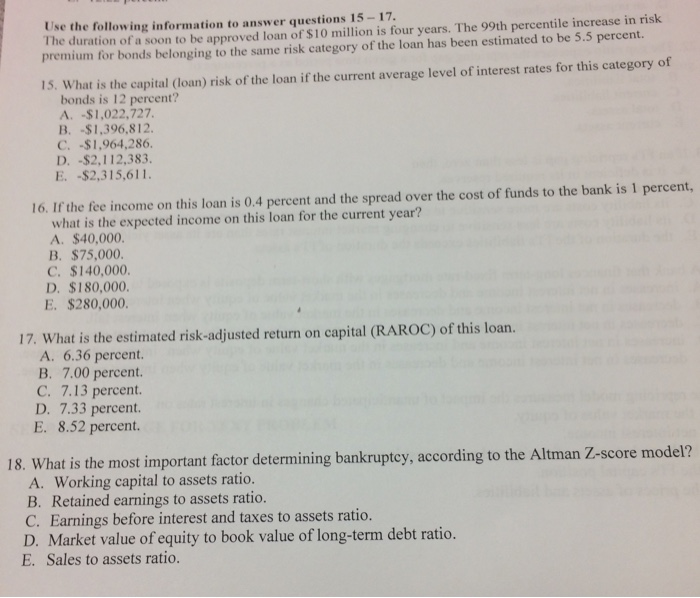

Use the following information to answer questions 15-17 The duration of a soon to be approved loan of $10 million is four years. The 99th percentile increase in risk premium for bonds belonging to the same risk category of the loan has been estimated to be 5.5 percent. 1S. What is the capital (loan) risk of the loan if the current average level of interest rates for this category of bonds is 12 percent? A. $1,022,727 B. -$1,396,812 C. -$1,964,286 D. -$2,112,383 E. -$2,315,611 16. If the fee income on this loan is 0.4 percent and the spread over the cost of funds to the bank is 1 percent, what is the expected income on this loan for the current year? A. $40,000 B. $75,000 C. $140,000 D. $180,000 E. $280,000 risk-adjusted return on capital (RAROC) of this loan. 17. What is the estimated A. 6.36 percent B. 7.00 percent C. 7.13 percent D. 7.33 percent. E. 8.52 percent. 18. What is the most important factor determining bankruptey, according to the Altman Z-score model A. Working capital to assets ratico B. Retained earnings to assets ratio C. Earnings before interest and taxes to assets ratio D. Market value of equity to book value of long-term debt ratio E. Sales to assets ratio Use the following information to answer questions 15-17 The duration of a soon to be approved loan of $10 million is four years. The 99th percentile increase in risk premium for bonds belonging to the same risk category of the loan has been estimated to be 5.5 percent. 1S. What is the capital (loan) risk of the loan if the current average level of interest rates for this category of bonds is 12 percent? A. $1,022,727 B. -$1,396,812 C. -$1,964,286 D. -$2,112,383 E. -$2,315,611 16. If the fee income on this loan is 0.4 percent and the spread over the cost of funds to the bank is 1 percent, what is the expected income on this loan for the current year? A. $40,000 B. $75,000 C. $140,000 D. $180,000 E. $280,000 risk-adjusted return on capital (RAROC) of this loan. 17. What is the estimated A. 6.36 percent B. 7.00 percent C. 7.13 percent D. 7.33 percent. E. 8.52 percent. 18. What is the most important factor determining bankruptey, according to the Altman Z-score model A. Working capital to assets ratico B. Retained earnings to assets ratio C. Earnings before interest and taxes to assets ratio D. Market value of equity to book value of long-term debt ratio E. Sales to assets ratio