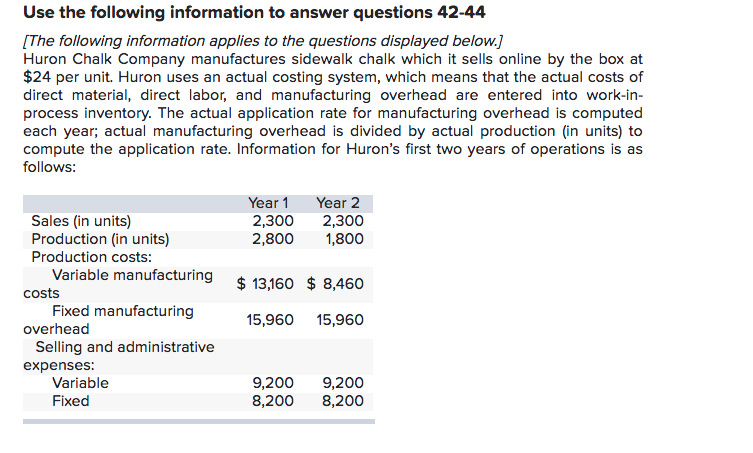

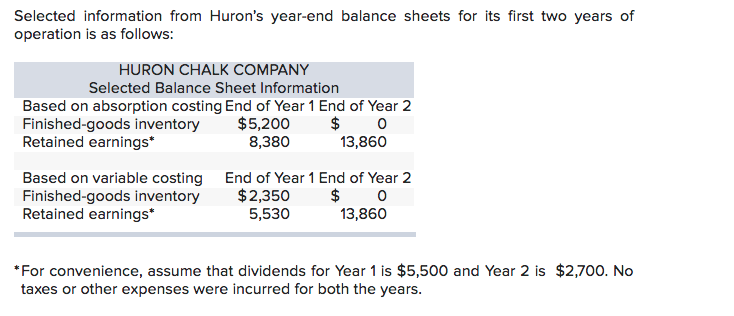

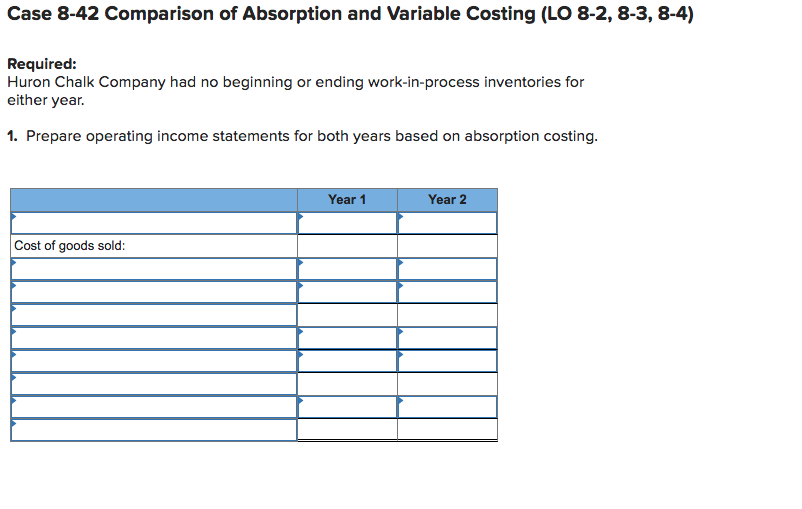

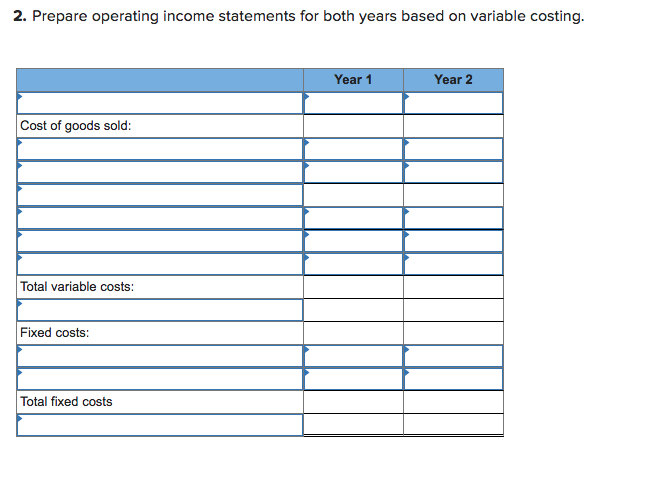

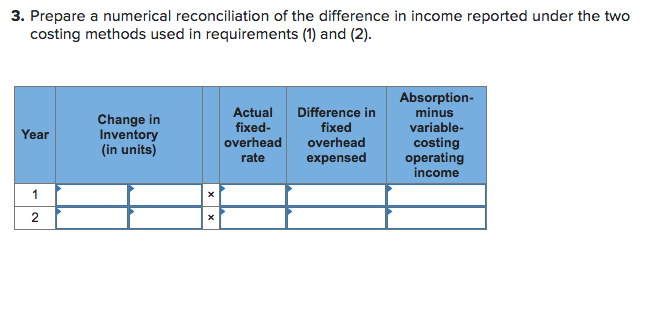

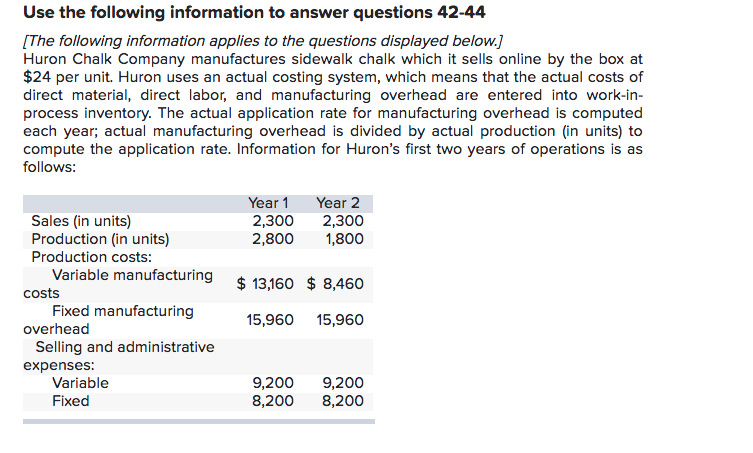

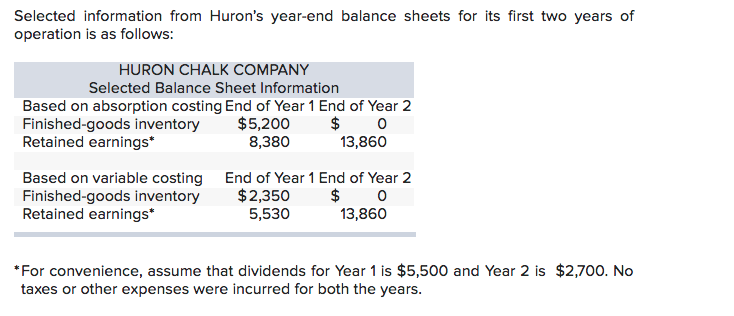

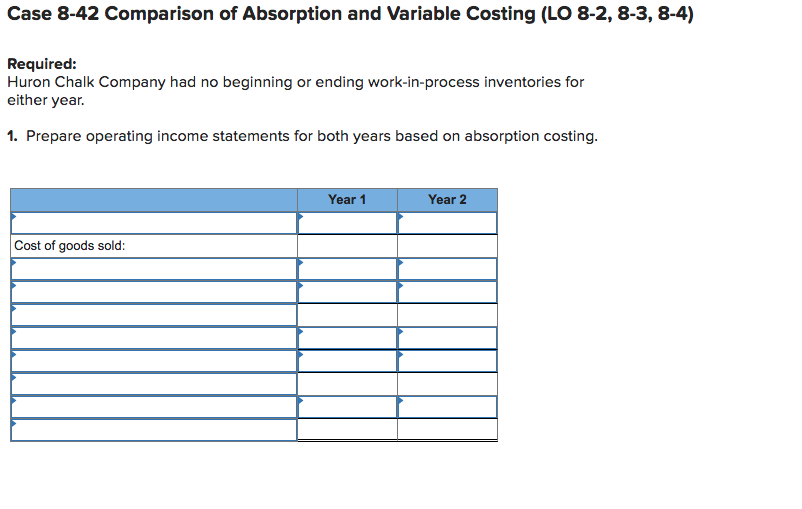

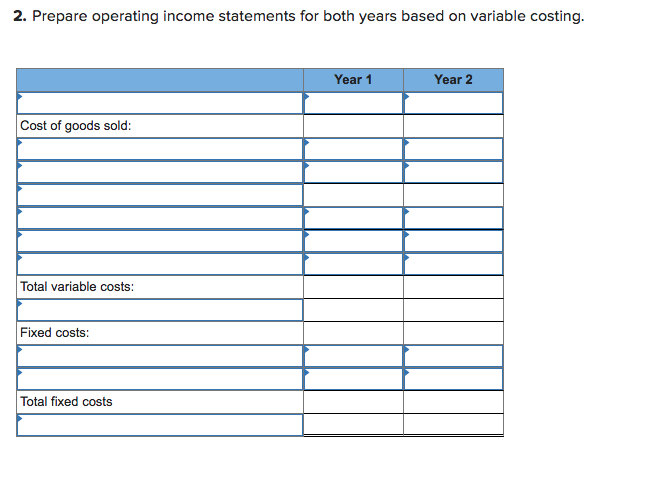

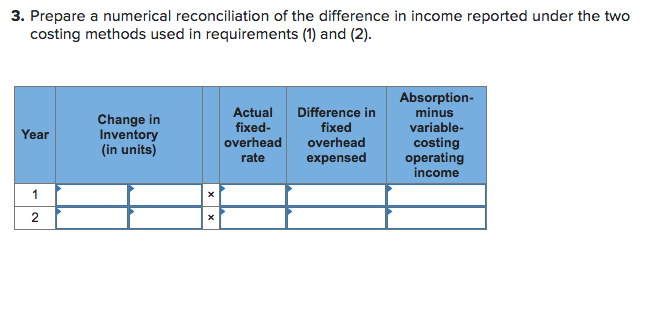

Use the following information to answer questions 42-44 [The following information applies to the questions displayed below.] Huron Chalk Company manufactures sidewalk chalk which it sells online by the box at $24 per unit. Huron uses an actual costing system, which means that the actual costs of direct material, direct labor, and manufacturing overhead are entered into work-in- process inventory. The actual application rate for manufacturing overhead is computed each year; actual manufacturing overhead is divided by actual production (in units) to compute the application rate. Information for Huron's first two years of operations is as follows: Sales (in units) Production (in units) Production costs: Year 1 Year 2 2,3002,300 2,800 1,800 Variable manufacturing $ 13,160 $8,460 costs Fixed manufacturing 15,960 15,960 overhead Selling and administrative expenses: Variable Fixed 9,2009,200 8,200 8,200 Selected information from Huron's year-end balance sheets for its first two years of operation is as follows: HURON CHALK COMPANY Selected Balance Sheet Information Based on absorption costing End of Year 1 End of Year 2 Finished-goods inventory $5,200 $ O Retained earnings* 8,380 13,860 Based on variable costing End of Year 1 End of Year 2 Finished-goods inventory $2,350 0 Retained earnings* 5,530 13,860 *For convenience, assume that dividends for Year 1 is $5,500 and Year 2 is $2,700. No taxes or other expenses were incurred for both the years. Case 8-42 Comparison of Absorption and Variable Costing (LO 8-2, 8-3, 8-4) Required: Huron Chalk Company had no beginning or ending work-in-process inventories for either year. 1. Prepare operating income statements for both years based on absorption costing. Year 1 Year 2 Cost of goods sold: 2. Prepare operating income statements for both years based on variable costing. Year 1 Year 2 Cost of goods sold: Total variable costs: Fixed costs: Total fixed costs 3. Prepare a numerical reconciliation of the difference in income reported under the two costing methods used in requirements (1) and (2). Absorption- Actual Difference in minus Change in Inventory (in units) fixed- fixed variable- costing operating income Year overhead overhead rate expensed 2