Answered step by step

Verified Expert Solution

Question

1 Approved Answer

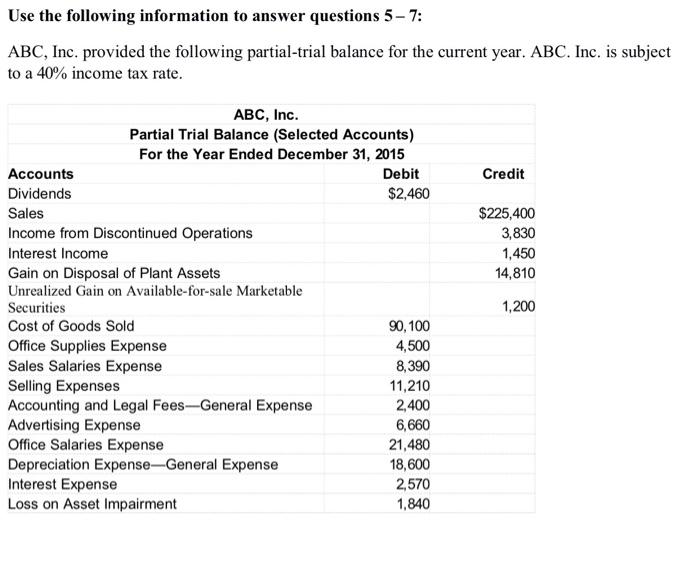

Use the following information to answer questions 5-7: ABC, Inc. provided the following partial-trial balance for the current year. ABC. Inc. is subject to

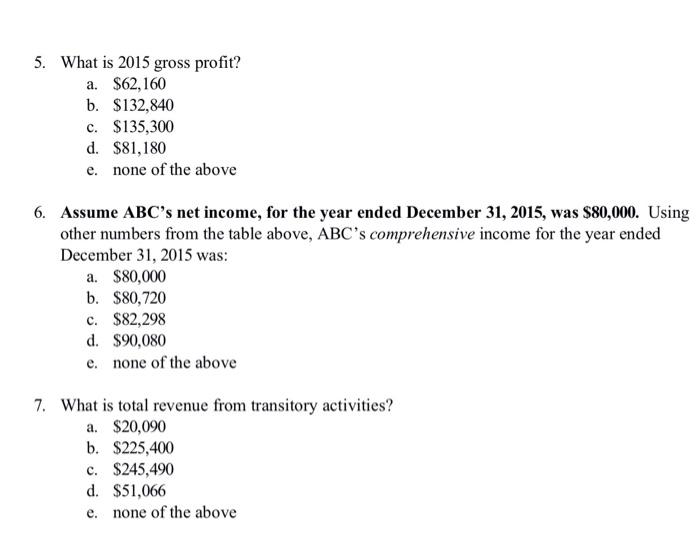

Use the following information to answer questions 5-7: ABC, Inc. provided the following partial-trial balance for the current year. ABC. Inc. is subject to a 40% income tax rate. ABC, Inc. Partial Trial Balance (Selected Accounts) For the Year Ended December 31, 2015 Accounts Debit Credit Dividends Sales $225,400 3,830 Income from Discontinued Operations Interest Income 1,450 Gain on Disposal of Plant Assets 14,810 Unrealized Gain on Available-for-sale Marketable Securities 1,200 Cost of Goods Sold Office Supplies Expense Sales Salaries Expense Selling Expenses Accounting and Legal Fees-General Expense Advertising Expense Office Salaries Expense Depreciation Expense-General Expense Interest Expense Loss on Asset Impairment $2,460 90,100 4,500 8,390 11,210 2,400 6,660 21,480 18,600 2,570 1,840 5. What is 2015 gross profit? a. $62,160 b. $132,840 c. $135,300 d. $81,180 e. none of the above 6. Assume ABC's net income, for the year ended December 31, 2015, was $80,000. Using other numbers from the table above, ABC's comprehensive income for the year ended December 31, 2015 was: a. $80,000 b. $80,720 c. $82,298 d. $90,080 e. none of the above 7. What is total revenue from transitory activities? a. $20,090 b. $225,400 c. $245,490 d. $51,066 e. none of the above

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

5 Sales 225400 Less Cost of Goods sold 90100 Gross Profit 135300 6 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started