Answered step by step

Verified Expert Solution

Question

1 Approved Answer

USE THE FOLLOWING INFORMATION TO ANSWER QUESTIONS 3 9 - 4 2 The Hester Corporation, a diversified distribution company, purchases cartons of canned golf balls

USE THE FOLLOWING INFORMATION TO ANSWER QUESTIONS

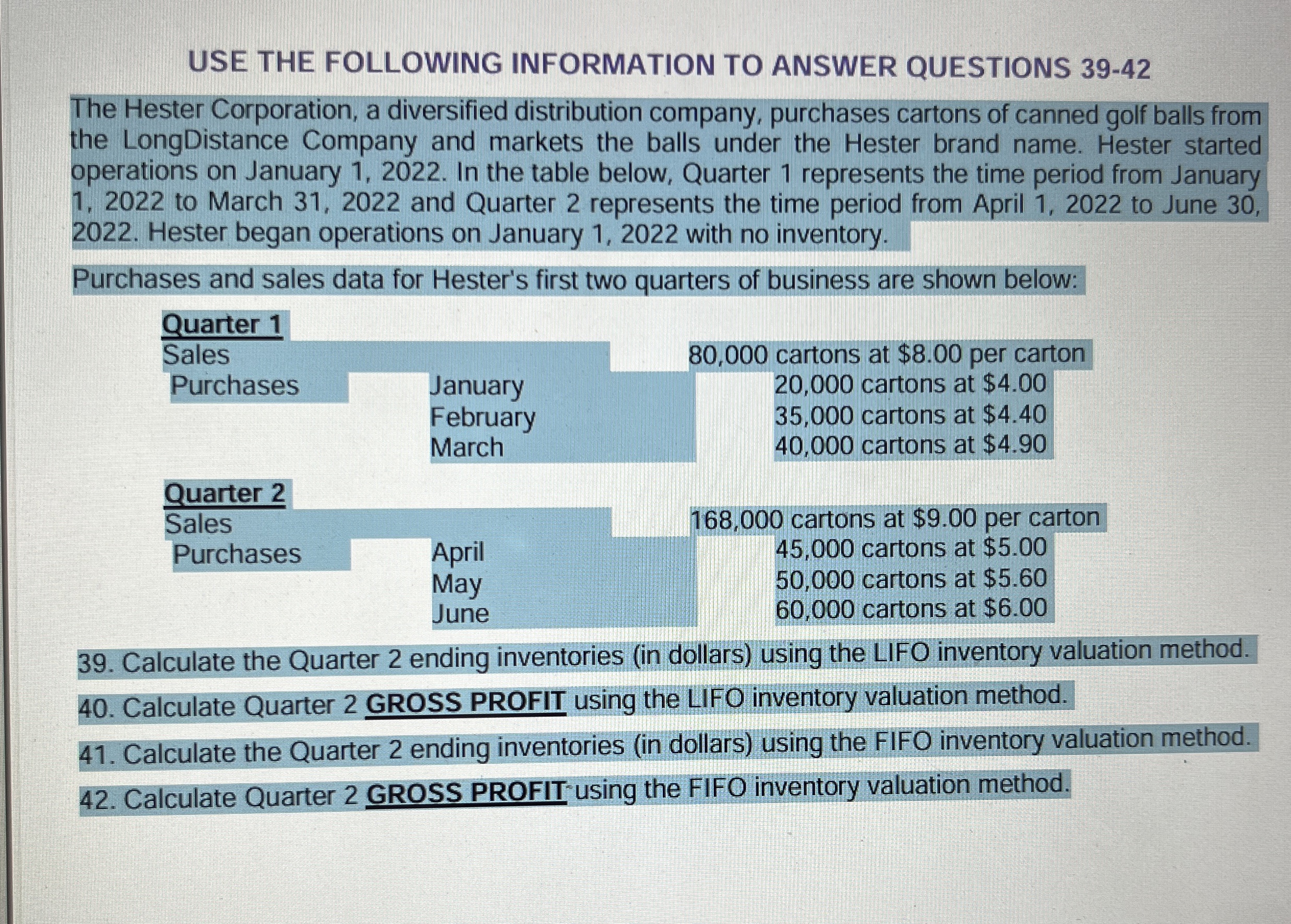

The Hester Corporation, a diversified distribution company, purchases cartons of canned golf balls from

the LongDistance Company and markets the balls under the Hester brand name. Hester started

operations on January In the table below, Quarter represents the time period from January

to March and Quarter represents the time period from April to June

Hester began operations on January with no inventory.

Purchases and sales data for Hester's first two quarters of business are shown below:

Calculate the Quarter ending inventories in dollars using the LIFO inventory valuation method.

Calculate Quarter GROSS PROFIT using the LIFO inventory valuation method.

Calculate the Quarter ending inventories in dollars using the FIFO inventory valuation method.

Calculate Quarter GROSS PROFIT using the FIFO inventory valuation method.USE THE FOLLOWING INFORMATION TO ANSWER QUESTIONS

The Hester Corporation, a diversified distribution company, purchases cartons of canned golf balls from

the LongDistance Company and markets the balls under the Hester brand name. Hester started

operations on January In the table below, Quarter represents the time period from January

to March and Quarter represents the time period from April to June

Hester began operations on January with no inventory.

Purchases and sales data for Hester's first two quarters of business are shown below:

Calculate the Quarter ending inventories in dollars using the LIFO inventory valuation method.

Calculate Quarter GROSS PROFIT using the LIFO inventory valuation method.

Calculate the Quarter ending inventories in dollars using the FIFO inventory valuation method.

Calculate Quarter GROSS PROFIT using the FIFO inventory valuation method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started