Answered step by step

Verified Expert Solution

Question

1 Approved Answer

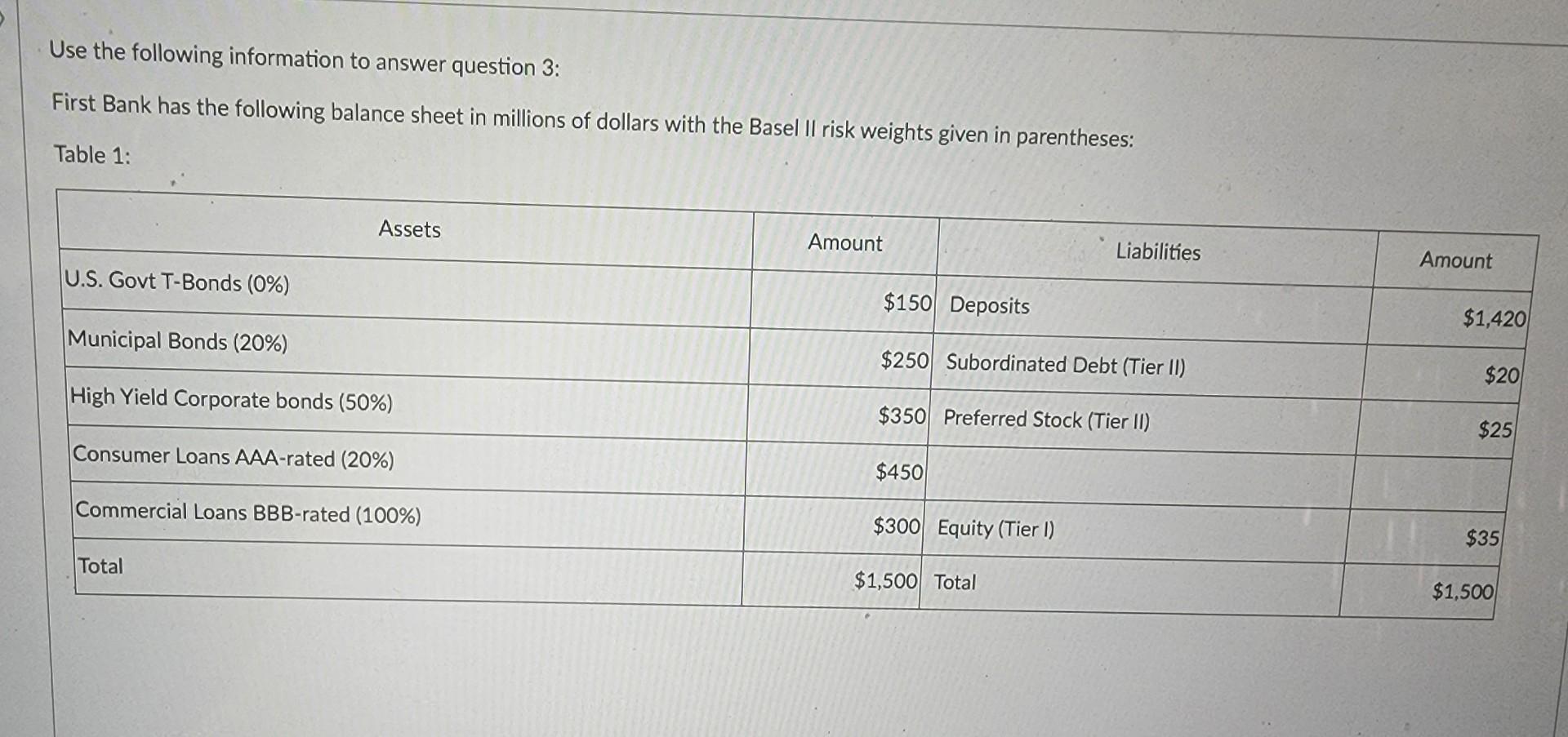

Use the following information to answer question 3: First Bank has the following balance sheet in millions of dollars with the Basel II risk weights

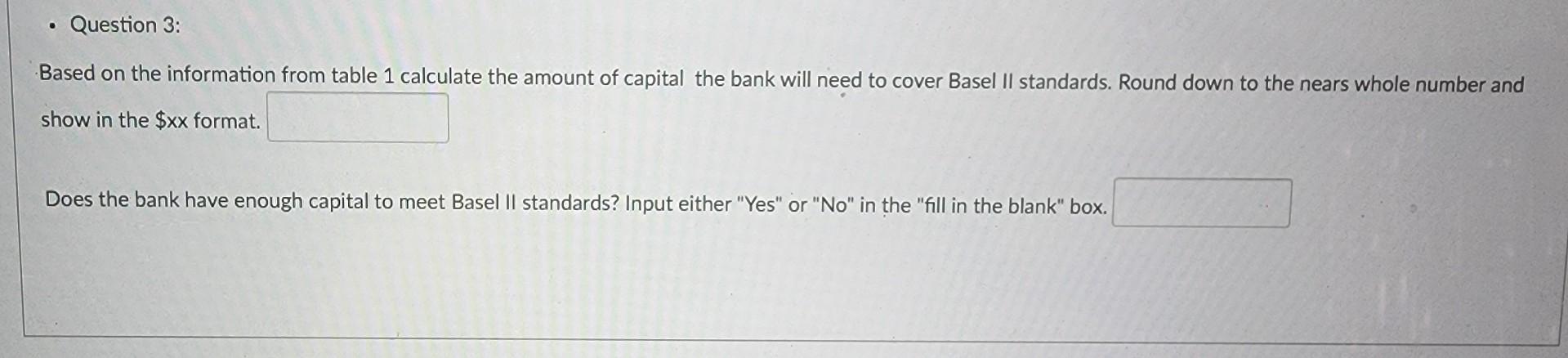

Use the following information to answer question 3: First Bank has the following balance sheet in millions of dollars with the Basel II risk weights given in parentheses: Table 1: Assets Amount Liabilities Amount U.S. Govt T-Bonds (0%) $150 Deposits $1,420 Municipal Bonds (20%) $250 Subordinated Debt (Tier II) $20 High Yield Corporate bonds (50%) $350 Preferred Stock (Tier II) $25 Consumer Loans AAA-rated (20%) $450 Commercial Loans BBB-rated (100%) $300 Equity (Tier I) $35 Total $1,500 Total $1,500 Question 3: Based on the information from table 1 calculate the amount of capital the bank will need to cover Basel II standards. Round down to the nears whole number and show in the $xx format. Does the bank have enough capital to meet Basel II standards? Input either "Yes" or "No" in the "fill in the blank" box

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started