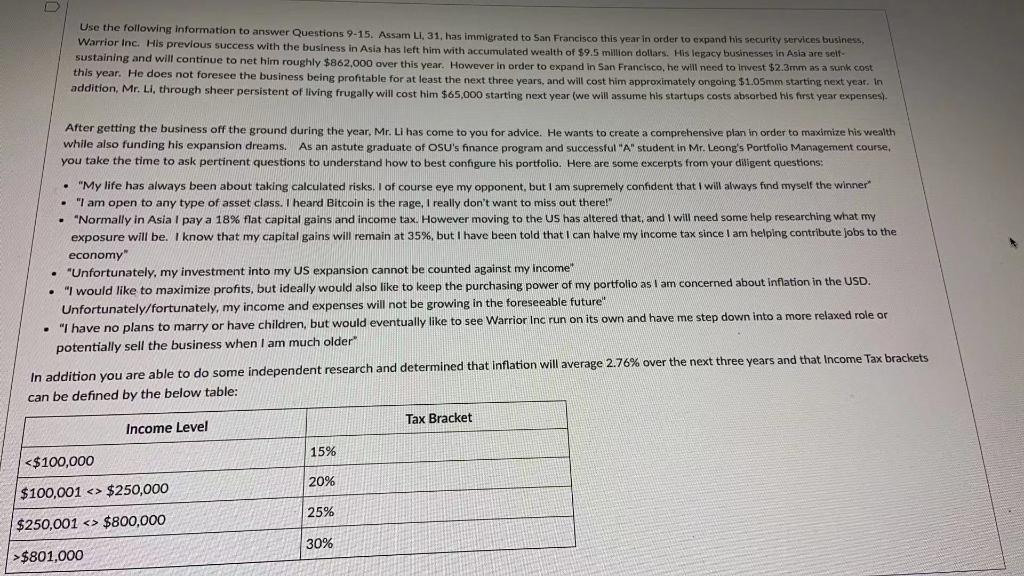

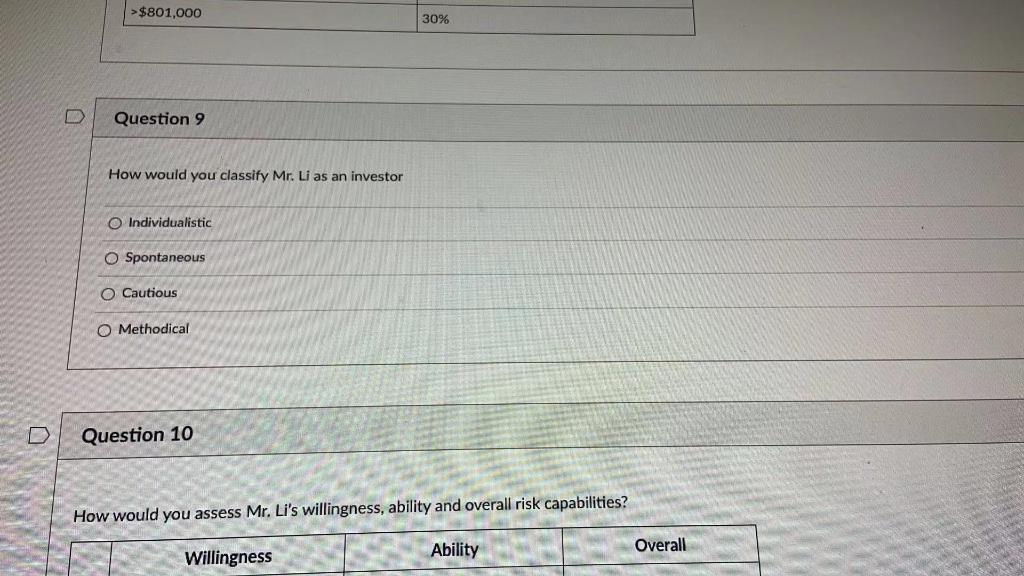

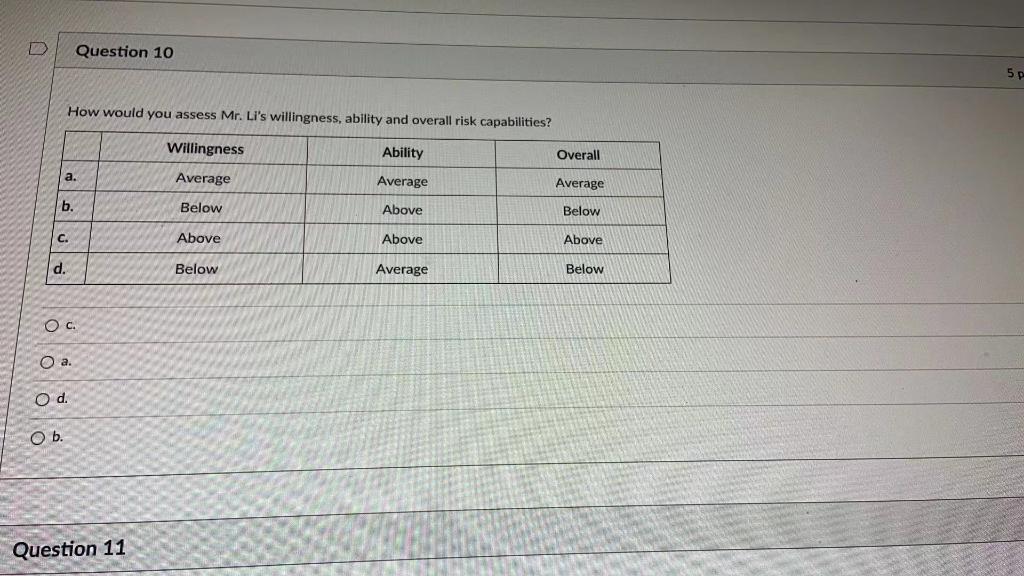

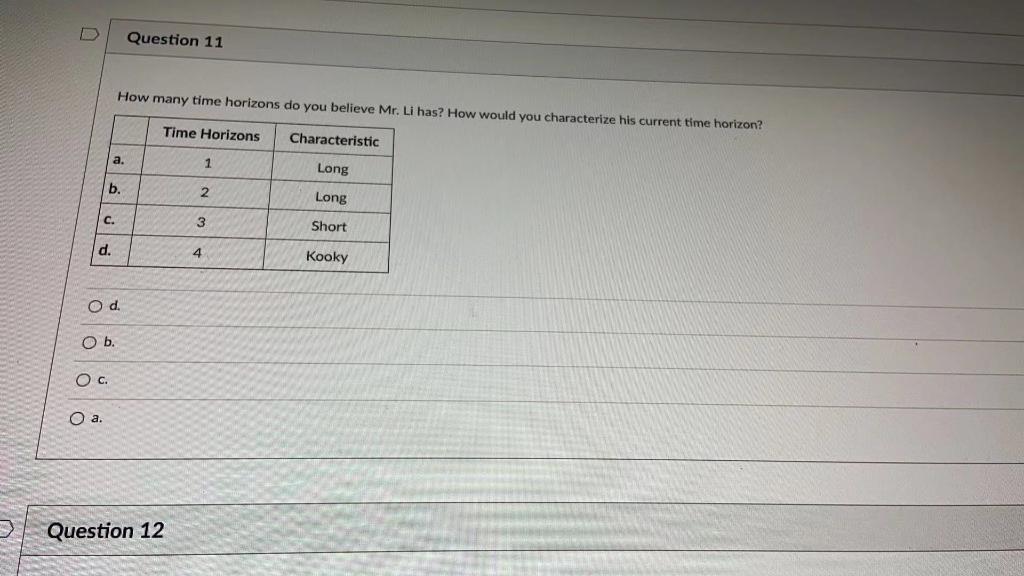

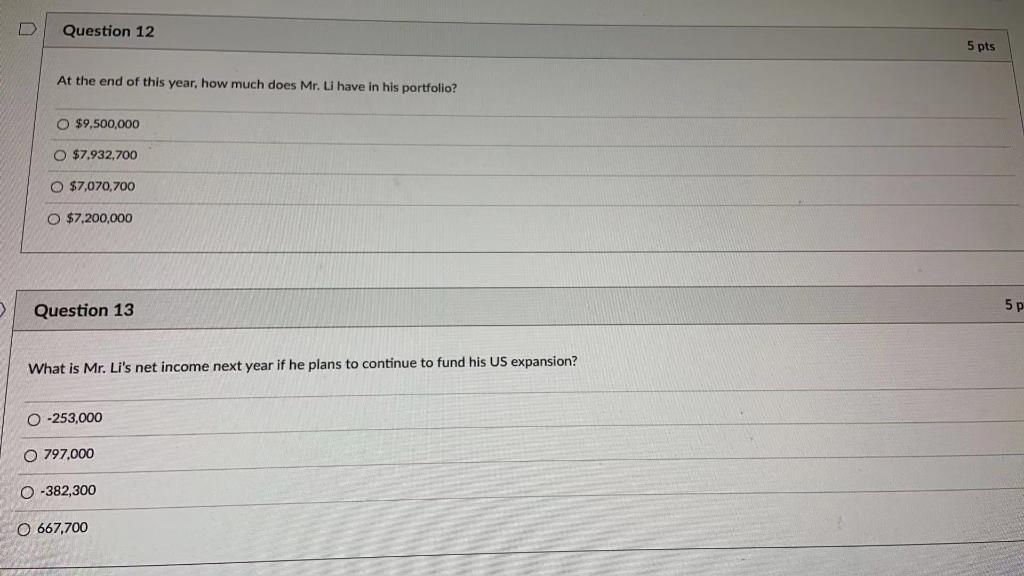

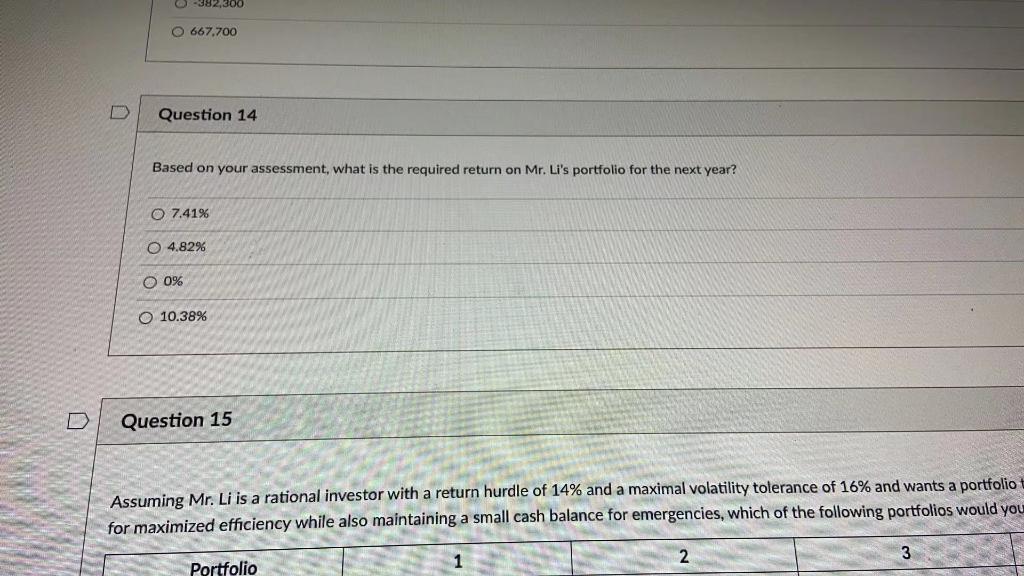

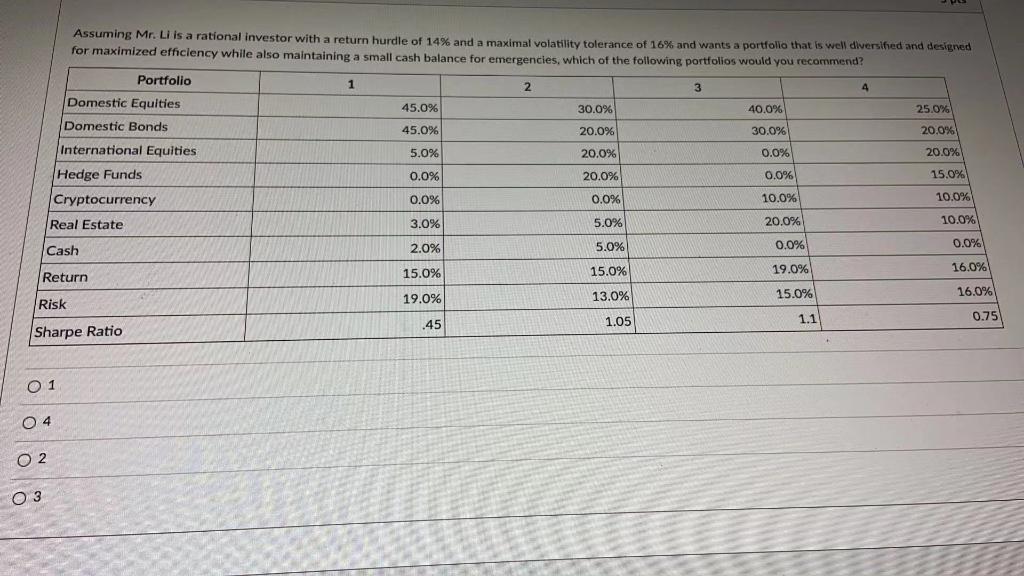

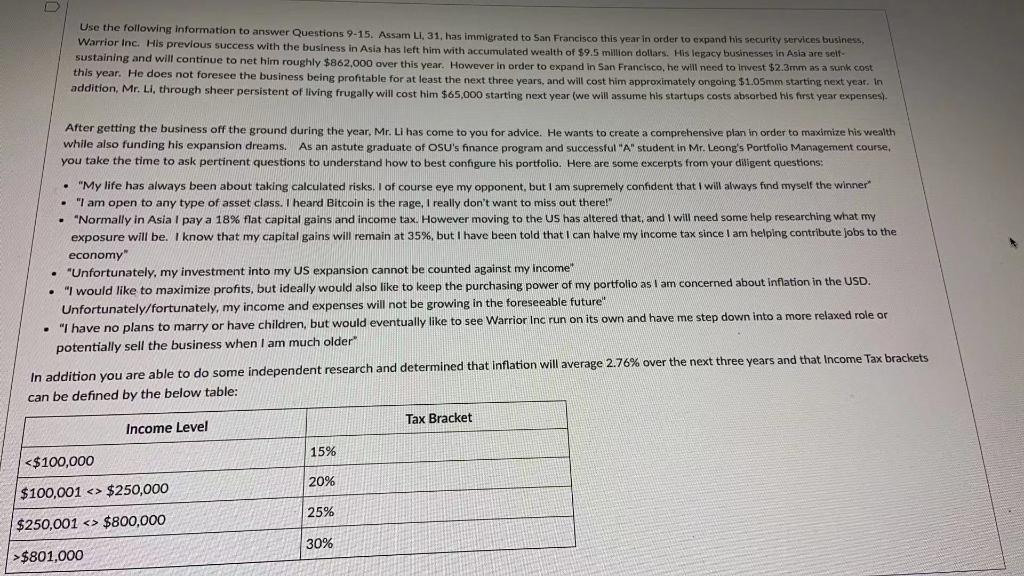

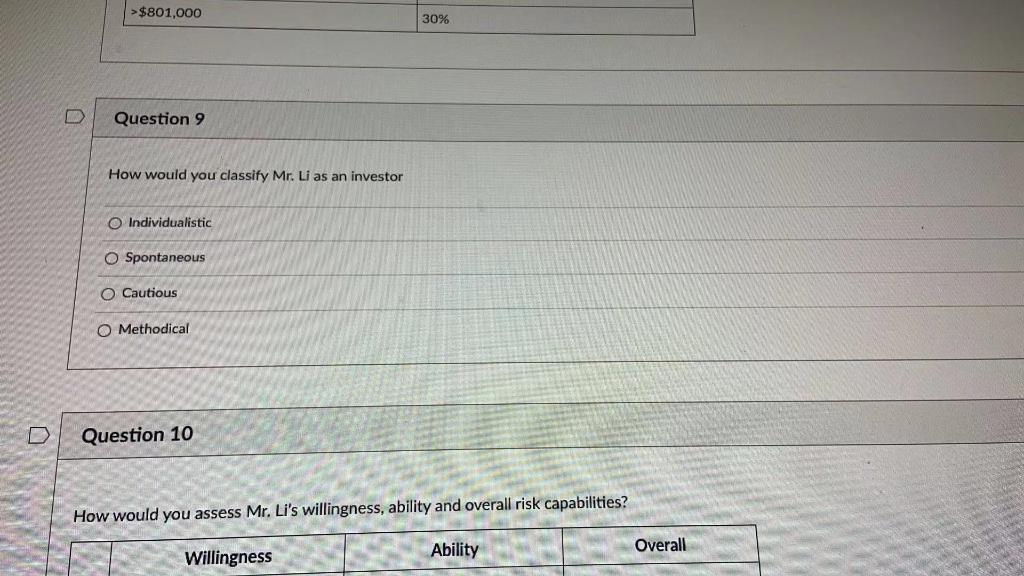

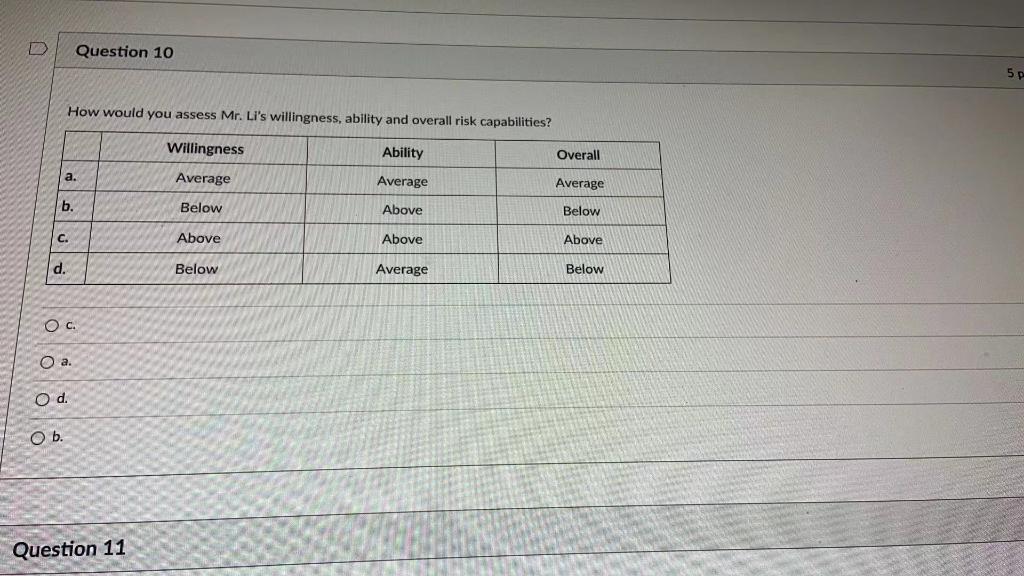

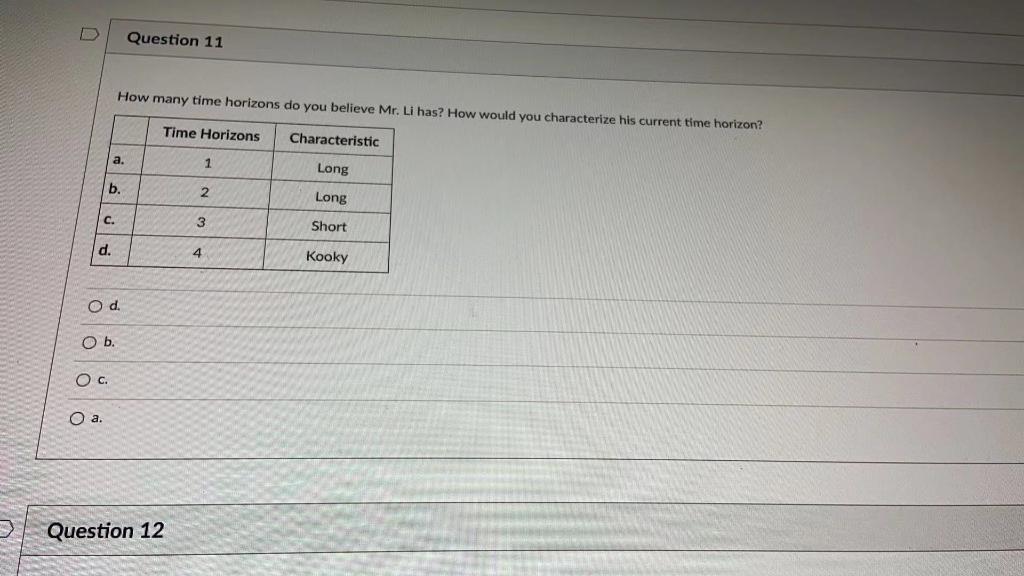

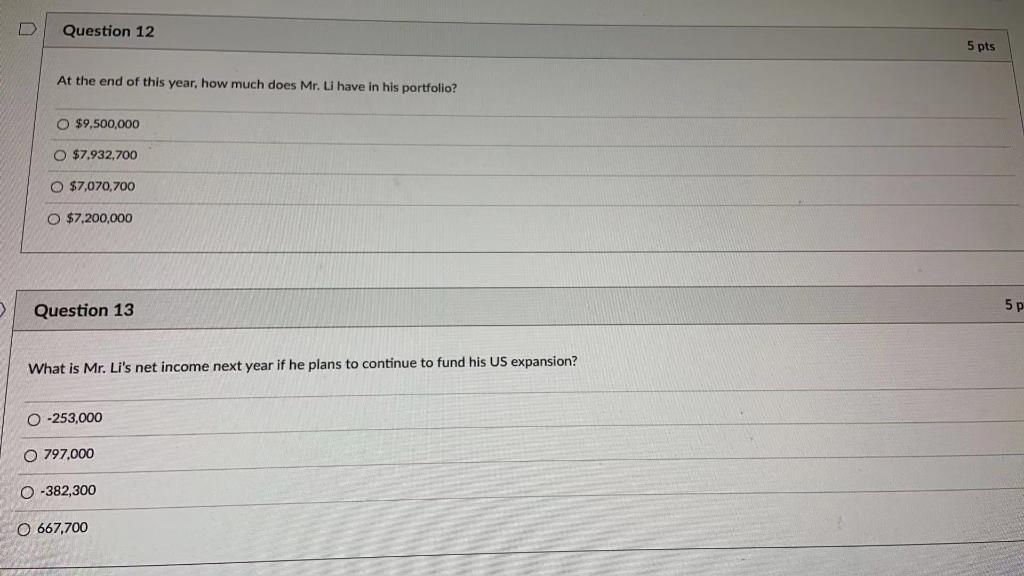

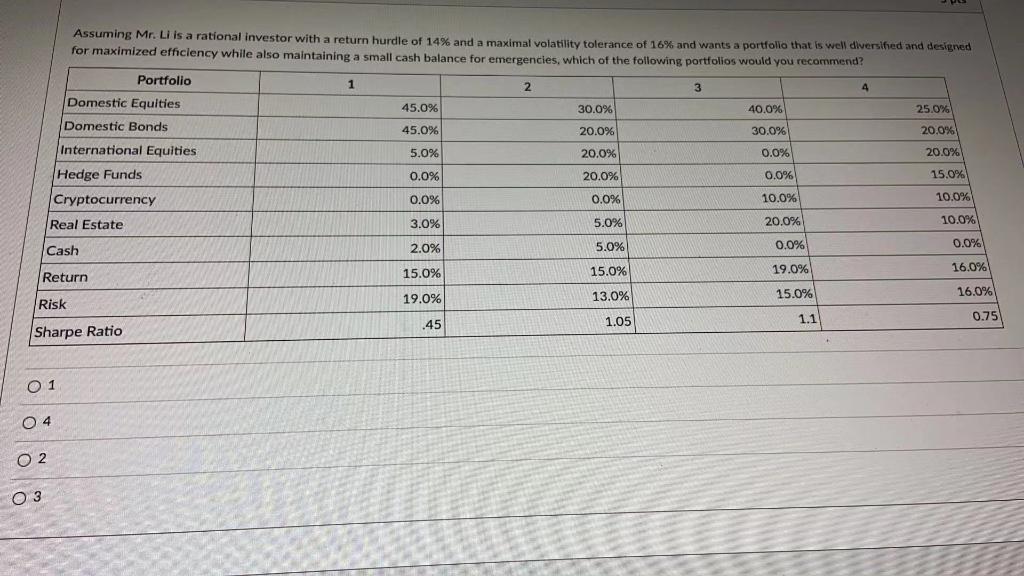

Use the following information to answer Questions 9-15. Assam I, 31. has immigrated to San Francisco this year in order to expand his security services business, Warrior Inc. His previous success with the business in Asia has left him with accumulated wealth of $9.5 million dollars. His legacy businesses in Asia are self- sustaining and will continue to net him roughly $862,000 over this year. However in order to expand in San Francisco, he will need to invest $2.3 as a sunk cost this year. He does not foresee the business being profitable for at least the next three years, and will cost him approximately ongoing $1.05mm starting next year. In addition, Mr. Li, through sheer persistent of living frugally will cost him $65,000 starting next year (we will assume his startups costs absorbed his first year expenses) After getting the business off the ground during the year, Mr. Li has come to you for advice. He wants to create a comprehensive plan in order to maximize his wealth while also funding his expansion dreams. As an astute graduate of OSU's finance program and successful "A" student in Mr. Leong's Portfolio Management course, you take the time to ask pertinent questions to understand how to best configure his portfolio. Here are some excerpts from your diligent questions: "My life has always been about taking calculated risks. I of course eye my opponent, but I am supremely confident that I will always find myself the winner . "I am open to any type of asset class. I heard Bitcoin is the rage, I really don't want to miss out there! . "Normally in Asia I pay a 18% flat capital gains and income tax. However moving to the US has altered that, and I will need some help researching what my exposure will be. I know that my capital gains will remain at 35%, but I have been told that I can halve my income tax since I am helping contribute jobs to the economy "Unfortunately, my investment into my US expansion cannot be counted against my income . "I would like to maximize profits, but ideally would also like to keep the purchasing power of my portfolio as I am concerned about inflation in the USD. Unfortunately/fortunately, my income and expenses will not be growing in the foreseeable future . "I have no plans to marry or have children, but would eventually like to see Warrior Inc run on its own and have me step down into a more relaxed role or potentially sell the business when I am much older" In addition you are able to do some independent research and determined that Inflation will average 2.76% over the next three years and that Income Tax brackets can be defined by the below table: Tax Bracket Income Level 15% $250,000 25% $250,001 $800,000 30% >$801,000 >$801,000 30% Question 9 How would you classify Mr. Li as an investor O Individualistic O Spontaneous O Cautious O Methodical Question 10 How would you assess Mr. Li's willingness, ability and overall risk capabilities? Willingness Ability Overall D Question 10 5D How would you assess Mr. Li's willingness, ability and overall risk capabilities? Willingness Ability Overall a. Average Average Average b. Below Above Below C Above Above Above d. Below Average Below O c. O a. O d. O b. Question 11 Question 11 How many time horizons do you believe Mr. Li has? How would you characterize his current time horizon? Time Horizons Characteristic a. 1 Long b. 2 Long C. 3 Short d. 4 Kooky O d. O b. O c. O a. Question 12 U Question 12 5 pts At the end of this year, how much does Mr. Li have in his portfolio? O $9,500,000 O $7,932,700 O $7,070,700 O $7.200,000 Question 13 5 p What is Mr. Li's net income next year if he plans to continue to fund his US expansion? 0-253,000 O 797.000 0 -382,300 0 667,700 382,300 O 667,700 Question 14 Based on your assessment, what is the required return on Mr. Li's portfolio for the next year? 0 7.41% 0 4.8296 0 0% O 10.38% Question 15 Assuming Mr. Li is a rational investor with a return hurdle of 14% and a maximal volatility tolerance of 16% and wants a portfolio for maximized efficiency while also maintaining a small cash balance for emergencies, which of the following portfolios would you 2 3 Portfolio Assuming Mr. Li is a rational investor with a return hurdle of 14% and a maximal volatility tolerance of 16% and wants a portfolio that is well diversified and desigrved for maximized efficiency while also maintaining a small cash balance for emergencies, which of the following portfolios would you recommend? Portfolio 1 2 3 4 Domestic Equities 45.0% 30.0% 40.0% 25.0% Domestic Bonds 45.0% 20.0% 30.0% 20.0% International Equities 5.0% 20.0% 0.0% 20.0% Hedge Funds 0.0% 20.0% 0.0% 15.0% Cryptocurrency 0.0% 0.0% 10.0% 10.0% Real Estate 3.0% 5.0% 20.0% 10.0% Cash 2.0% 5.0% 0.0% 0.0% 15.0% Return 15.0% 19.0% 16.0% 13.0% 19.0% 15.0% 16.0% Risk .45 1.05 1.1 0.75 Sharpe Ratio O 1 04 O2 O 3 Use the following information to answer Questions 9-15. Assam I, 31. has immigrated to San Francisco this year in order to expand his security services business, Warrior Inc. His previous success with the business in Asia has left him with accumulated wealth of $9.5 million dollars. His legacy businesses in Asia are self- sustaining and will continue to net him roughly $862,000 over this year. However in order to expand in San Francisco, he will need to invest $2.3 as a sunk cost this year. He does not foresee the business being profitable for at least the next three years, and will cost him approximately ongoing $1.05mm starting next year. In addition, Mr. Li, through sheer persistent of living frugally will cost him $65,000 starting next year (we will assume his startups costs absorbed his first year expenses) After getting the business off the ground during the year, Mr. Li has come to you for advice. He wants to create a comprehensive plan in order to maximize his wealth while also funding his expansion dreams. As an astute graduate of OSU's finance program and successful "A" student in Mr. Leong's Portfolio Management course, you take the time to ask pertinent questions to understand how to best configure his portfolio. Here are some excerpts from your diligent questions: "My life has always been about taking calculated risks. I of course eye my opponent, but I am supremely confident that I will always find myself the winner . "I am open to any type of asset class. I heard Bitcoin is the rage, I really don't want to miss out there! . "Normally in Asia I pay a 18% flat capital gains and income tax. However moving to the US has altered that, and I will need some help researching what my exposure will be. I know that my capital gains will remain at 35%, but I have been told that I can halve my income tax since I am helping contribute jobs to the economy "Unfortunately, my investment into my US expansion cannot be counted against my income . "I would like to maximize profits, but ideally would also like to keep the purchasing power of my portfolio as I am concerned about inflation in the USD. Unfortunately/fortunately, my income and expenses will not be growing in the foreseeable future . "I have no plans to marry or have children, but would eventually like to see Warrior Inc run on its own and have me step down into a more relaxed role or potentially sell the business when I am much older" In addition you are able to do some independent research and determined that Inflation will average 2.76% over the next three years and that Income Tax brackets can be defined by the below table: Tax Bracket Income Level 15% $250,000 25% $250,001 $800,000 30% >$801,000 >$801,000 30% Question 9 How would you classify Mr. Li as an investor O Individualistic O Spontaneous O Cautious O Methodical Question 10 How would you assess Mr. Li's willingness, ability and overall risk capabilities? Willingness Ability Overall D Question 10 5D How would you assess Mr. Li's willingness, ability and overall risk capabilities? Willingness Ability Overall a. Average Average Average b. Below Above Below C Above Above Above d. Below Average Below O c. O a. O d. O b. Question 11 Question 11 How many time horizons do you believe Mr. Li has? How would you characterize his current time horizon? Time Horizons Characteristic a. 1 Long b. 2 Long C. 3 Short d. 4 Kooky O d. O b. O c. O a. Question 12 U Question 12 5 pts At the end of this year, how much does Mr. Li have in his portfolio? O $9,500,000 O $7,932,700 O $7,070,700 O $7.200,000 Question 13 5 p What is Mr. Li's net income next year if he plans to continue to fund his US expansion? 0-253,000 O 797.000 0 -382,300 0 667,700 382,300 O 667,700 Question 14 Based on your assessment, what is the required return on Mr. Li's portfolio for the next year? 0 7.41% 0 4.8296 0 0% O 10.38% Question 15 Assuming Mr. Li is a rational investor with a return hurdle of 14% and a maximal volatility tolerance of 16% and wants a portfolio for maximized efficiency while also maintaining a small cash balance for emergencies, which of the following portfolios would you 2 3 Portfolio Assuming Mr. Li is a rational investor with a return hurdle of 14% and a maximal volatility tolerance of 16% and wants a portfolio that is well diversified and desigrved for maximized efficiency while also maintaining a small cash balance for emergencies, which of the following portfolios would you recommend? Portfolio 1 2 3 4 Domestic Equities 45.0% 30.0% 40.0% 25.0% Domestic Bonds 45.0% 20.0% 30.0% 20.0% International Equities 5.0% 20.0% 0.0% 20.0% Hedge Funds 0.0% 20.0% 0.0% 15.0% Cryptocurrency 0.0% 0.0% 10.0% 10.0% Real Estate 3.0% 5.0% 20.0% 10.0% Cash 2.0% 5.0% 0.0% 0.0% 15.0% Return 15.0% 19.0% 16.0% 13.0% 19.0% 15.0% 16.0% Risk .45 1.05 1.1 0.75 Sharpe Ratio O 1 04 O2 O 3