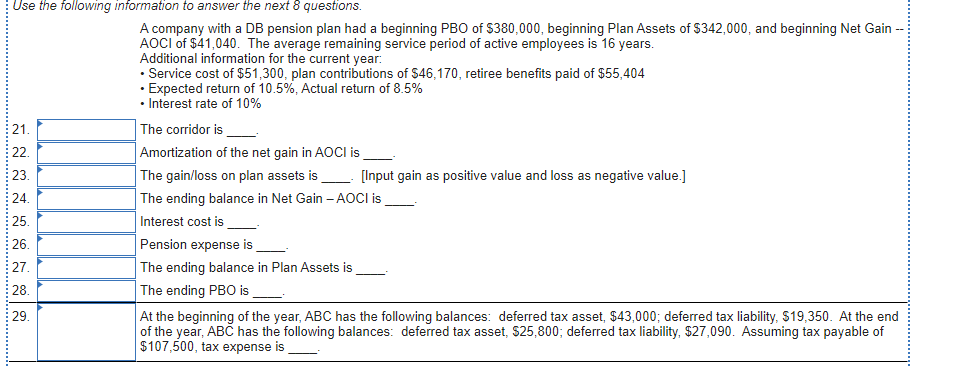

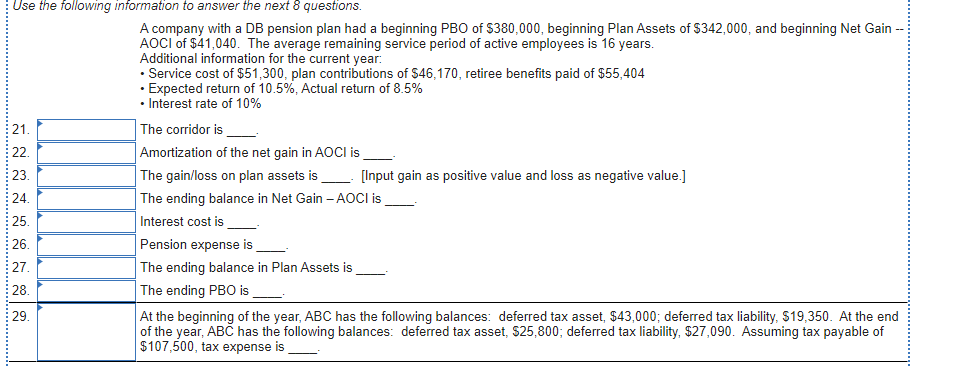

Use the following information to answer the next 8 questions. A company with a DB pension plan had a beginning PBO of $380,000, beginning Plan Assets of $342,000, and beginning Net Gain AOCI of $41,040. The average remaining service period of active employees is 16 years. Additional information for the current year: Service cost of $51,300, plan contributions of 546,170, retiree benefits paid of $55,404 Expected return of 10.5%, Actual return of 8.5% Interest rate of 10% 21. The corridor is 22. Amortization of the net gain in AOCI is 23. The gain/loss on plan assets is [Input gain as positive value and loss as negative value.] 24. The ending balance in Net Gain - AOCI is 25. Interest cost is 26. Pension expense is 27. The ending balance in Plan Assets is 28. The ending PBO is 29. At the beginning of the year, ABC has the following balances: deferred tax asset, $43,000; deferred tax liability, S19,350. At the end of the year, ABC has the following balances: deferred tax asset, $25,800; deferred tax liability, $27,090. Assuming tax payable of $107,500, tax expense is Use the following information to answer the next 8 questions. A company with a DB pension plan had a beginning PBO of $380,000, beginning Plan Assets of $342,000, and beginning Net Gain AOCI of $41,040. The average remaining service period of active employees is 16 years. Additional information for the current year: Service cost of $51,300, plan contributions of 546,170, retiree benefits paid of $55,404 Expected return of 10.5%, Actual return of 8.5% Interest rate of 10% 21. The corridor is 22. Amortization of the net gain in AOCI is 23. The gain/loss on plan assets is [Input gain as positive value and loss as negative value.] 24. The ending balance in Net Gain - AOCI is 25. Interest cost is 26. Pension expense is 27. The ending balance in Plan Assets is 28. The ending PBO is 29. At the beginning of the year, ABC has the following balances: deferred tax asset, $43,000; deferred tax liability, S19,350. At the end of the year, ABC has the following balances: deferred tax asset, $25,800; deferred tax liability, $27,090. Assuming tax payable of $107,500, tax expense is