Answered step by step

Verified Expert Solution

Question

1 Approved Answer

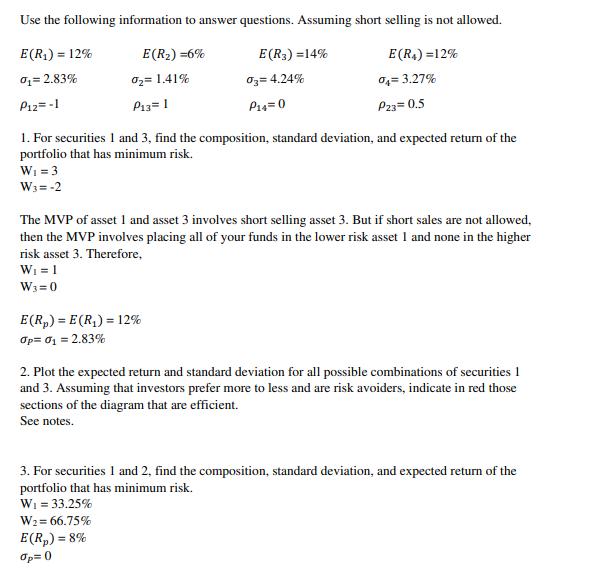

Use the following information to answer questions. Assuming short selling is not allowed. E(R) =6% E (R4) =12% E(R) = 12% 0= 2.83% P12=-1

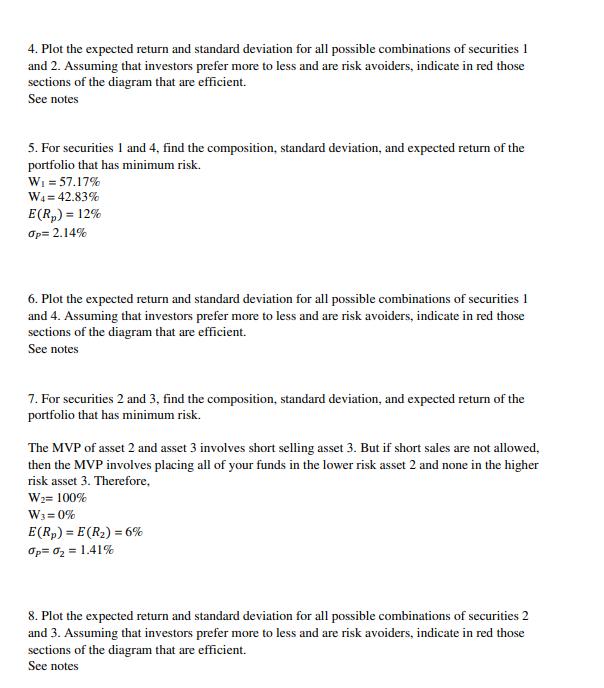

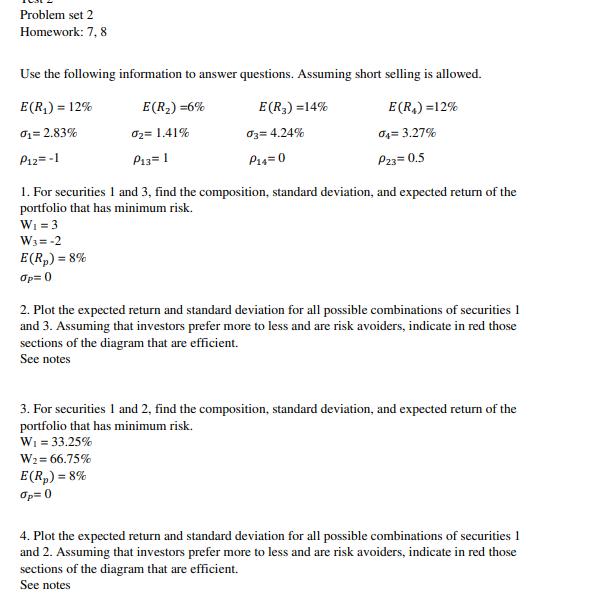

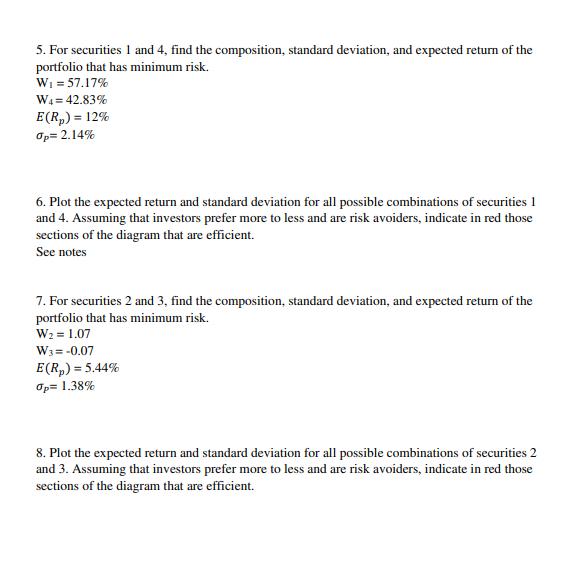

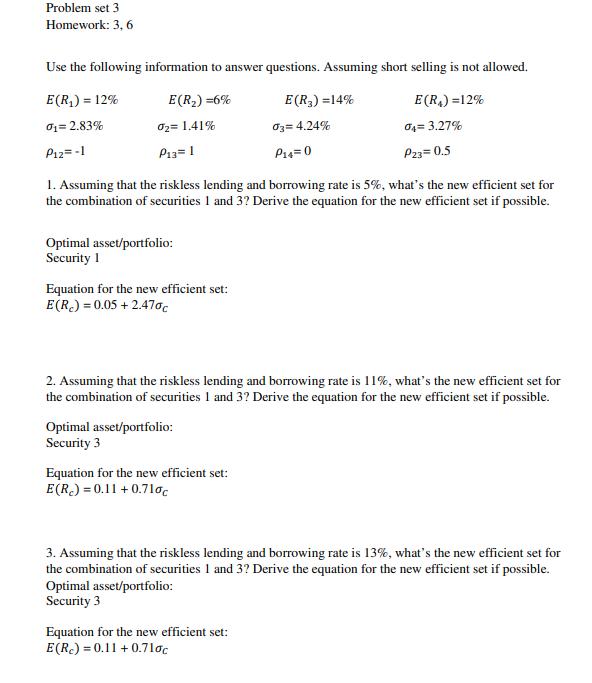

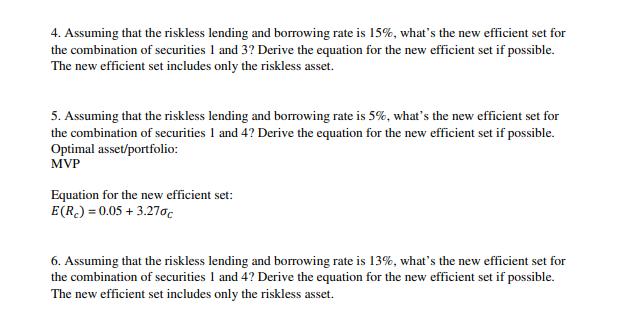

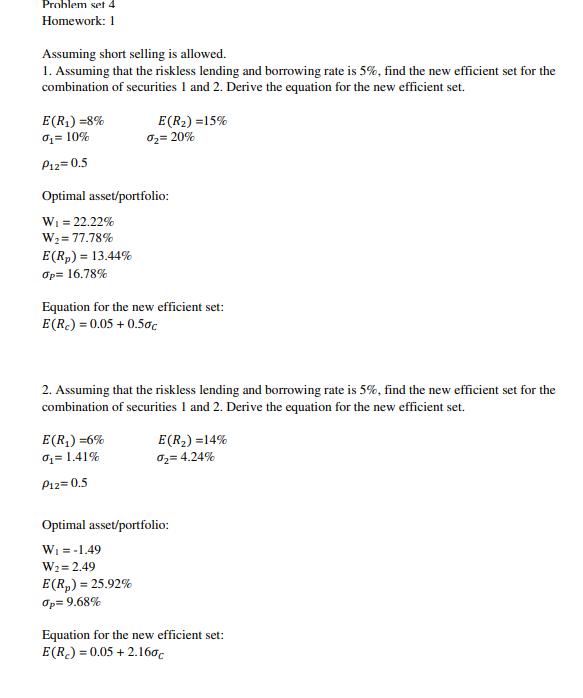

Use the following information to answer questions. Assuming short selling is not allowed. E(R) =6% E (R4) =12% E(R) = 12% 0= 2.83% P12=-1 0= 1.41% P13= 1 E (R) = 14% 03= 4.24% P14=0 E(R) =E(R) = 12% Op=0 = 2.83% 04= 3.27% P23= 0.5 1. For securities 1 and 3, find the composition, standard deviation, and expected return of the portfolio that has minimum risk. W = 3 W3 = -2 The MVP of asset 1 and asset 3 involves short selling asset 3. But if short sales are not allowed, then the MVP involves placing all of your funds in the lower risk asset 1 and none in the higher risk asset 3. Therefore, W = 1 W=0 2. Plot the expected return and standard deviation for all possible combinations of securities 1 and 3. Assuming that investors prefer more to less and are risk avoiders, indicate in red those sections of the diagram that are efficient. See notes. 3. For securities 1 and 2, find the composition, standard deviation, and expected return of the portfolio that has minimum risk. W = 33.25% W=66.75% E(R) =8% Op=() 4. Plot the expected return and standard deviation for all possible combinations of securities 1 and 2. Assuming that investors prefer more to less and are risk avoiders, indicate in red those sections of the diagram that are efficient. See notes 5. For securities 1 and 4, find the composition, standard deviation, and expected return of the portfolio that has minimum risk. W = 57.17% W4=42.83% E(R) = 12% Op= 2.14% 6. Plot the expected return and standard deviation for all possible combinations of securities 1 and 4. Assuming that investors prefer more to less and are risk avoiders, indicate in red those sections of the diagram that are efficient. See notes 7. For securities 2 and 3, find the composition, standard deviation, and expected return of the portfolio that has minimum risk. The MVP of asset 2 and asset 3 involves short selling asset 3. But if short sales are not allowed. then the MVP involves placing all of your funds in the lower risk asset 2 and none in the higher risk asset 3. Therefore, W= 100% W3 =0% E(Rp)= E(R) = 6% Op=0= 1.41% 8. Plot the expected return and standard deviation for all possible combinations of securities 2 and 3. Assuming that investors prefer more to less and are risk avoiders, indicate in red those sections of the diagram that are efficient. See notes Problem set 2 Homework: 7, 8 Use the following information to answer questions. Assuming short selling is allowed. E(R) = 12% E(R) =6% 01= 2.83% P12 = -1 0= 1.41% P13= 1 E(R) =14% 03= 4.24% P14 = 0 W=66.75% E(Rp) = 8% Op=0) E(R) =12% 04= 3.27% P23=0.5 1. For securities 1 and 3, find the composition, standard deviation, and expected return of the portfolio that has minimum risk. W = 3 W3 = -2 E (R) =8% Op=0) 2. Plot the expected return and standard deviation for all possible combinations of securities 1 and 3. Assuming that investors prefer more to less and are risk avoiders, indicate in red those sections of the diagram that are efficient. See notes 3. For securities 1 and 2, find the composition, standard deviation, and expected return of the portfolio that has minimum risk. W = 33.25% 4. Plot the expected return and standard deviation for all possible combinations of securities 1 and 2. Assuming that investors prefer more to less and are risk avoiders, indicate in red those sections of the diagram that are efficient. See notes 5. For securities 1 and 4, find the composition, standard deviation, and expected return of the portfolio that has minimum risk. W = 57.17% W4= 42.83% E (R) = 12% Op= 2.14% 6. Plot the expected return and standard deviation for all possible combinations of securities 1 and 4. Assuming that investors prefer more to less and are risk avoiders, indicate in red those sections of the diagram that are efficient. See notes 7. For securities 2 and 3, find the composition, standard deviation, and expected return of the portfolio that has minimum risk. W = 1.07 W3 = -0.07 E(R) =5.44% Op= 1.38% 8. Plot the expected return and standard deviation for all possible combinations of securities 2 and 3. Assuming that investors prefer more to less and are risk avoiders, indicate in red those sections of the diagram that are efficient. Problem set 3 Homework: 3, 6 Use the following information to answer questions. Assuming short selling is not allowed. E (R) = 12% E(R) =6% E(R) =12% 0= 2.83% P12 = -1 0= 1.41% P13= 1 Optimal asset/portfolio: Security 1 Equation for the new efficient set: E(R) = 0.05 +2.470c 1. Assuming that the riskless lending and borrowing rate is 5%, what's the new efficient set for the combination of securities 1 and 3? Derive the equation for the new efficient set if possible. Optimal asset/portfolio: Security 3 E (R) =14% Equation for the new efficient set: E(R)=0.11 +0.71%c 03= 4.24% P14=0 2. Assuming that the riskless lending and borrowing rate is 11%, what's the new efficient set for the combination of securities 1 and 3? Derive the equation for the new efficient set if possible. 04= 3.27% P23=0.5 Equation for the new efficient set: E(R) =0.11 +0.710c 3. Assuming that the riskless lending and borrowing rate is 13%, what's the new efficient set for the combination of securities 1 and 3? Derive the equation for the new efficient set if possible. Optimal asset/portfolio: Security 3 4. Assuming that the riskless lending and borrowing rate is 15%, what's the new efficient set for the combination of securities 1 and 3? Derive the equation for the new efficient set if possible. The new efficient set includes only the riskless asset. 5. Assuming that the riskless lending and borrowing rate is 5%, what's the new efficient set for the combination of securities 1 and 4? Derive the equation for the new efficient set if possible. Optimal asset/portfolio: MVP Equation for the new efficient set: E(R) = 0.05 + 3.270c 6. Assuming that the riskless lending and borrowing rate is 13%, what's the new efficient set for the combination of securities 1 and 4? Derive the equation for the new efficient set if possible. The new efficient set includes only the riskless asset. Problem set 4 Homework: 1 Assuming short selling is allowed. 1. Assuming that the riskless lending and borrowing rate is 5%, find the new efficient set for the combination of securities 1 and 2. Derive the equation for the new efficient set. E(R) =8% 0 = 10% P12=0.5 E(R) =15% %= 20% Optimal asset/portfolio: W = 22.22% W=77.78% E(Rp) = 13.44% Op= 16.78% Equation for the new efficient set: E(R) = 0.05 +0.50c E(R) =6% % = 1.41% P12=0.5 2. Assuming that the riskless lending and borrowing rate is 5%, find the new efficient set for the combination of securities 1 and 2. Derive the equation for the new efficient set. E(R)=14% 0=4.24% Optimal asset/portfolio: W = -1.49 W=2.49 E(R) = 25.92% Op= 9.68% Equation for the new efficient set: E(R)=0.05 +2.160c

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started