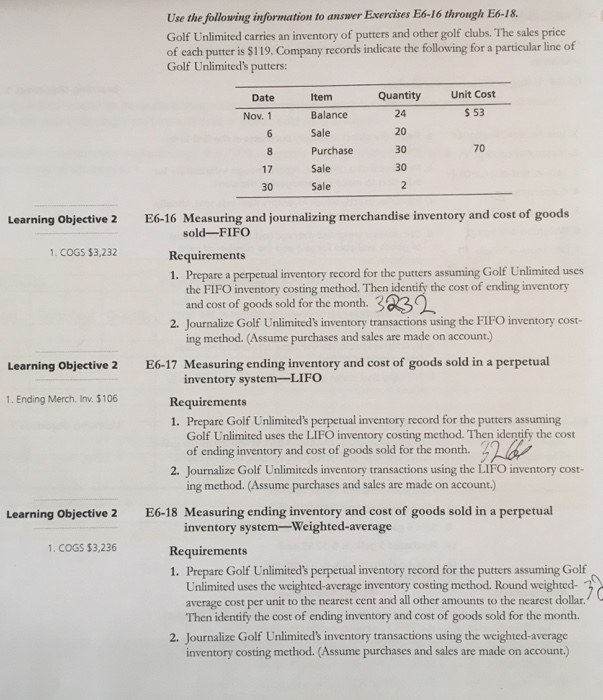

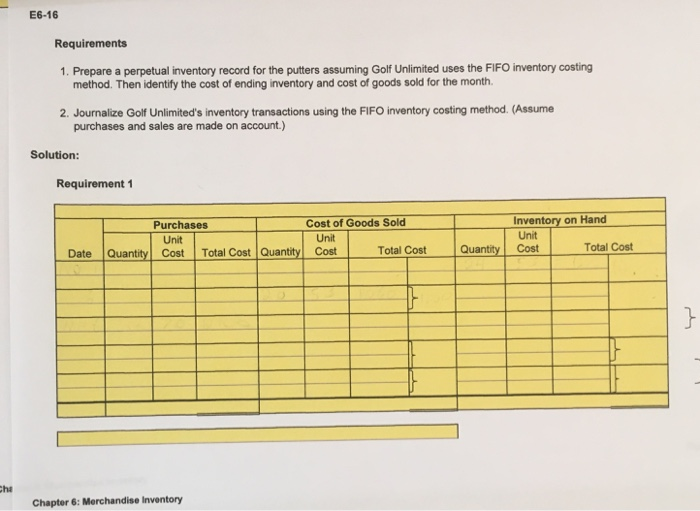

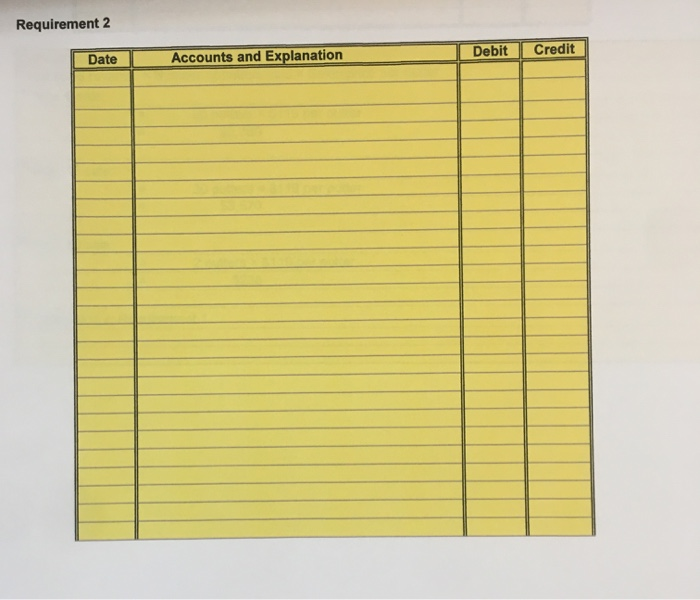

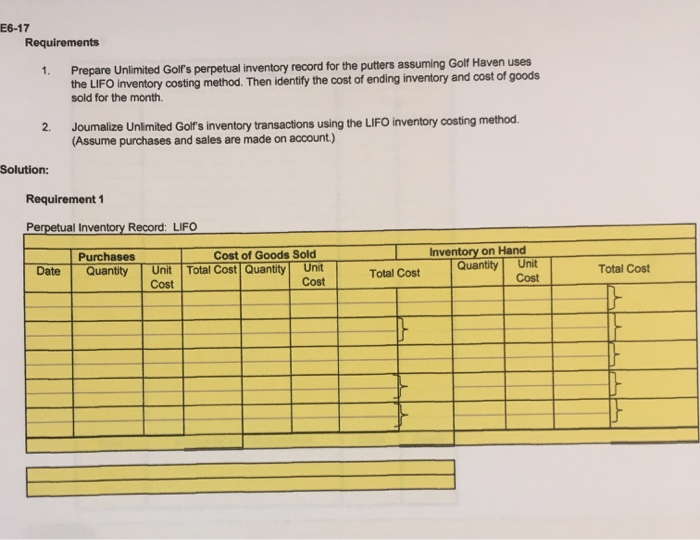

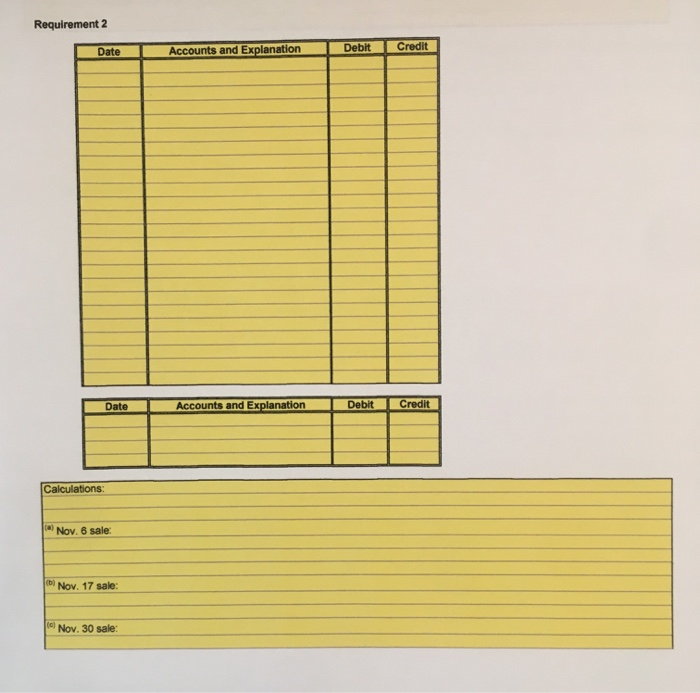

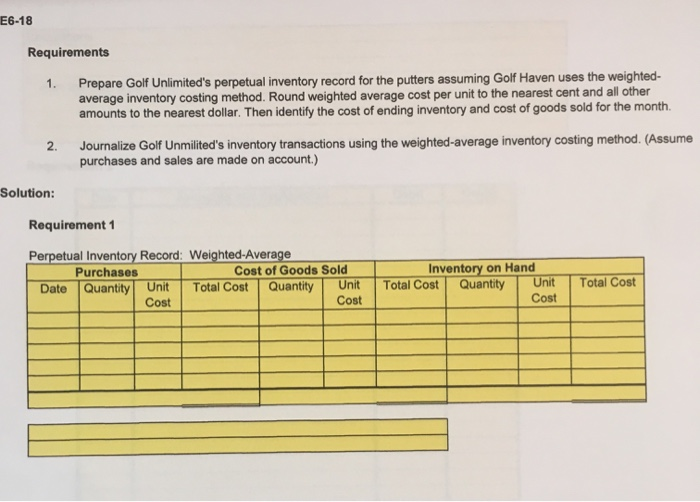

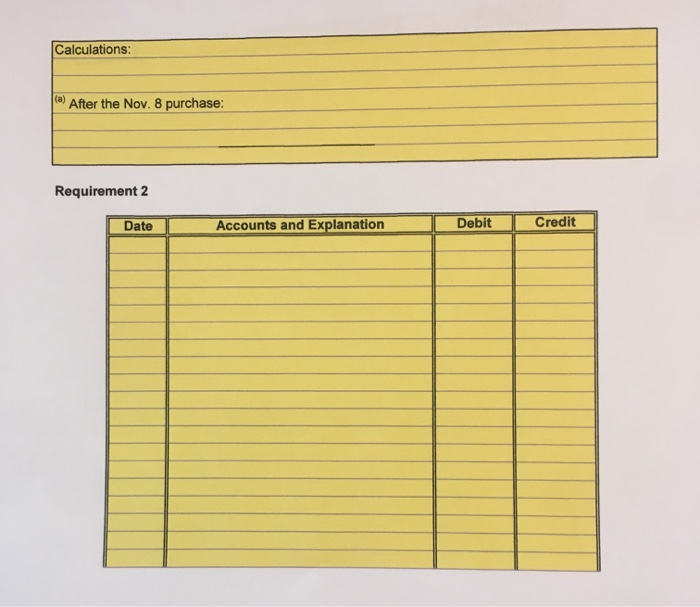

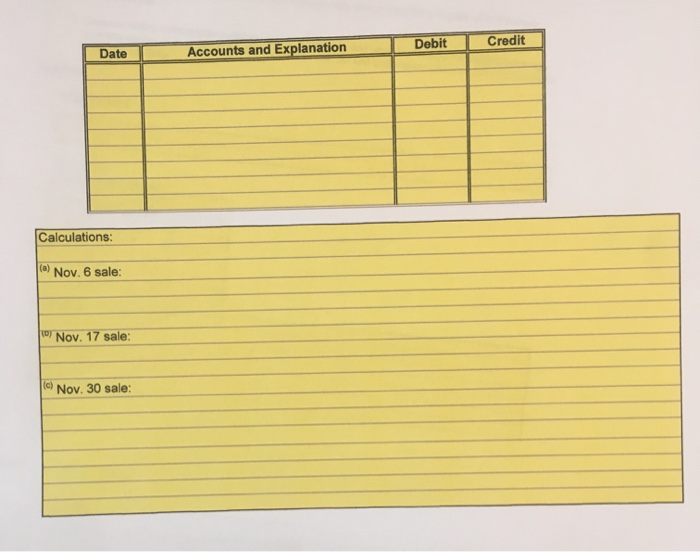

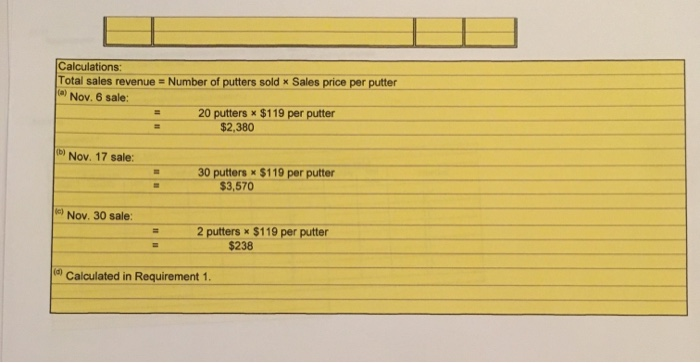

Use the following information to answer Exercises E6-16 through E6-18. Golf Unlimited carries an inventory of putters and other golf clubs. The sales price of cach putter is $119. Company records indicate the following for a particular line of Golf Unlimited's putters: Quantity Date Nov. 1 Unit Cost $53 Item Balance Sale Purchase Sale Sale 30 70 30 Learning Objective 2 1. COGS 53,232 E6-16 Measuring and journalizing merchandise inventory and cost of goods sold-FIFO Requirements 1. Prepare a perpetual inventory record for the putters assuming Golf Unlimited uses the FIFO inventory costing method. Then identify the cost of ending inventory and cost of goods sold for the month. 3239 2. Journalize Golf Unlimited's inventory transactions using the FIFO inventory cost- ing method. (Assume purchases and sales are made on account.) Learning Objective 2 1. Ending Merch. Inv. 5106 E6-17 Measuring ending inventory and cost of goods sold in a perpetual inventory system-LIFO Requirements 1. Prepare Golf Unlimited's perpetual inventory record for the putters assuming Golf Unlimited uses the LIFO inventory costing method. Then identify the cost of ending inventory and cost of goods sold for the month. 22 2. Journalize Golf Unlimiteds inventory transactions using the LIFO inventory cost- ing method. (Assume purchases and sales are made on account.) Learning Objective 2 1. COGS $3,236 E6-18 Measuring ending inventory and cost of goods sold in a perpetual inventory system-Weighted average Requirements 1. Prepare Golf Unlimited's perpetual inventory record for the putters assuming Golf Unlimited uses the weighted average inventory costing method. Round weighted- 32 average cost per unit to the nearest cent and all other amounts to the nearest dollar. Then identify the cost of ending inventory and cost of goods sold for the month. 2. Journalize Golf Unlimited's inventory transactions using the weighted average inventory costing method. (Assume purchases and sales are made on account.) E6-16 Requirements 1. Prepare a perpetual inventory record for the putters assuming Golf Unlimited uses the FIFO inventory costing method. Then identify the cost of ending inventory and cost of goods sold for the month 2. Journalize Golf Unlimited's inventory transactions using the FIFO inventory costing method. (Assume purchases and sales are made on account.) Solution: Requirement 1 Purchases Unit Quantity Cost Total Cost Quantity Cost of Goods Sold Unit Cost Total Cost Inventory on Hand Unit Cost Total Cost Date Quantity Chapter 6: Merchandise Inventory Requirement 2 Date Accounts and Explanation Debit Credit E6-17 Requirements Prepare Unlimited Golf's perpetual inventory record for the putters assuming Golf Haven uses the LIFO inventory costing method. Then identify the cost of ending inventory and cost of goods sold for the month 2. Joumalize Unlimited Golf's inventory transactions using the LIFO inventory costing method. (Assume purchases and sales are made on account) Solution: Requirement 1 Perpetual Inventory Record: LIFO Date Purchases Quantity Unit Cost Cost of Goods Sold Total Cost Quantity Unit Cost Inventory on Hand Quantity Unit Total Cost Total Cost Cost Requirement 2 Date Accounts and Explanation Debit Credit Accounts and Explanation Debit Credit Calculations: Nov. 6 sale: Nov. 17 sale: (Nov. 30 sale: E6-18 Requirements 1. Prepare Golf Unlimited's perpetual inventory record for the putters assuming Golf Haven uses the weighted- average inventory costing method. Round weighted average cost per unit to the nearest cent and all other amounts to the nearest dollar. Then identify the cost of ending inventory and cost of goods sold for the month, 2. Journalize Golf Unmilited's inventory transactions using the weighted average inventory costing method. (Assume purchases and sales are made on account.) Solution: Requirement 1 Perpetual Inventory Record: Weighted-Average Purchases Cost of Goods Sold Date Quantity Unit Total Cost Quantity Unit Cost Cost Inventory on Hand Total Cost Quantity Unit Cost Total Cost Calculations: (a) After the Nov. 8 purchase: Requirement 2 Date Accounts and Explanation Debit Credit Date Accounts and Explanation Debit I Credit Calculations: (a) Nov. 6 sale: Nov. 17 sale: (0) Nov. 30 sale: Calculations: Total sales revenue Number of putters sold * Sales price per putter (a) Nov. 6 sale: 20 putters * $119 per putter $2,380 b) Nov. 17 sale: 30 putters * $119 per putter $3,570 Nov. 30 sale: 2 putters * $119 per putter $238 (W) Calculated in Requirement 1