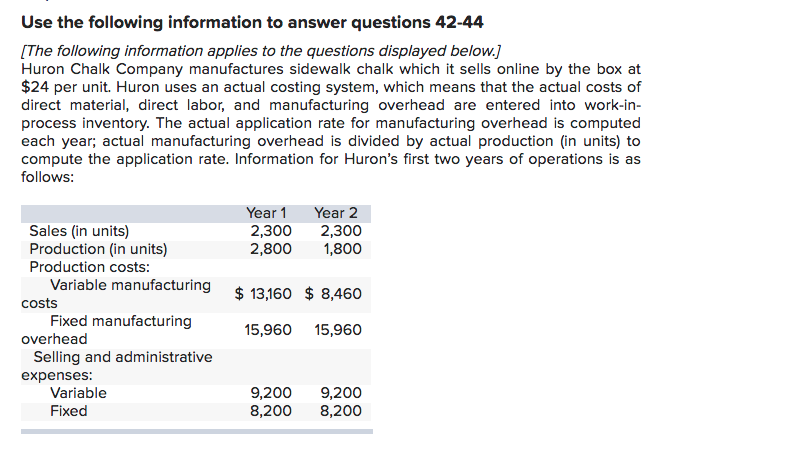

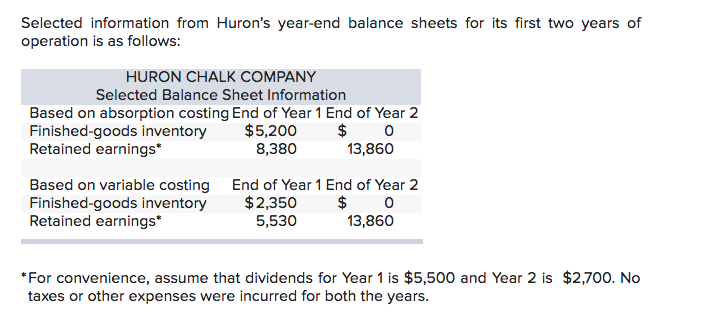

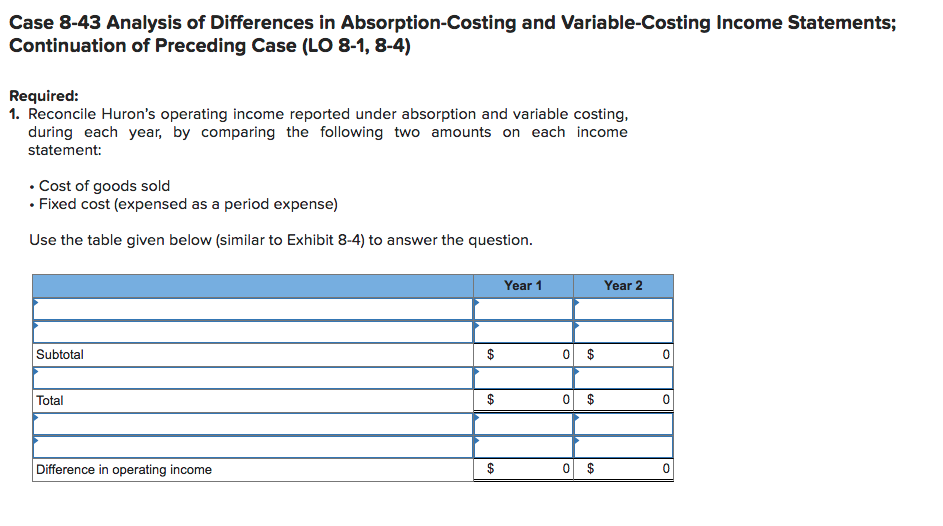

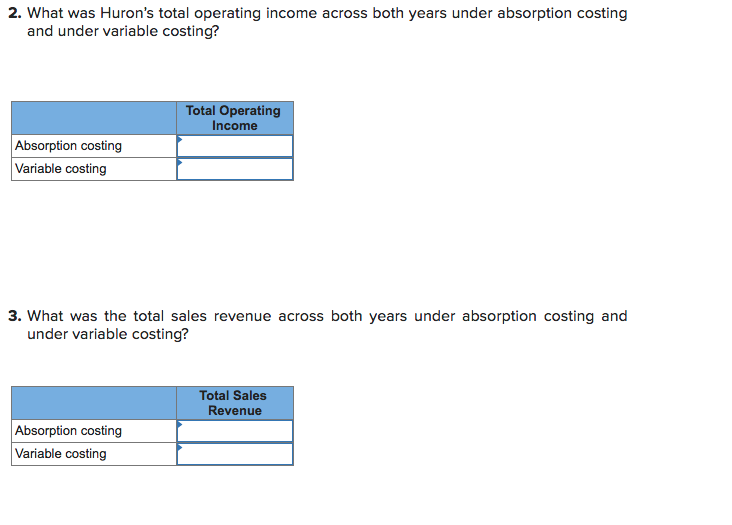

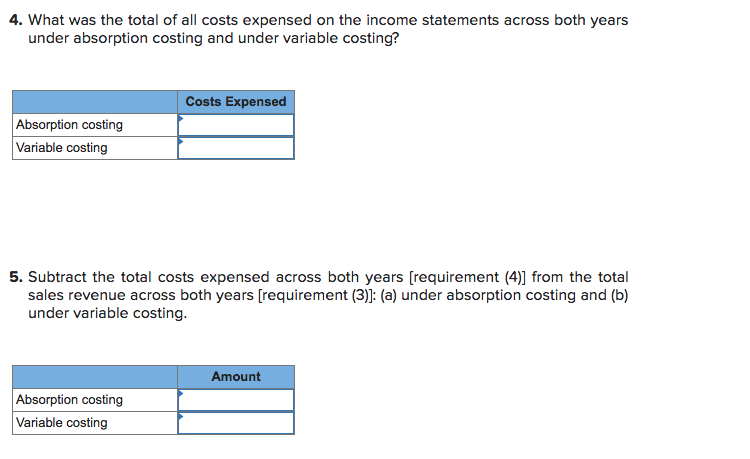

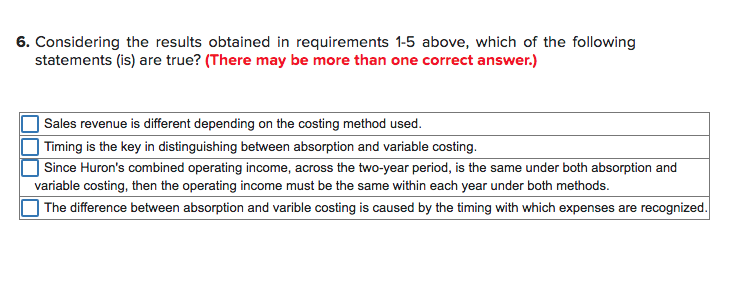

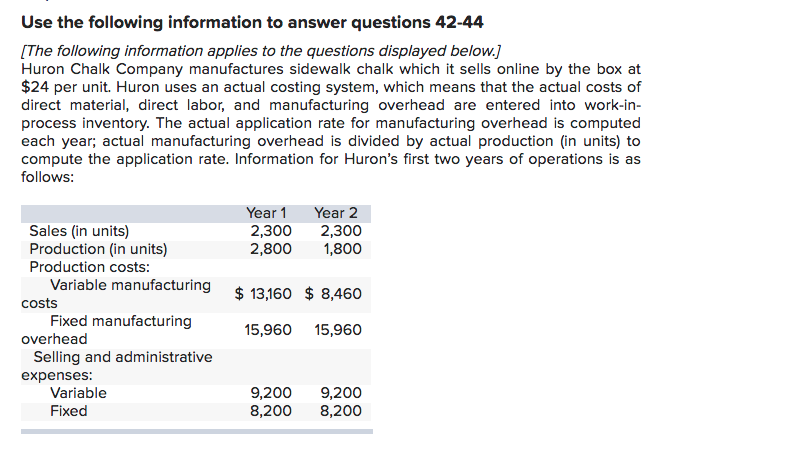

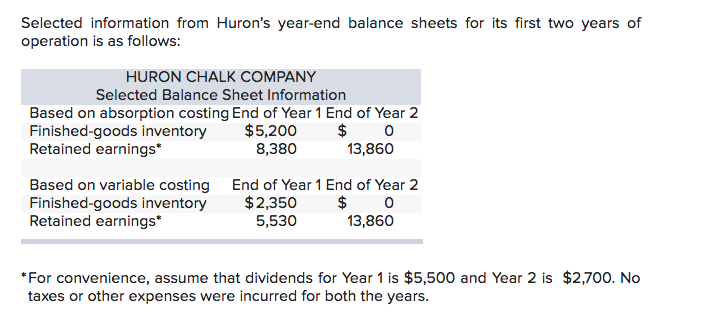

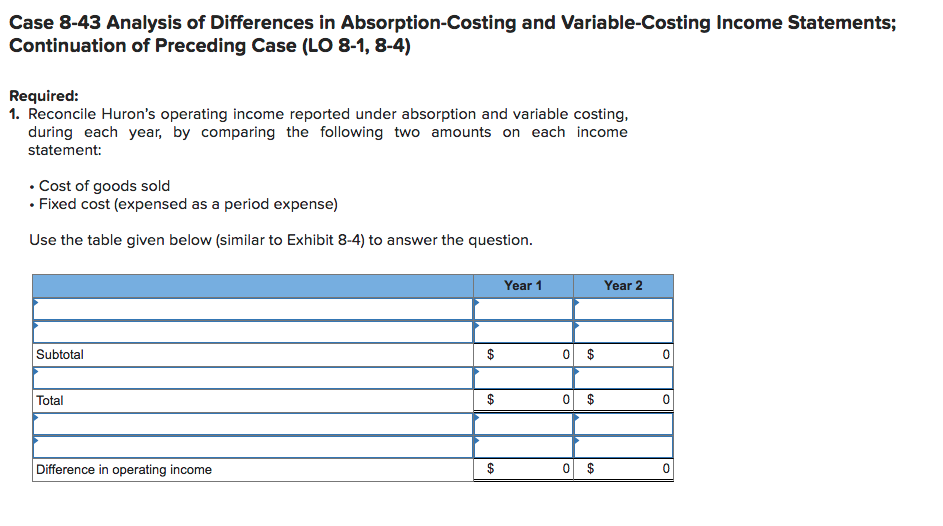

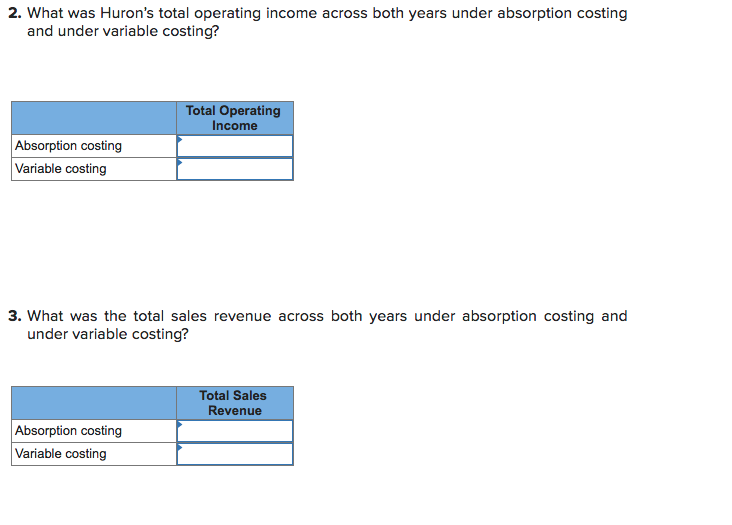

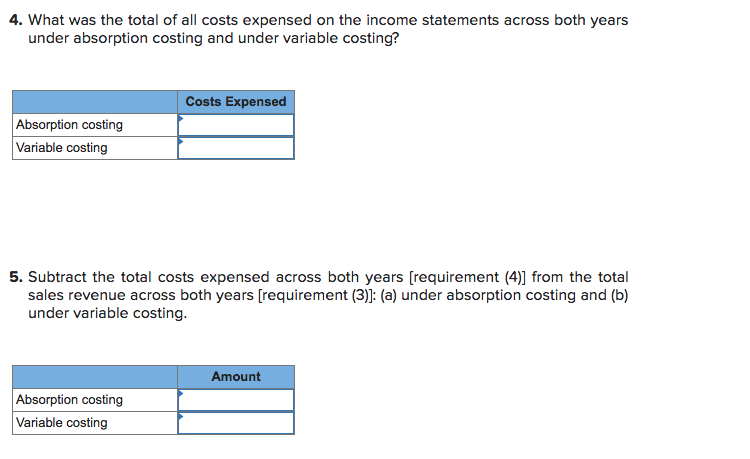

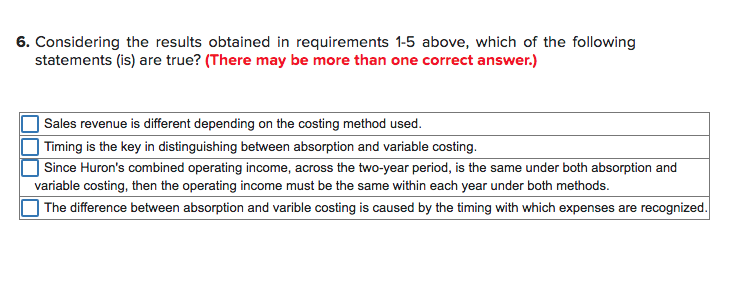

Use the following information to answer questions 42-44 [The following information applies to the questions displayed below.] Huron Chalk Company manufactures sidewalk chalk which it sells online by the box at $24 per unit. Huron uses an actual costing system, which means that the actual costs of direct material, direct labor, and manufacturing overhead are entered into work-in- process inventory. The actual application rate for manufacturing overhead is computed each year; actual manufacturing overhead is divided by actual production (in units) to compute the application rate. Information for Huron's first two years of operations is as follows: Sales (in units) Production (in units) Production costs: Year 1 Year 2 2,3002,300 2,800 1,800 Variable manufacturing $13,160 8,460 costs Fixed manufacturing 15,960 15,960 overhead Selling and administrative expenses: Variable Fixed 9,2009,200 8,200 8,200 Selected information from Huron's year-end balance sheets for its first two years of operation is as follows: HURON CHALK COMPANY Selected Balance Sheet Information Based on absorption costing End of Year 1 End of Year 2 Finished-goods inventory $5,200 0 Retained earnings* 13,860 Based on variable costing End of Year 1 End of Year 2 Finished-goods inventory $2,350 $ 0 Retained earnings* 5,530 13,860 *For convenience, assume that dividends for Year 1 is $5,500 and Year 2 is $2,700. No taxes or other expenses were incurred for both the years. Case 8-43 Analysis of Differences in Absorption-Costing and Variable-Costing Income Statements; Continuation of Preceding Case (LO 8-1, 8-4) Required: 1. Reconcile Huron's operating income reported under absorption and variable costing, during each year, by comparing the following two amounts on each income statement: Cost of goods sold . Fixed cost (expensed as a period expense) Use the table given below (similar to Exhibit 8-4) to answer the question. Year 1 Year 2 Subtotal 0 Total 0 Difference in operating income 0 2. What was Huron's total operating income across both years under absorption costing and under variable costing? Total Operating Income Absorption costing Variable costing 3. What was the total sales revenue across both years under absorption costing and under variable costing? Total Sales Revenue Absorption costing Variable costing 4. What was the total of all costs expensed on the income statements across both years under absorption costing and under variable costing? Costs Expensed Absorption costing Variable costing 5. Subtract the total costs expensed across both years [requirement (4)] from the total sales revenue across both years [requirement (3)]: (a) under absorption costing and (b) under variable costing. Amount Absorption costing Variable costing 6. Considering the results obtained in requirements 1-5 above, which of the following statements (is) are true? (There may be more than one correct answer.) Sales revenue is different depending on the costing method used. Timing is the key in distinguishing between absorption and variable costing Since Huron's combined operating income, across the two-year period, is the same under both absorption and variable costing, then the operating income must be the same within each year under both methods. The difference between absorption and varible costing is caused by the timing with which expenses are recognized