Answered step by step

Verified Expert Solution

Question

1 Approved Answer

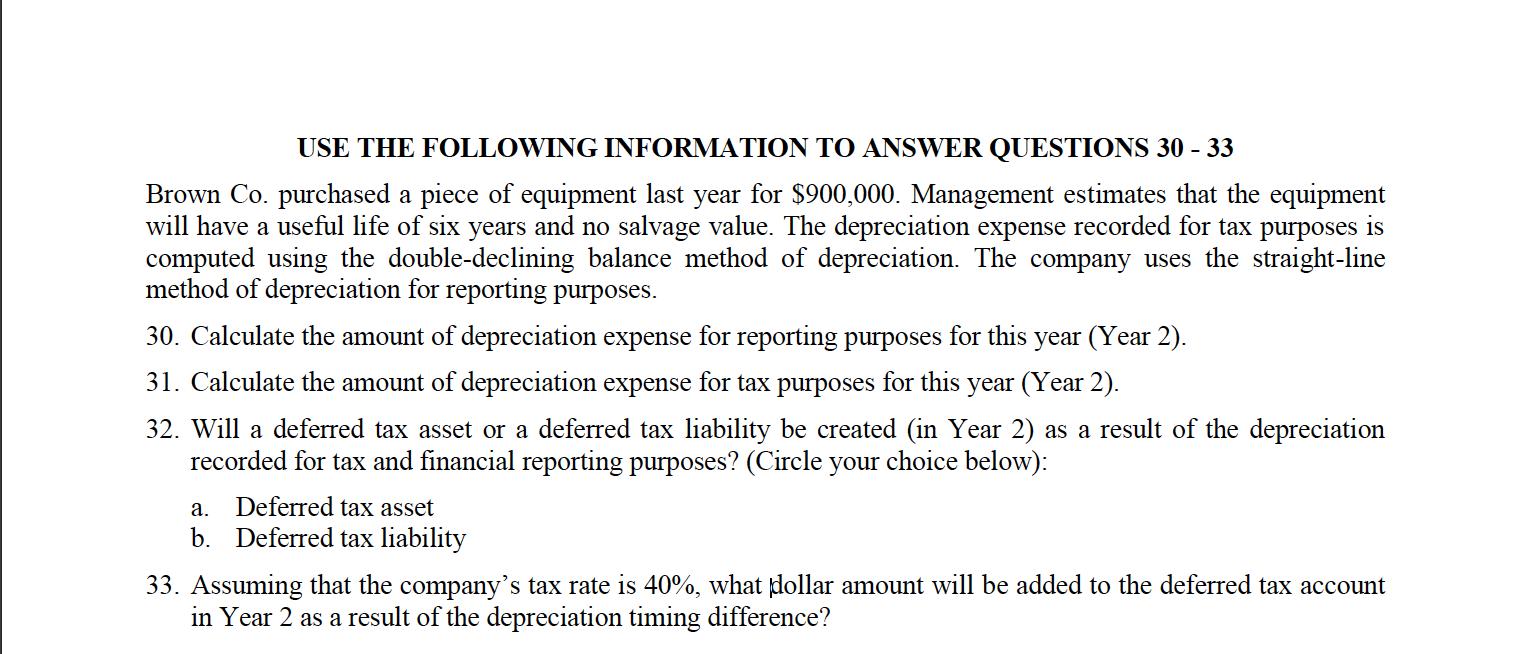

USE THE FOLLOWING INFORMATION TO ANSWER QUESTIONS 30 - 33 Brown Co. purchased a piece of equipment last year for $900,000. Management estimates that

USE THE FOLLOWING INFORMATION TO ANSWER QUESTIONS 30 - 33 Brown Co. purchased a piece of equipment last year for $900,000. Management estimates that the equipment will have a useful life of six years and no salvage value. The depreciation expense recorded for tax purposes is computed using the double-declining balance method of depreciation. The company uses the straight-line method of depreciation for reporting purposes. 30. Calculate the amount of depreciation expense for reporting purposes for this year (Year 2). 31. Calculate the amount of depreciation expense for tax purposes for this year (Year 2). 32. Will a deferred tax asset or a deferred tax liability be created (in Year 2) as a result of the depreciation recorded for tax and financial reporting purposes? (Circle your choice below): a. Deferred tax asset b. Deferred tax liability 33. Assuming that the company's tax rate is 40%, what dollar amount will be added to the deferred tax account in Year 2 as a result of the depreciation timing difference?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculating Depreciation and Deferred Tax 30 Depreciation Expense for Reporting Purposes Year 2 Stra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started