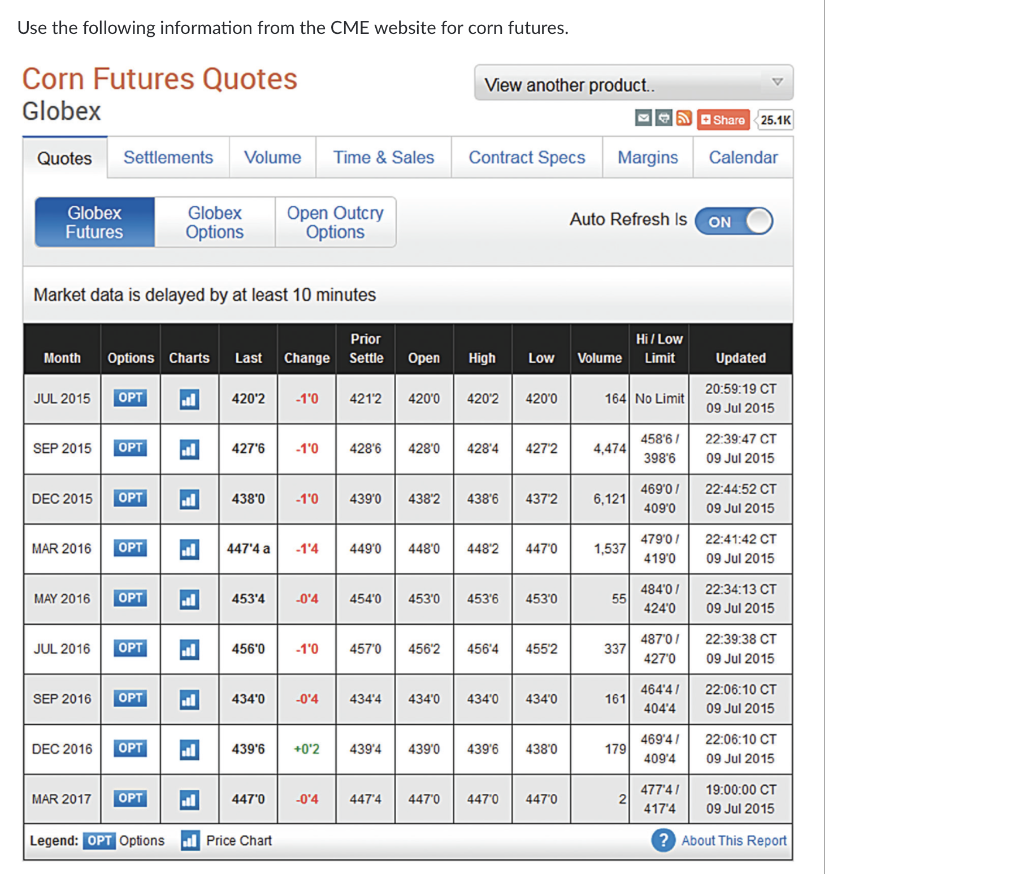

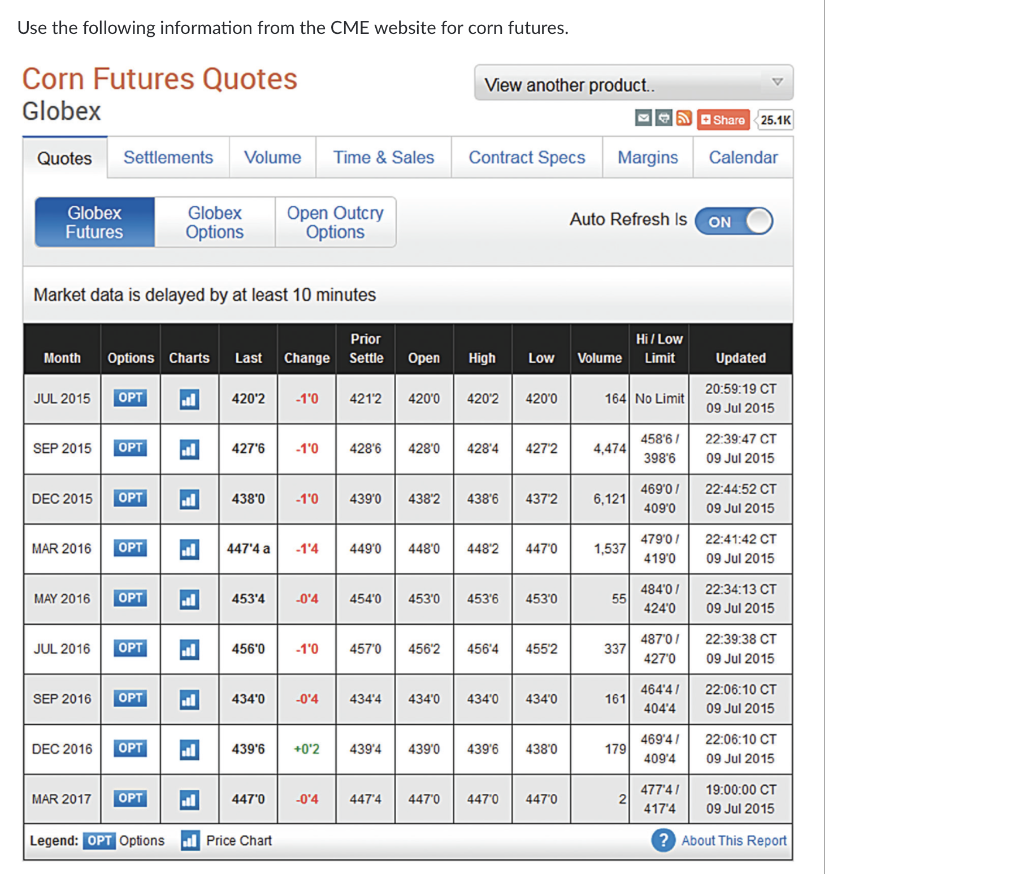

Use the following information from the CME website for corn futures. Corn Futures Quotes Globex Quotes Settlements Volume Time & Sales Globex Globex Open Outcry Options Options Futures Market data is delayed by at least 10 minutes Month Options Charts Last Change JUL 2015 OPT 4202 -1'0 SEP 2015 OPT 427'6 -1'0 DEC 2015 OPT 438'0 -1'0 MAR 2016 OPT 447'4 a -1'4 MAY 2016 OPT 453'4 -0'4 JUL 2016 OPT 456'0 -1'0 SEP 2016 OPT 434'0 -0'4 DEC 2016 OPT 439'6 +0'2 MAR 2017 OPT 447'0 -0'4 Legend: OPT Options 0 0 0 0 0 0 0 0 0 3 Price Chart View another product.. Share 25.1K Contract Specs Margins Calendar Auto Refresh Is ON Hi/Low Prior Settle Open High Low Volume Limit 4212 420'0 420'2 420'0 428'6 428'0 428'4 427'2 439'0 438'2 438'6 437'2 449'0 448'0 448'2 447'0 454'0 453'0 453'6 453'0 457'0 456'2 456'4 455'2 434'4 434'0 434'0 434'0 439'4 439'0 439'6 438'0 447'4 447'0 447'0 447'0 Updated 20:59:19 CT 09 Jul 2015 22:39:47 CT 09 Jul 2015 22:44:52 CT 09 Jul 2015 22:41:42 CT 09 Jul 2015 22:34:13 CT 09 Jul 2015 22:39:38 CT 09 Jul 2015 22:06:10 CT 09 Jul 2015 22:06:10 CT 09 Jul 2015 19:00:00 CT 09 Jul 2015 ? About This Report 164 No Limit 458'6/ 398'6 469'0/ 409'0 479'0/ 419'0 484'0/ 424'0 487'0/ 427'0 464'4/ 404'4 469'4/ 409'4 477'41 417'4 4,474 6,121 1,537 55 337 161 179 2 Suppose that you buy (long) two March 2017 corn futures contracts (5,000 bushels each) at the most recent price quoted above. Your initial margin is $3,500 per contract. Now assume that one month later the futures price for March 2017 corn futures is 450'0. What is your profit? What is your return on your invested capital? Finally, suppose that you wanted to initially purchase more than two futures contracts. Is that feasible, infeasible, or unclear based on the above information? (If the picture does not show up, you can find it on https://ibb.co/vV1R1Z5) Use the following information from the CME website for corn futures. Corn Futures Quotes Globex Quotes Settlements Volume Time & Sales Globex Globex Open Outcry Options Options Futures Market data is delayed by at least 10 minutes Month Options Charts Last Change JUL 2015 OPT 4202 -1'0 SEP 2015 OPT 427'6 -1'0 DEC 2015 OPT 438'0 -1'0 MAR 2016 OPT 447'4 a -1'4 MAY 2016 OPT 453'4 -0'4 JUL 2016 OPT 456'0 -1'0 SEP 2016 OPT 434'0 -0'4 DEC 2016 OPT 439'6 +0'2 MAR 2017 OPT 447'0 -0'4 Legend: OPT Options 0 0 0 0 0 0 0 0 0 3 Price Chart View another product.. Share 25.1K Contract Specs Margins Calendar Auto Refresh Is ON Hi/Low Prior Settle Open High Low Volume Limit 4212 420'0 420'2 420'0 428'6 428'0 428'4 427'2 439'0 438'2 438'6 437'2 449'0 448'0 448'2 447'0 454'0 453'0 453'6 453'0 457'0 456'2 456'4 455'2 434'4 434'0 434'0 434'0 439'4 439'0 439'6 438'0 447'4 447'0 447'0 447'0 Updated 20:59:19 CT 09 Jul 2015 22:39:47 CT 09 Jul 2015 22:44:52 CT 09 Jul 2015 22:41:42 CT 09 Jul 2015 22:34:13 CT 09 Jul 2015 22:39:38 CT 09 Jul 2015 22:06:10 CT 09 Jul 2015 22:06:10 CT 09 Jul 2015 19:00:00 CT 09 Jul 2015 ? About This Report 164 No Limit 458'6/ 398'6 469'0/ 409'0 479'0/ 419'0 484'0/ 424'0 487'0/ 427'0 464'4/ 404'4 469'4/ 409'4 477'41 417'4 4,474 6,121 1,537 55 337 161 179 2 Suppose that you buy (long) two March 2017 corn futures contracts (5,000 bushels each) at the most recent price quoted above. Your initial margin is $3,500 per contract. Now assume that one month later the futures price for March 2017 corn futures is 450'0. What is your profit? What is your return on your invested capital? Finally, suppose that you wanted to initially purchase more than two futures contracts. Is that feasible, infeasible, or unclear based on the above information? (If the picture does not show up, you can find it on https://ibb.co/vV1R1Z5)