Answered step by step

Verified Expert Solution

Question

1 Approved Answer

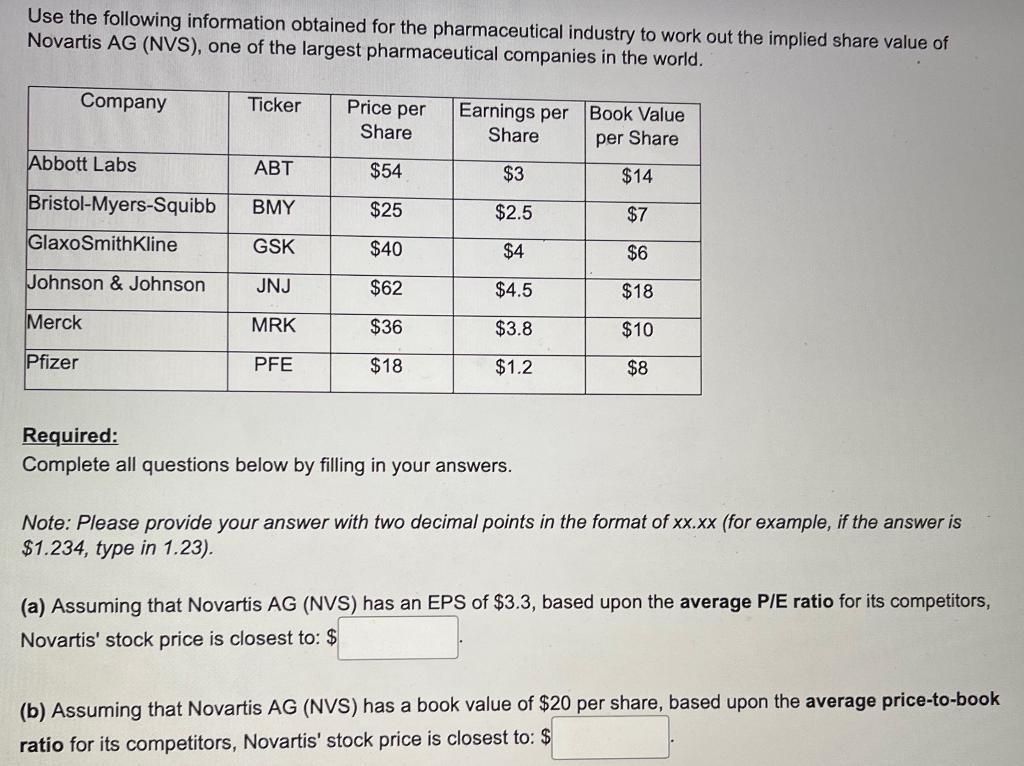

Use the following information obtained for the pharmaceutical industry to work out the implied share value of Novartis AG (NVS), one of the largest

Use the following information obtained for the pharmaceutical industry to work out the implied share value of Novartis AG (NVS), one of the largest pharmaceutical companies in the world. Earnings per Book Value Company Ticker Price per Share Share per Share Abbott Labs ABT $54 $3 $14 Bristol-Myers-Squibb BMY $25 $2.5 $7 GlaxoSmithKline GSK $40 $4 $6 Johnson & Johnson JNJ $62 $4.5 $18 Merck MRK $36 $3.8 $10 Pfizer PFE $18 $1.2 $8 Required: Complete all questions below by filling in your answers. Note: Please provide your answer with two decimal points in the format of xx.xx (for example, if the answer is $1.234, type in 1.23). (a) Assuming that Novartis AG (NVS) has an EPS of $3.3, based upon the average P/E ratio for its competitors, Novartis' stock price is closest to: $ (b) Assuming that Novartis AG (NVS) has a book value of $20 per share, based upon the average price-to-book ratio for its competitors, Novartis' stock price is closest to: $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started