (excluding depreciation) will be 28% of revenues. The syndicate would also need to commit initial working capital to the project of $3,500,000. While the syndicate is able to avoid most of it's taxes it does expect to pay an approximately 24% tax rate, and usually requires a 12% rate of return for projects of this risk level. What is the Cash Flow From Assets for Year 0 for this new project? Select one: Oa$ 31500000 b.$-32000000 Oc$-29500000 d. S-30500000 @e: $ 28000000 Use the following information for the next four questions: The Crimson Dawn Crime Syndicate is reviewing a potential investment project that would result in a new starship that is rumored to be able to make the kessel run in under 12 parsecs. This project would entail a significant initial capital investment of $27,000,000 and these assets would need to be depreciated (straight- line to zero) over their 3 year life. The syndicate expects to be able to sell the assets for $10,750,000 at the end of the projects life. The syndicate expects to be able to bring in additional revenue of $19,640,000 annually during the 3 year period, and estimates the projects operating costs (excluding depreciation) will be 28% of revenues. The syndicate would also need to commit initial working capital to the project of $3,500,000. While the syndicate is able to avoid most of it's taxes it does expect to pay an approximately 24% tax rate, and usually requires a 12% rate of return for projects of this risk level. What is the Cash Flow From Assets for Year 1 for this new project? Select one: O a. 12907008 Ob 12148623 OC 12275695 d. 13710724 De 13510757 What is the Net Present Value for this new project? Select one: O a. 9671993 b. 8110796 c. 8143989 Od: 8806931 e 9477575 What is the Cash Flow From Assets for Year 3 for this new project? Select one: 23588095 e b: 25283946 Od 25877455 O d. 24577008 De 23870915