You have been assigned to analyze the year-end inventory of Dynomil Company. This company sells three items of inventory and tracks of the average purchase

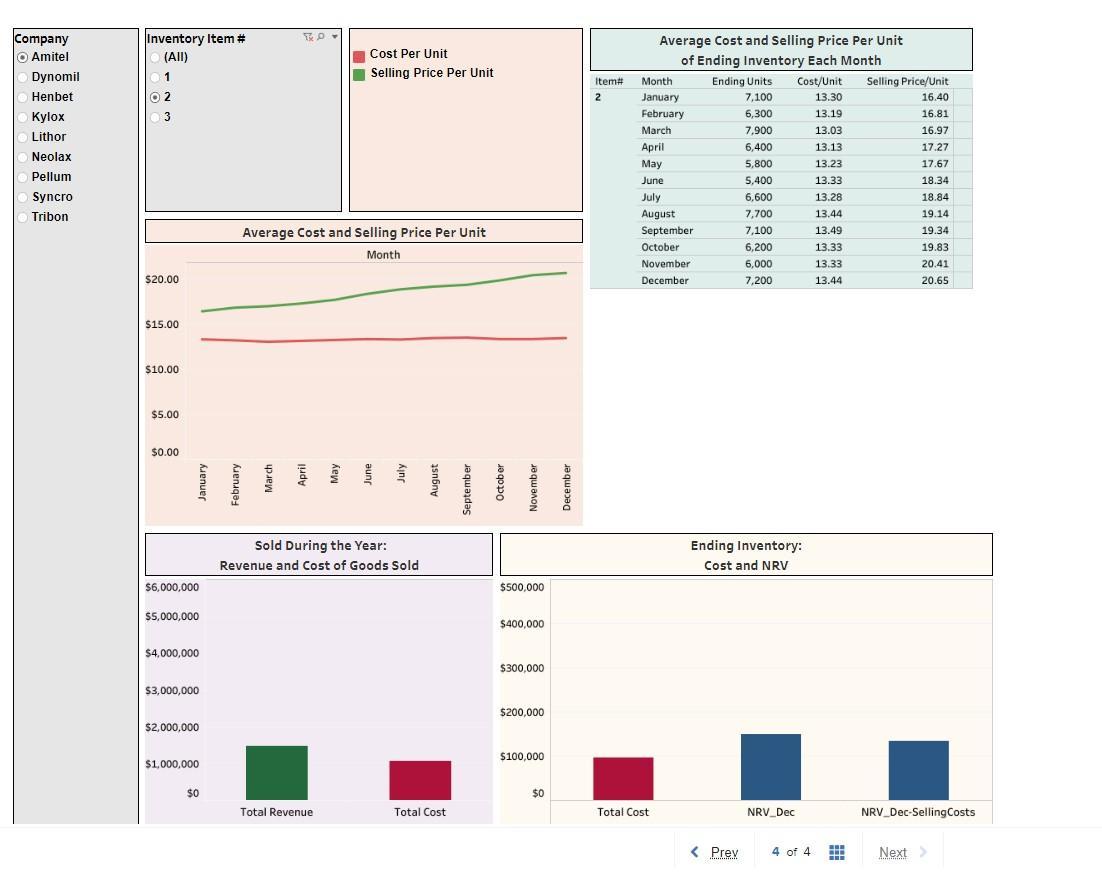

You have been assigned to analyze the year-end inventory of Dynomil Company. This company sells three items of inventory and tracks of the average purchase cost and average selling price each month. At the end of each year (December), the company uses the lower of cost or net realizable value (LCNRV) approach to report ending inventory.

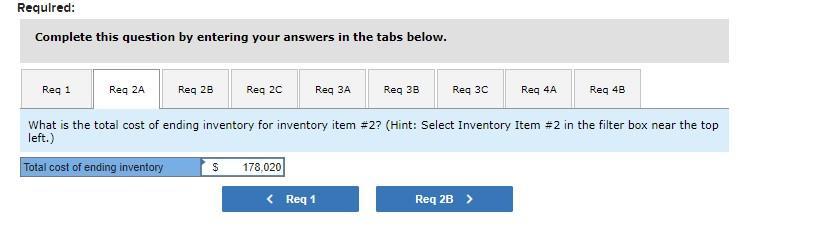

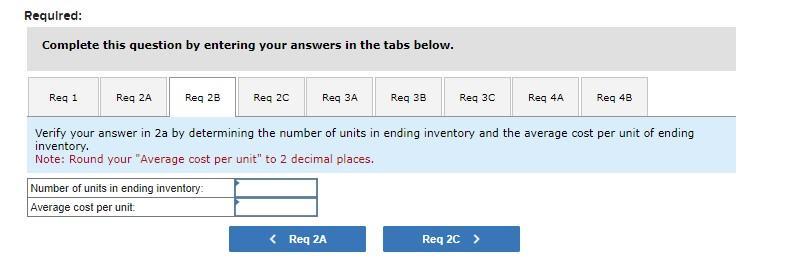

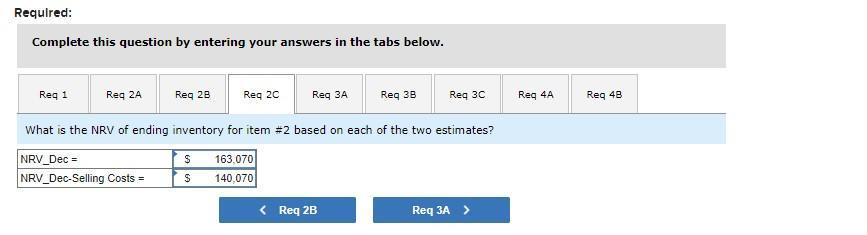

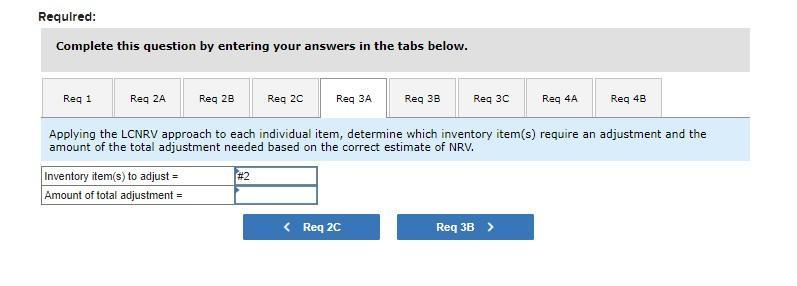

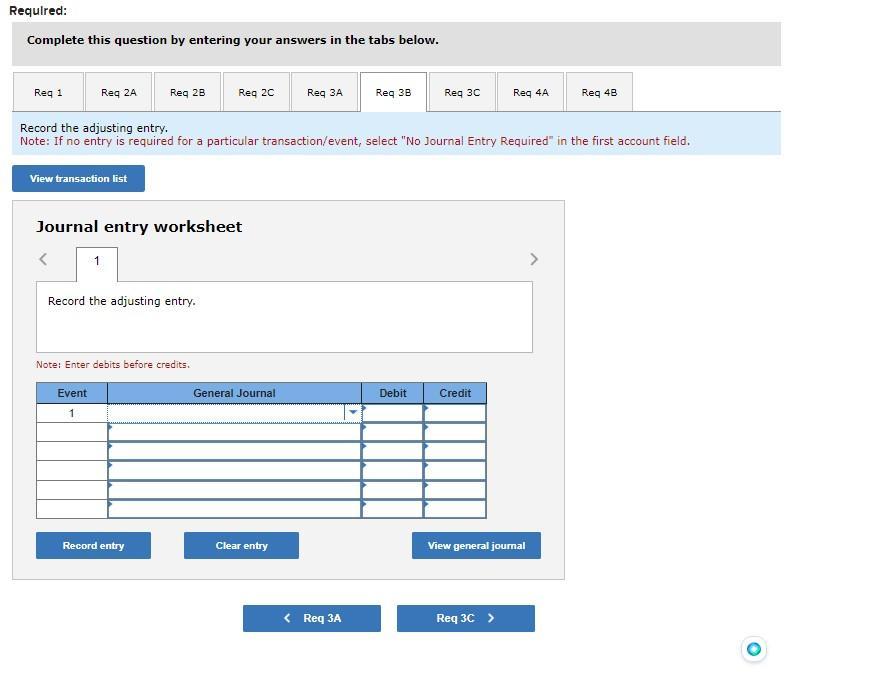

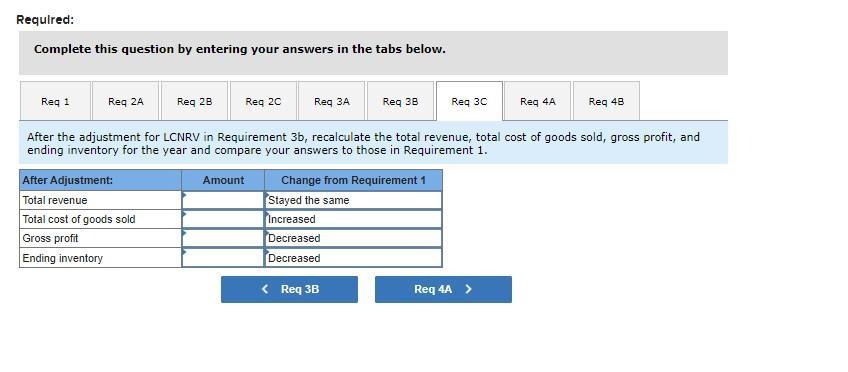

The total cost of ending inventory is shown in the bottom right of the dashboard. Also shown in the bottom right are two amounts for net realizable value (NRV) of ending inventory:

NRV_Dec = Average selling price per unit in December times the number of units in ending inventory.

NRV_Dec-Selling Costs = Average selling price per unit in December minus estimated selling costs of $2 per unit, times the number of units in ending inventory. The estimated selling cost of $2 is the average cost of selling a unit of inventory (packaging, shipping, sales commissions, etc.)

Company O Amitel Dynomil Henbet Kylox Lithor Neolax Pellum Syncro Tribon Inventory Item # (All) 1 02 3 $20.00 $15.00 $10.00 $5.00 $0.00 January $6,000,000 $5,000,000 $4,000,000 $3,000,000 $2,000,000 $1,000,000 $0 February TO Average Cost and Selling Price Per Unit Month March www. Cost Per Unit Selling Price Per Unit Total Revenue 2000 fine Sold During the Year: Revenue and Cost of Goods Sold August Total Cost September October November $500,000 $400,000 $300,000 $200,000 $100,000 $0 December Item# 2 Average Cost and Selling Price Per Unit of Ending Inventory Each Month Ending Units Cost/Unit Selling Price/Unit 7,100 13.30 16.40 6,300 13.19 16.81 7,900 13.03 16.97 to do 17.07 6,400 13.13 17.27 m 5,800 13.23 17.67 5,400 anve 13.33 18.34 avi 6.600 13.28 18.84 7,700 13.44 19.14 7,100 13.49 19.34 6,200 13.33 6,000 13.33 7,200 13.44 Month January February March April May June July August September October November December Total Cost Ending Inventory: Cost and NRV < Prev NRV Dec 4 of 4 19.83 20.41 20.65 NRV_Dec-SellingCosts Next >

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the yearend inventory for Dynomil Company using the LCNRV approach lets go through the st...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started