Question

Use the following information to answer questions 1 through 4. The company Maya Inc. acquired different types of investments in debt instruments (investments in debt

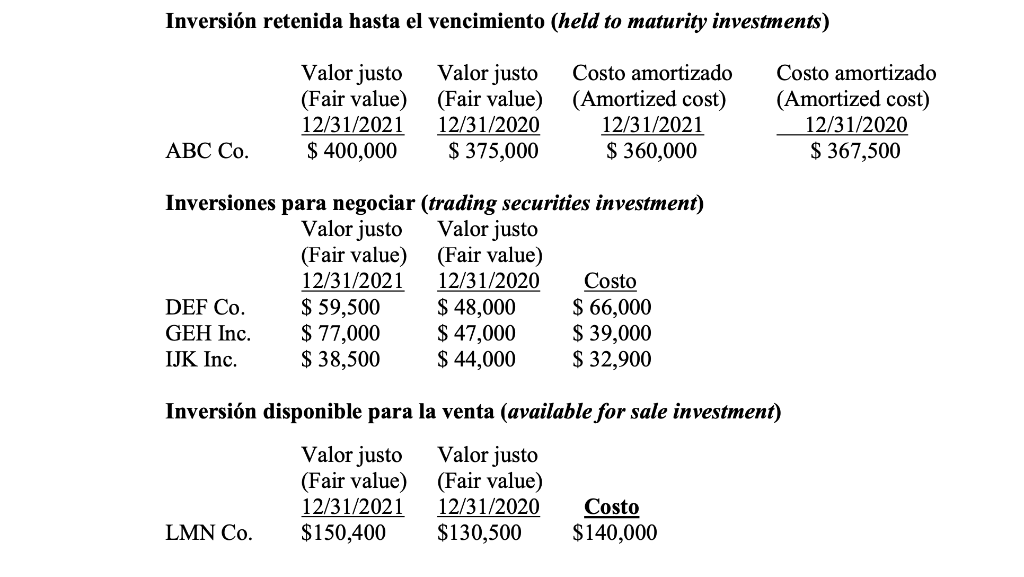

Use the following information to answer questions 1 through 4. The company Maya Inc. acquired different types of investments in debt instruments (investments in debt securities) during 2020, its first year of operations. The investment pattern continued through 2021, so as of December 31, 2021, Maya Inc. still has an investment portfolio on its books. Below, we reflect the values associated with the different types of investment that Maya has, both at the end of 2020 and 2021. The fluctuations that are reflected in the market values (fair values) are temporary

1- By analyzing these data, we can conclude that the balance in accumulated comprehensive income (AOCI) as of December 31, 2021 is: a- $ 55,100 c. $ 26,500 b- $ 36,000 d. $ 10,400

2- If all the final balances that must be reflected in the Balance Sheet as of December 31, 2020 and related to these investments are added, regardless of their classification and the section where they are presented, and taking into account the value at which each type of investment is presented in accordance with accounting principles, said total would amount to a. $ 637,000 c. $ 645,400 b. $ 644,500 d. $ 652,900

3- As a result of Maya Inc.'s analysis of its investment portfolio for trading, the following amount will be reflected in the "Other income and expenses" section of the Income Statement for the year ended December 31, 2021 a. $ 0 c. $ 36,000 b. $ 19,900 d. $ 55,900

4- As a result of Maya Inc.'s analysis of your investment available for sale, the following amount will be reflected in the "Other income and expenses" section of the Income Statement for the year ended December 31, 2021 a. $ 0 c. $ 36,000 b. $ 19,900 d. $ 55,900

Inversin retenida hasta el vencimiento (held to maturity investments) Valor justo (Fair value) 12/31/2021 $ 400,000 Valor justo (Fair value) 12/31/2020 $375,000 Costo amortizado (Amortized cost) 12/31/2021 $360,000 Costo amortizado (Amortized cost) 12/31/2020 $ 367,500 ABC Co. Inversiones para negociar (trading securities investment) Valor justo Valor justo (Fair value) (Fair value) 12/31/2021 12/31/2020 Costo DEF Co. $ 59,500 $ 48,000 $ 66,000 GEH Inc. $ 77,000 $ 47,000 $ 39,000 IJK Inc. $ 38,500 $ 44,000 $ 32,900 Inversin disponible para la venta (available for sale investment) Valor justo Valor justo (Fair value) (Fair value) 12/31/2021 12/31/2020 Costo LMN Co. $150,400 $130,500 $140,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started