Answered step by step

Verified Expert Solution

Question

1 Approved Answer

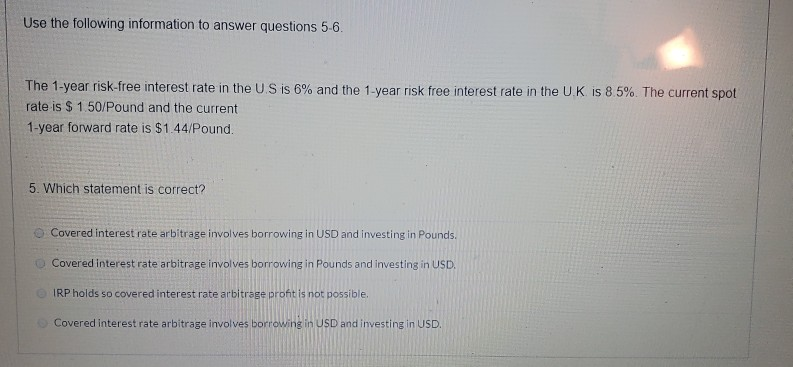

Use the following information to answer questions 5-6. The 1-year risk-free interest rate in the US is 6% and the 1-year risk free interest rate

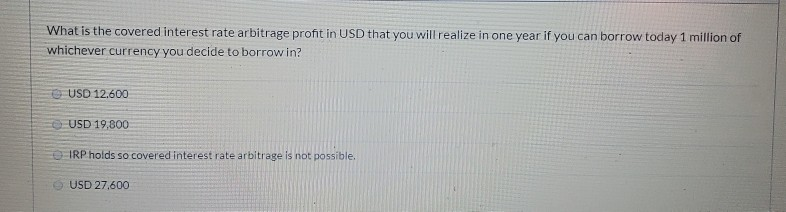

Use the following information to answer questions 5-6. The 1-year risk-free interest rate in the US is 6% and the 1-year risk free interest rate in the UK is 8.5%. The current spot rate is $ 150/Pound and the current 1-year forward rate is $1.44/Pound. 5. Which statement is correct? Covered interest rate arbitrage involves borrowing in USD and investing in Pounds. Covered interest rate arbitrage involves borrowing in Pounds and investing in USD. IRP holds so covered interest rate arbitrage profit is not possible Covered interest rate arbitrage involves borrowing in USD and investing in USD. What is the covered interest rate arbitrage pront in USD that you will realize in one year if you can borrow today 1 million of whichever currency you decide to borrowin? USD 12.600 USD 19,800 IRP holds so covered interest rate arbitrage is not possible. USD 27,600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started