Question

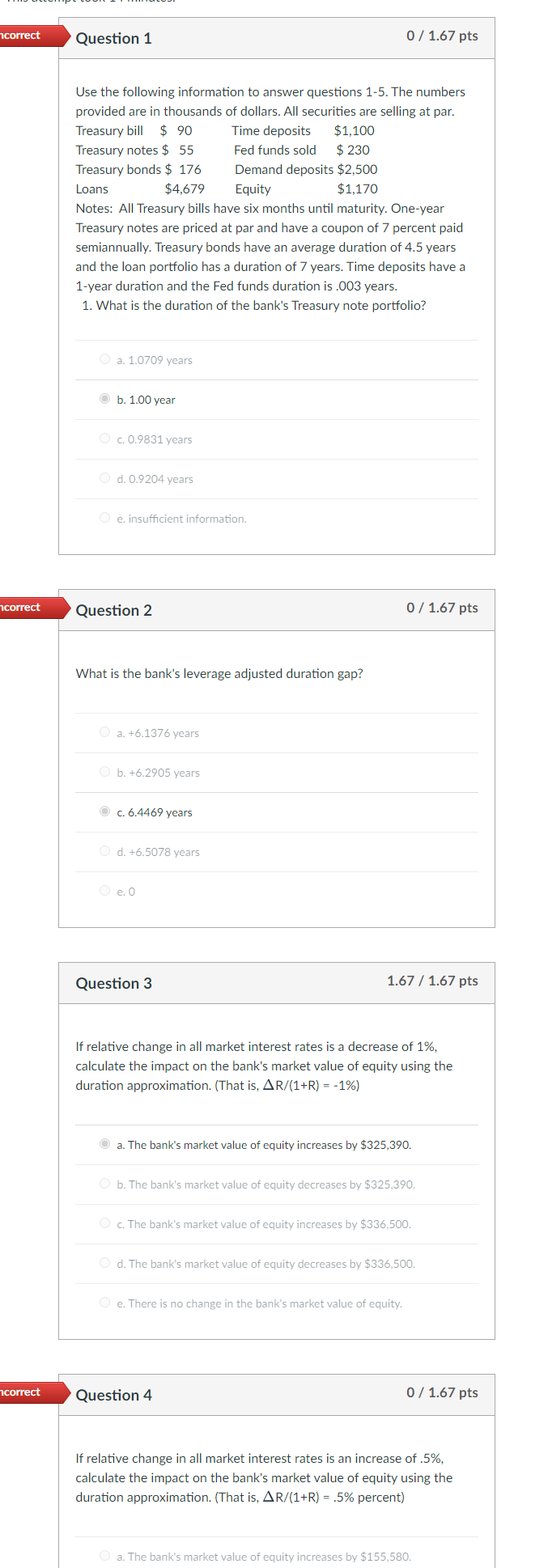

Use the following information to answer questions 1-5. The numbers provided are in thousands of dollars. All securities are selling at par. Treasury bill $

Use the following information to answer questions 1-5. The numbers provided are in thousands of dollars. All securities are selling at par.

Treasury bill $ 90 Time deposits $1,100

Treasury notes $ 55 Fed funds sold $ 230

Treasury bonds $ 176 Demand deposits $2,500

Loans $4,679 Equity $1,170

Notes: All Treasury bills have six months until maturity. One-year Treasury notes are priced at par and have a coupon of 7 percent paid semiannually. Treasury bonds have an average duration of 4.5 years and the loan portfolio has a duration of 7 years. Time deposits have a 1-year duration and the Fed funds duration is .003 years.

Use the following information to answer questions 1-5. The numbers nrovided are in thousands of dollars. All ser.urities are selling at par. Notes: All Treasury bills have six months until maturity. One-year Treasury notes are priced at par and have a coupon of 7 percent paid semiannually. Treasury bonds have an average duration of 4.5 years and the loan portfolio has a duration of 7 years. Time deposits have a 1 -year duration and the Fed funds duration is .003 years. 1. What is the duration of the bank's Treasury note portfolio? a. 1.0709 years b. 1.00 year c. 0.9831 years d. 0.9204 years e. insufficient information. Question 2 0/1.67 pts What is the bank's leverage adjusted duration gap? a.+6.1376yearsb.+6.2905yearsc.6.4469yearsd.+6.5078yearse.0 Question 3 1.67/1.67pts If relative change in all market interest rates is a decrease of 1%, calculate the impact on the bank's market value of equity using the duration approximation. (That is, R/(1+R)=1% ) a. The bank's market value of equity increases by $325,390. b. The bank's market value of equity decreases by $325,390. c. The bank's market value of equity increases by $336,500. d. The bank's market value of equity decreases by $336,500. e. There is no change in the bank's market value of equity. Question 4 0/1.67 pts If relative change in all market interest rates is an increase of .5\%, calculate the impact on the bank's market value of equity using the duration approximation. (That is, R/(1+R)=.5% percent) Use the following information to answer questions 1-5. The numbers nrovided are in thousands of dollars. All ser.urities are selling at par. Notes: All Treasury bills have six months until maturity. One-year Treasury notes are priced at par and have a coupon of 7 percent paid semiannually. Treasury bonds have an average duration of 4.5 years and the loan portfolio has a duration of 7 years. Time deposits have a 1 -year duration and the Fed funds duration is .003 years. 1. What is the duration of the bank's Treasury note portfolio? a. 1.0709 years b. 1.00 year c. 0.9831 years d. 0.9204 years e. insufficient information. Question 2 0/1.67 pts What is the bank's leverage adjusted duration gap? a.+6.1376yearsb.+6.2905yearsc.6.4469yearsd.+6.5078yearse.0 Question 3 1.67/1.67pts If relative change in all market interest rates is a decrease of 1%, calculate the impact on the bank's market value of equity using the duration approximation. (That is, R/(1+R)=1% ) a. The bank's market value of equity increases by $325,390. b. The bank's market value of equity decreases by $325,390. c. The bank's market value of equity increases by $336,500. d. The bank's market value of equity decreases by $336,500. e. There is no change in the bank's market value of equity. Question 4 0/1.67 pts If relative change in all market interest rates is an increase of .5\%, calculate the impact on the bank's market value of equity using the duration approximation. (That is, R/(1+R)=.5% percent)

Use the following information to answer questions 1-5. The numbers nrovided are in thousands of dollars. All ser.urities are selling at par. Notes: All Treasury bills have six months until maturity. One-year Treasury notes are priced at par and have a coupon of 7 percent paid semiannually. Treasury bonds have an average duration of 4.5 years and the loan portfolio has a duration of 7 years. Time deposits have a 1 -year duration and the Fed funds duration is .003 years. 1. What is the duration of the bank's Treasury note portfolio? a. 1.0709 years b. 1.00 year c. 0.9831 years d. 0.9204 years e. insufficient information. Question 2 0/1.67 pts What is the bank's leverage adjusted duration gap? a.+6.1376yearsb.+6.2905yearsc.6.4469yearsd.+6.5078yearse.0 Question 3 1.67/1.67pts If relative change in all market interest rates is a decrease of 1%, calculate the impact on the bank's market value of equity using the duration approximation. (That is, R/(1+R)=1% ) a. The bank's market value of equity increases by $325,390. b. The bank's market value of equity decreases by $325,390. c. The bank's market value of equity increases by $336,500. d. The bank's market value of equity decreases by $336,500. e. There is no change in the bank's market value of equity. Question 4 0/1.67 pts If relative change in all market interest rates is an increase of .5\%, calculate the impact on the bank's market value of equity using the duration approximation. (That is, R/(1+R)=.5% percent) Use the following information to answer questions 1-5. The numbers nrovided are in thousands of dollars. All ser.urities are selling at par. Notes: All Treasury bills have six months until maturity. One-year Treasury notes are priced at par and have a coupon of 7 percent paid semiannually. Treasury bonds have an average duration of 4.5 years and the loan portfolio has a duration of 7 years. Time deposits have a 1 -year duration and the Fed funds duration is .003 years. 1. What is the duration of the bank's Treasury note portfolio? a. 1.0709 years b. 1.00 year c. 0.9831 years d. 0.9204 years e. insufficient information. Question 2 0/1.67 pts What is the bank's leverage adjusted duration gap? a.+6.1376yearsb.+6.2905yearsc.6.4469yearsd.+6.5078yearse.0 Question 3 1.67/1.67pts If relative change in all market interest rates is a decrease of 1%, calculate the impact on the bank's market value of equity using the duration approximation. (That is, R/(1+R)=1% ) a. The bank's market value of equity increases by $325,390. b. The bank's market value of equity decreases by $325,390. c. The bank's market value of equity increases by $336,500. d. The bank's market value of equity decreases by $336,500. e. There is no change in the bank's market value of equity. Question 4 0/1.67 pts If relative change in all market interest rates is an increase of .5\%, calculate the impact on the bank's market value of equity using the duration approximation. (That is, R/(1+R)=.5% percent) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started