Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the following information to answer Question 1 to Question 1 1 . Amy, Bob and Cat were in partnership sharing profits and losses in

Use the following information to answer Question to Question Amy, Bob and Cat were in partnership sharing profits and losses in the ratio of :: respectively. An extract of the account balances as at December is given below:Capital accounts:AmyCr BobCr CatCrOffice equipment, netInventoryAccount receivablesCash at bankDrLoan from TimAccount payablesOn January Bob was declared bankrupt, and the partnership was dissolved. The relevant information is as follows:a Amy took over the office equipment at of its net book value.b Cat took over all the inventory to settle of his loan to the partnership. The partnership paid the outstanding loan balance by cheque.c Amy was responsible for collecting all the account receivables for the partnership. Finally, she collected $ and deposited the amount into the partnership's cash at bank account. The partnership agreed to pay him a handling fee of on the amount collected.d The partnership received a discount on the account payables, which were settled by Cat behalf the partnership.e Realization expenses of $ were paid by cheque Bob was unable to settle his account and it was agreed that his deficiency was to be borne by the rer partners accordng to their profit and loss sharing ratio.

Use the following information to answer Question to Question

Amy, Bob and Cat were in partnership sharing profits and losses in the ratio of :: respectively. An extract of the account balances as at December is given below:

table$Capital accounts:,, Amy,Cr Bob,Cr Cat,CrOffice equipment, net,InventoryAccount receivables,Cash at bank,DrLoan from Tim,Account payables,

On January Bob was declared bankrupt, and the partnership was dissolved. The relevant information is as follows:

a Amy took over the office equipment at of its net book value.

b Cat took over all the inventory to settle of his loan to the partnership. The partnership paid the outstanding loan balance by cheque.

c Amy was responsible for collecting all the account receivables for the partnership. Finally, she collected $ and deposited the amount into the partnership's cash at bank account. The partnership agreed to pay him a handling fee of on the amount collected.

d The partnership received a discount on the account payables, which were settled by Cat behalf the partnership.

e Realization expenses of $ were paid by cheque.

f Bob was unable to settle his account and it was agreed that his deficiency was to be borne by the ren partners according to their profit and loss sharing ratio.

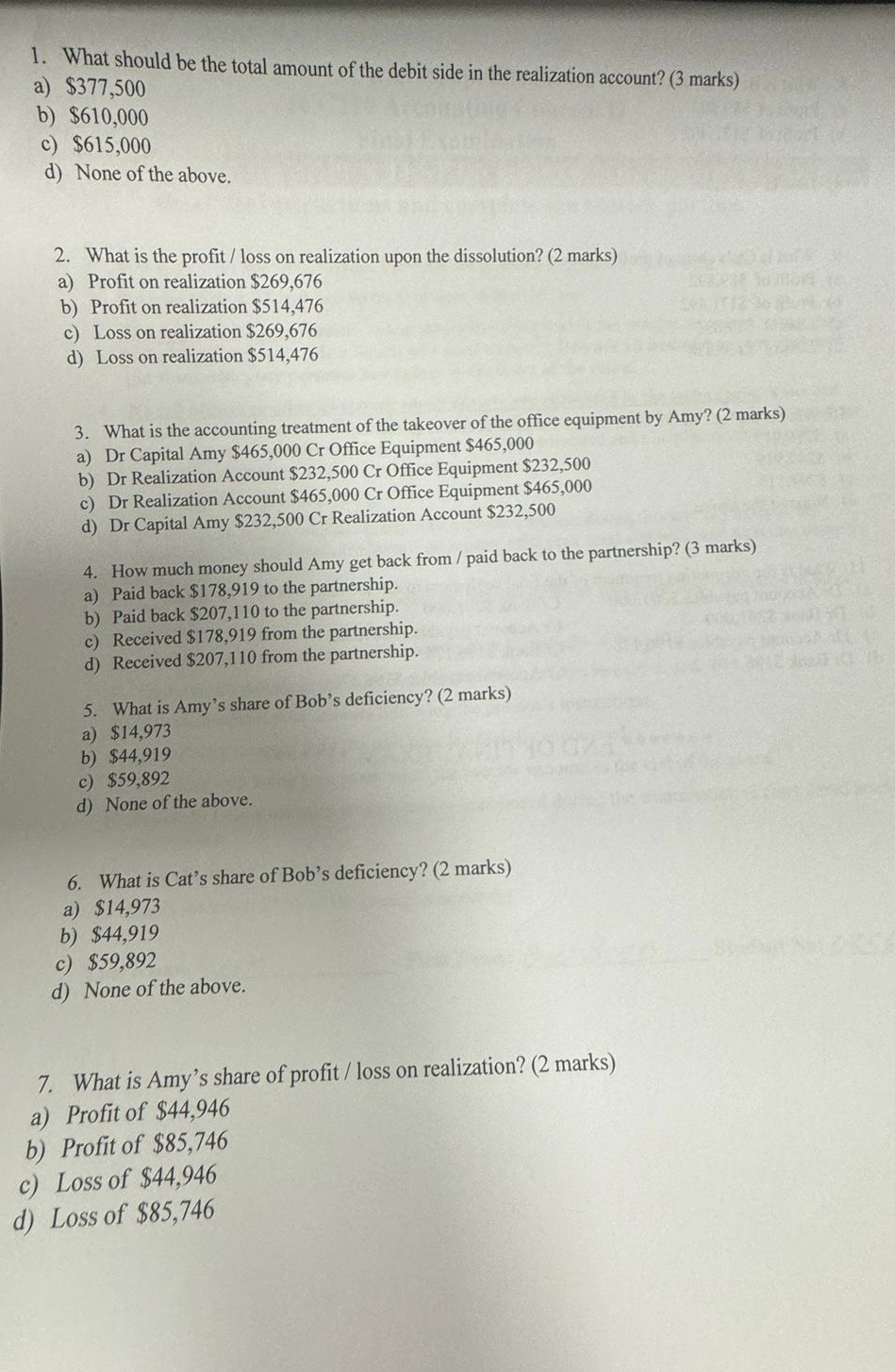

What should be the total amount of the debit side in the realization account? marks

a $

b $

c $

d None of the above.

What is the profit loss on realization upon the dissolution? marks

a Profit on realization $

b Profit on realization $

c Loss on realization $

d Loss on realization $

What is the accounting treatment of the takeover of the office equipment by Amy? marks

a Dr Capital Amy $ Office Equipment $

b Dr Realization Account $ Office Equipment $

c Dr Realization Account $ Office Equipment $

d Dr Capital Amy $ Realization Account $

How much money should Amy get back from paid back to the partnership? marks

a Paid back $ to the partnership.

b Paid back $ to the partnership.

c Received $ from the partnership.

d Received $ from the partnership.

What is Amy's share of Bob's deficiency? marks

a $

b $

c $

d None of the above.

What is Cat's share of Bob's deficiency? marks

a $

b $

c $

d None of the above.

What is Amy's share of profit loss on

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started