Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the following information to answer all remaining questions on this exam. You are considering the acquisition of Colony Park Apartments. Colony Park is a

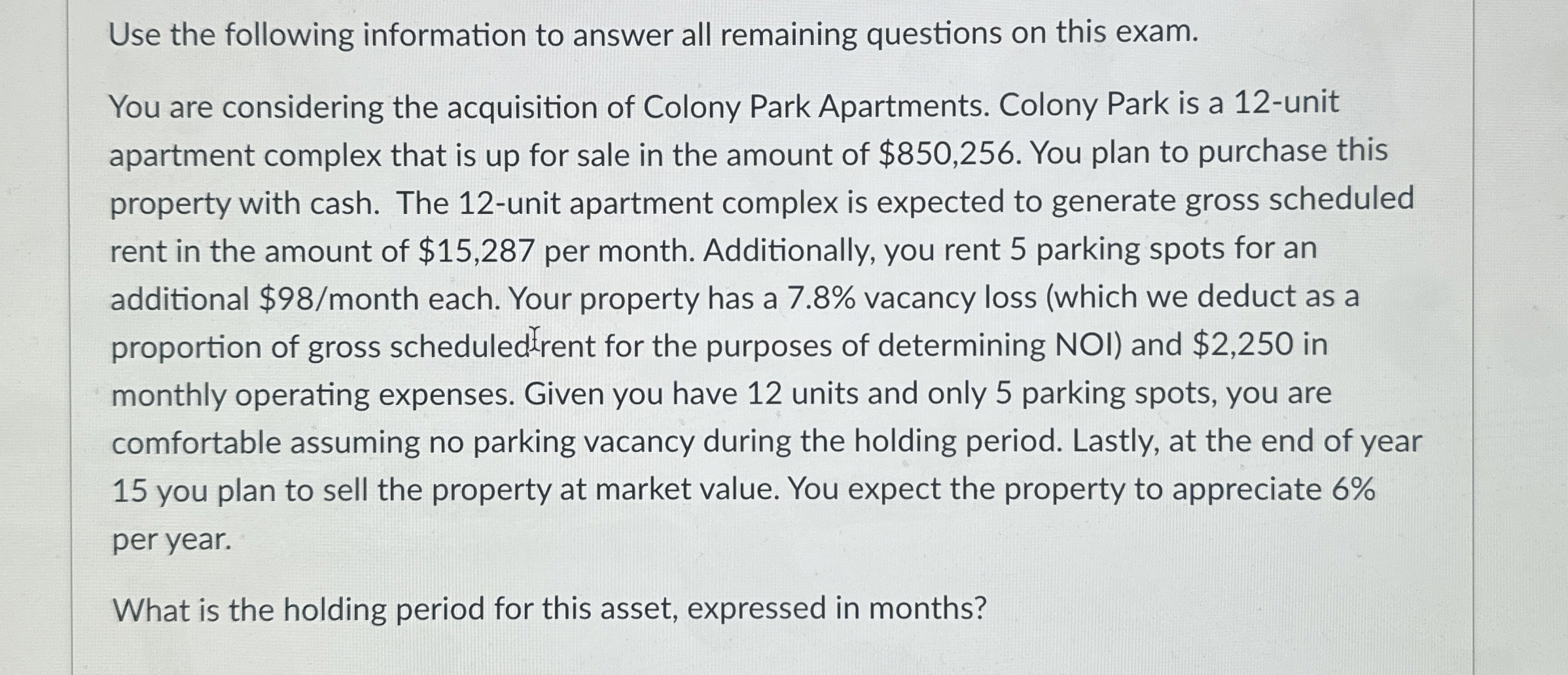

Use the following information to answer all remaining questions on this exam.

You are considering the acquisition of Colony Park Apartments. Colony Park is a unit apartment complex that is up for sale in the amount of $ You plan to purchase this property with cash. The unit apartment complex is expected to generate gross scheduled rent in the amount of $ per month. Additionally, you rent parking spots for an additional $ month each. Your property has a vacancy loss which we deduct as a proportion of gross scheduledrent for the purposes of determining NOI and $ in monthly operating expenses. Given you have units and only parking spots, you are comfortable assuming no parking vacancy during the holding period. Lastly, at the end of year you plan to sell the property at market value. You expect the property to appreciate per year.

What is the holding period for this asset, expressed in months?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started