Question

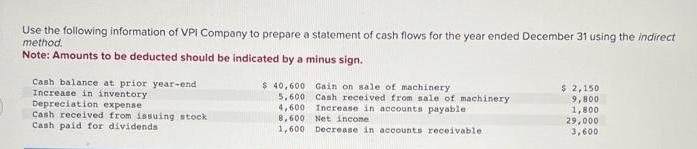

Use the following information of VPI Company to prepare a statement of cash flows for the year ended December 31 using the indirect method.

Use the following information of VPI Company to prepare a statement of cash flows for the year ended December 31 using the indirect method. Note: Amounts to be deducted should be indicated by a minus sign. Cash balance at prior year-end Increase in inventory Depreciation expense. Cash received from issuing stock Cash paid for dividends $ 40,600 5,600 4,600 8,600 Net income 1,600 Decrease in accounts receivable Gain on sale of machinery Cash received from sale of machinery Increase in accounts payable $ 2,150 9,800 1,800 29,000 3,600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Statement of Cash Flows for VPI Company For the Year Ended December 31 Operating Activities Net Income 29000 Adjustments to Reconcile Net Income to Ne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial accounting

Authors: Walter T. Harrison, Charles T. Horngren, William Bill Thomas

8th Edition

9780135114933, 136108865, 978-0136108863

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App