Question

Use the following information to answer questions 1-2 The Federal Tax Credit is 18.97%; the Provincial Tax Credit is 6.7%; Dividends must first be grossed

Use the following information to answer questions 1-2

The Federal Tax Credit is 18.97%; the Provincial Tax Credit is 6.7%; Dividends must

first be grossed up by 45%.

1- An Ontario resident earned $1,545 in dividends in 2009. His regular income was

$176,000 and the Ontario dividend tax credit is 6.7%. Calculate the following: the

dollar amount of the federal tax payable on dividends, the dollar amount of the

provincial tax payable on dividends, and the total tax rate on dividends.

(Please provide detailed calculation)

2- Calculate the total tax bill and effective tax rate for an Ontario resident whose

regular income was $140,000 in 2009. (Please provide detailed calculation)

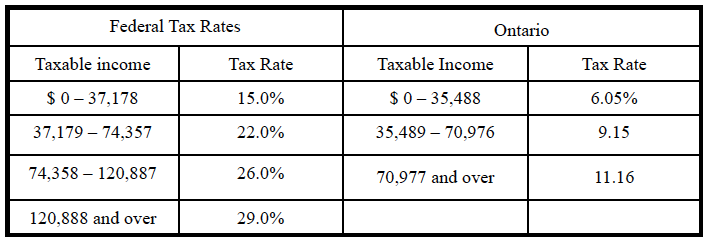

\begin{tabular}{|c|c|c|c|} \hline \multicolumn{2}{|c|}{ Federal Tax Rates } & \multicolumn{2}{|c|}{ Ontario } \\ \hline Taxable income & Tax Rate & Taxable Income & Tax Rate \\ \hline$037,178 & 15.0% & $035,488 & 6.05% \\ \hline 37,17974,357 & 22.0% & 35,48970,976 & 9.15 \\ \hline 74,358120,887 & 26.0% & 70,977 and over & 11.16 \\ \hline 120,888 and over & 29.0% & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started