Answered step by step

Verified Expert Solution

Question

1 Approved Answer

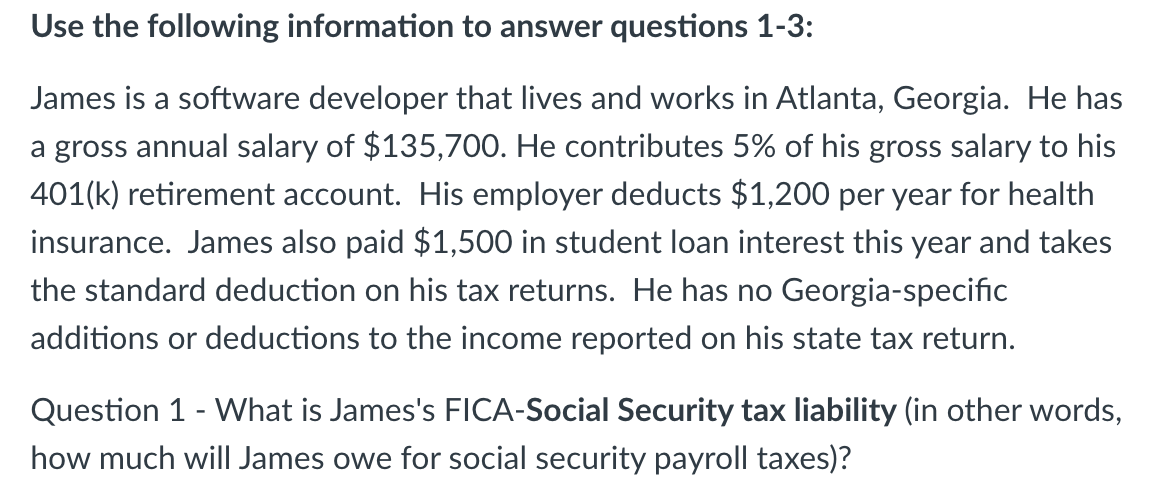

Use the following information to answer questions 1 - 3 : James is a software developer that lives and works in Atlanta, Georgia. He has

Use the following information to answer questions :

James is a software developer that lives and works in Atlanta, Georgia. He has

a gross annual salary of $ He contributes of his gross salary to his

k retirement account. His employer deducts $ per year for health

insurance. James also paid $ in student loan interest this year and takes

the standard deduction on his tax returns. He has no Georgiaspecific

additions or deductions to the income reported on his state tax return.

Question What is James's FICASocial Security tax liability in other words,

how much will James owe for social security payroll taxes

QUESTION what is james effective tax rate for federal income taxes only?

QUESTION What is James state taxable income for Georgia income taxes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started